Nauticus SPAC Presentation Deck

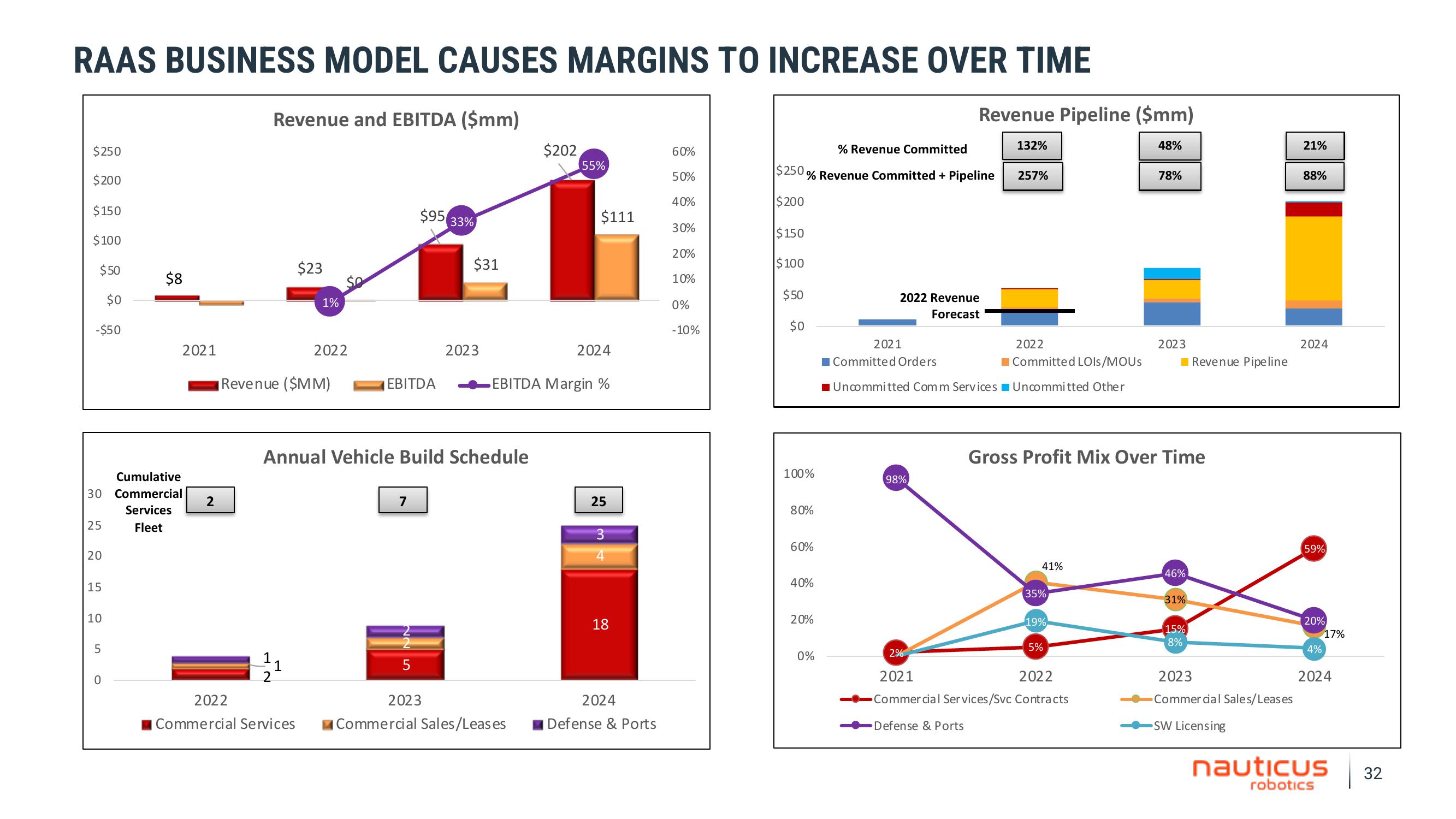

RAAS BUSINESS MODEL CAUSES MARGINS TO INCREASE OVER TIME

$250

$200

$150

$100

$50

$0

-$50

30

25

20

15

10

5

0

$8

2021

Cumulative

Commercial

Services

Fleet

2

Revenue and EBITDA ($mm)

1

2

Revenue ($MM)

$23

1

1%

2022

Commercial Services

SO

2022

EBITDA

$95

Annual Vehicle Build Schedule

7

5

33%

2023

$31

2023

$202

Commercial Sales/Leases

55%

$111

EBITDA Margin %

2024

25

34

18

2024

Defense & Ports

60%

50%

40%

30%

20%

10%

0%

-10%

% Revenue Committed

$250% Revenue Committed + Pipeline

$200

$150

$100

$50

$0

100%

80%

60%

40%

20%

0%

Revenue Pipeline ($mm)

2022 Revenue

Forecast

2021

98%

132%

2022

Committed LOIS/MOUS

Committed Orders

Uncommitted Comm Services Uncommitted Other

257%

41%

35%

19%

Gross Profit Mix Over Time

5%

48%

2%

2021

2022

Commercial Services/Svc Contracts

Defense & Ports

78%

2023

46%

31%

Revenue Pipeline

15%

8%

2023

Commercial Sales/Leases

SW Licensing

21%

88%

2024

59%

20%

4%

17%

2024

nauticus

robotics

32View entire presentation