Olaplex Results Presentation Deck

1.

2.

3.

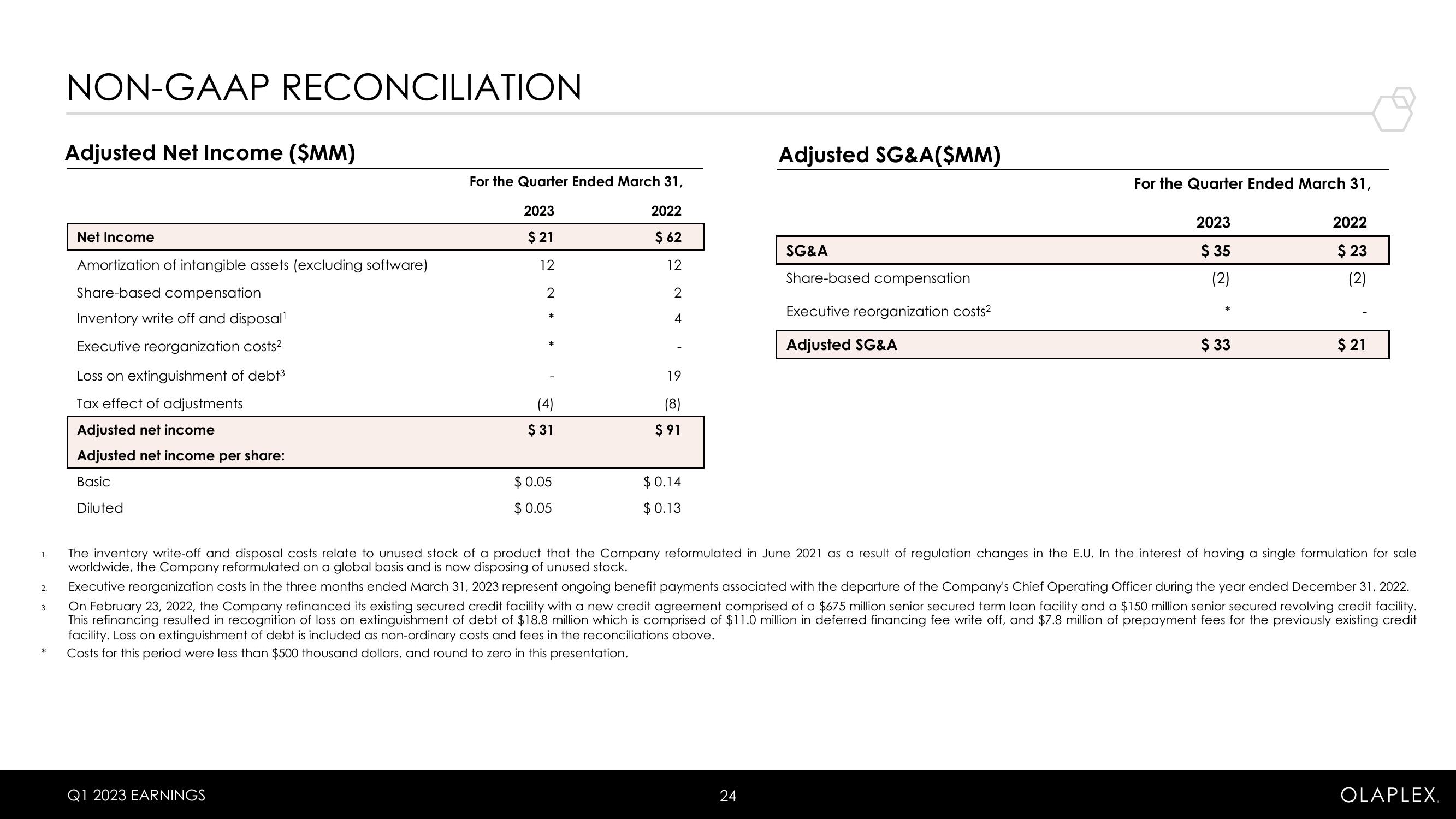

NON-GAAP RECONCILIATION

Adjusted Net Income ($MM)

Net Income

Amortization of intangible assets (excluding software)

Share-based compensation

Inventory write off and disposal¹

Executive reorganization costs²

Loss on extinguishment of debt³

Tax effect of adjustments

Adjusted net income

Adjusted net income per share:

Basic

Diluted

For the Quarter Ended March 31,

2023

$ 21

12

2

*

Q1 2023 EARNINGS

*

(4)

$31

$ 0.05

$0.05

2022

$ 62

12

2

4

19

(8)

$91

$0.14

$0.13

Adjusted SG&A($MM)

SG&A

24

Share-based compensation

Executive reorganization costs²

Adjusted SG&A

For the Quarter Ended March 31,

2023

$ 35

(2)

$ 33

2022

$ 23

(2)

The inventory write-off and disposal costs relate to unused stock of a product that the Company reformulated in June 2021 as a result of regulation changes in the E.U. In the interest of having a single formulation for sale

worldwide, the Company reformulated on a global basis and is now disposing of unused stock.

$21

Executive reorganization costs in the three months ended March 31, 2023 represent ongoing benefit payments associated with the departure of the Company's Chief Operating Officer during the year ended December 31, 2022.

On February 23, 2022, the Company refinanced its existing secured credit facility with a new credit agreement comprised of a $675 million senior secured term loan facility and a $150 million senior secured revolving credit facility.

This refinancing resulted in recognition of loss on extinguishment of debt of $18.8 million which is comprised of $11.0 million in deferred financing fee write off, and $7.8 million of prepayment fees for the previously existing credit

facility. Loss on extinguishment of debt is included as non-ordinary costs and fees in the reconciliations above.

Costs for this period were less than $500 thousand dollars, and round to zero in this presentation.

OLAPLEX.View entire presentation