Engine No. 1 Activist Presentation Deck

ExxonMobil's world view has resulted in a failure to position

itself for success in lower demand scenarios

●

Mb/d

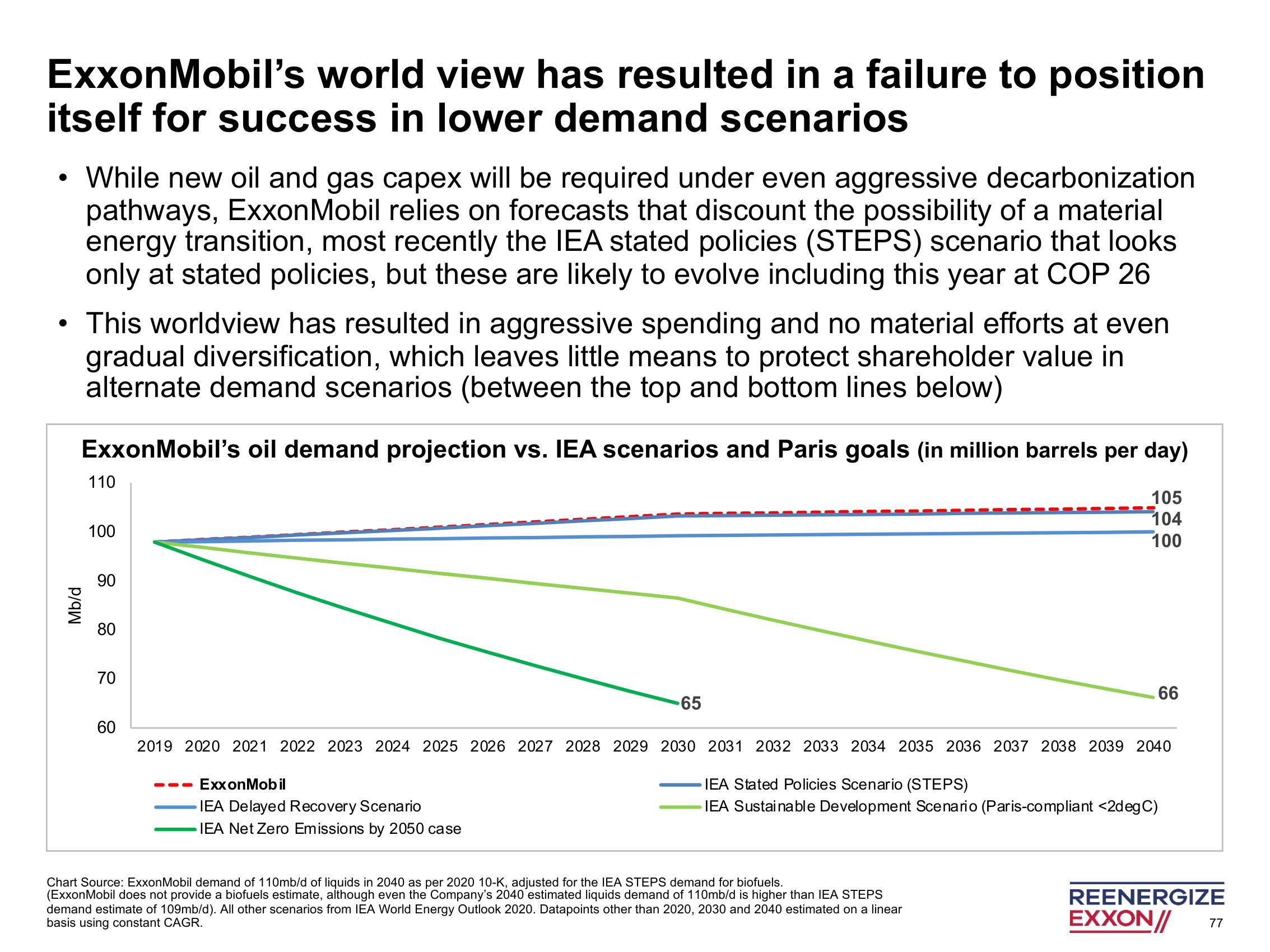

While new oil and gas capex will be required under even aggressive decarbonization

pathways, ExxonMobil relies on forecasts that discount the possibility of a material

energy transition, most recently the IEA stated policies (STEPS) scenario that looks

only at stated policies, but these are likely to evolve including this year at COP 26

This worldview has resulted in aggressive spending and no material efforts at even

gradual diversification, which leaves little means to protect shareholder value in

alternate demand scenarios (between the top and bottom lines below)

ExxonMobil's oil demand projection vs. IEA scenarios and Paris goals (in million barrels per day)

105

104

100

110

100

90

80

70

60

65

ExxonMobil

IEA Delayed Recovery Scenario

IEA Net Zero Emissions by 2050 case

2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040

66

IEA Stated Policies Scenario (STEPS)

IEA Sustainable Development Scenario (Paris-compliant <2degC)

Chart Source: ExxonMobil demand of 110mb/d of liquids in 2040 as per 2020 10-K, adjusted for the IEA STEPS demand for biofuels.

(ExxonMobil does not provide a biofuels estimate, although even the Company's 2040 estimated liquids demand of 110mb/d is higher than IEA STEPS

demand estimate of 109mb/d). All other scenarios from IEA World Energy Outlook 2020. Datapoints other than 2020, 2030 and 2040 estimated on a linear

basis using constant CAGR.

REENERGIZE

EXXON//

77View entire presentation