AeroFarms SPAC Presentation Deck

AeroFarms Financial Overview

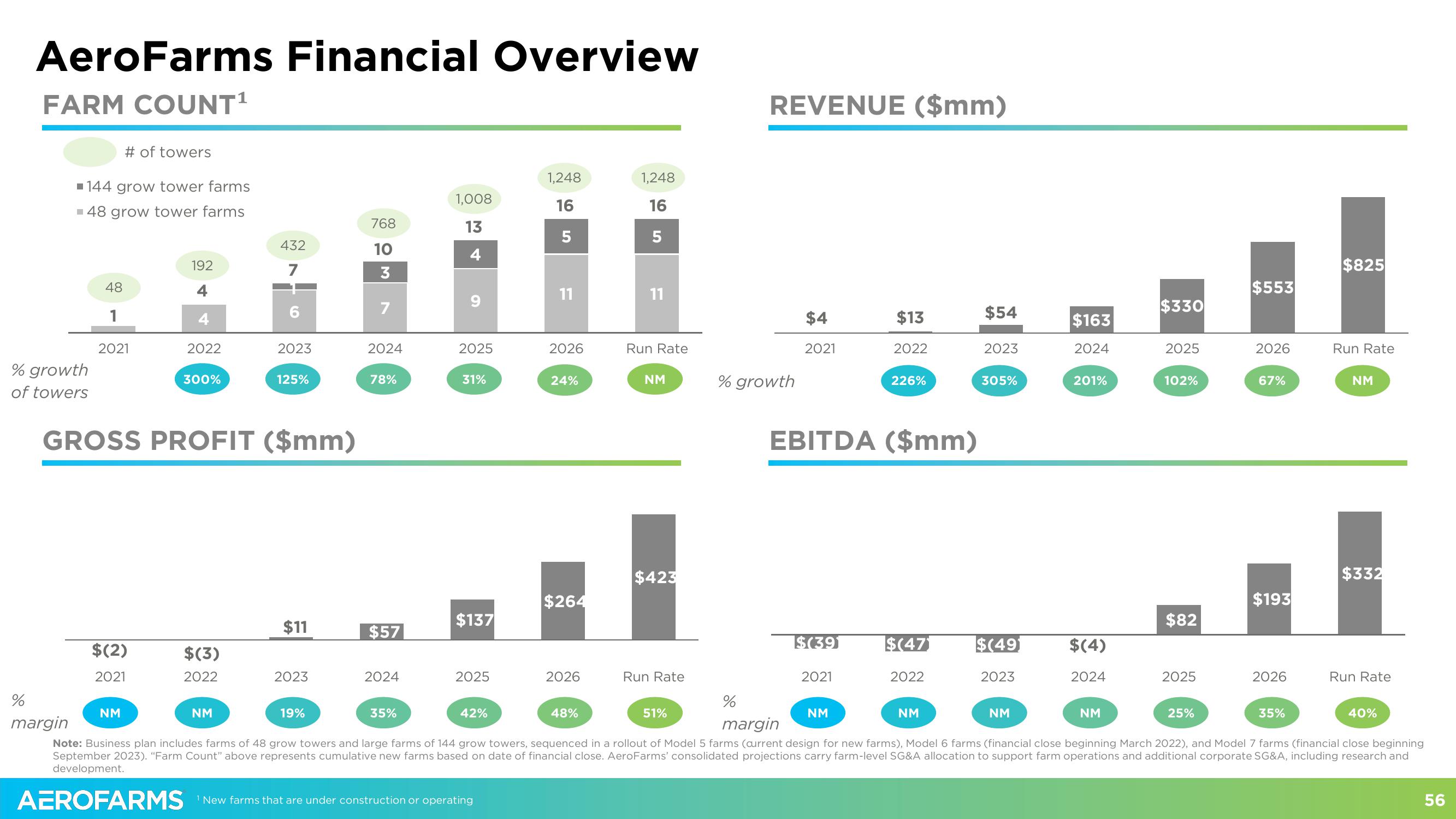

FARM COUNT¹

% growth

of towers

■144 grow tower farms

■ 48 grow tower farms

%

margin

48

1

# of towers

2021

$(2)

2021

192

NM

2022

300%

GROSS PROFIT ($mm)

$(3)

2022

432

7

6

NM

2023

125%

$11

2023

768

10

3

19%

7

2024

78%

$57

2024

1,008

13

4

35%

9

2025

31%

$137

2025

42%

1,248

16

5

1 New farms that are under construction or operating

11

2026

24%

$264

2026

1,248

16

5

48%

11

Run Rate

NM

$423

Run Rate

REVENUE ($mm)

51%

% growth

$4

2021

$(391

EBITDA ($mm)

2021

$13

2022

226%

NM

$(47)

2022

$54

NM

2023

305%

$(49)

2023

$163

2024

NM

201%

$(4)

2024

$330

NM

2025

102%

$82

%

margin

Note: Business plan includes farms of 48 grow towers and large farms of 144 grow towers, sequenced in a rollout of Model 5 farms (current design for new farms), Model 6 farms (financial close beginning March 2022), and Model 7 farms (financial close beginning

September 2023). "Farm Count" above represents cumulative new farms based on date of financial close. AeroFarms' consolidated projections carry farm-level SG&A allocation to support farm operations and additional corporate SG&A, including research and

development.

AEROFARMS

2025

$553

25%

2026

67%

$193

2026

$825

35%

Run Rate

NM

$332

Run Rate

40%

56View entire presentation