Flutter Results Presentation Deck

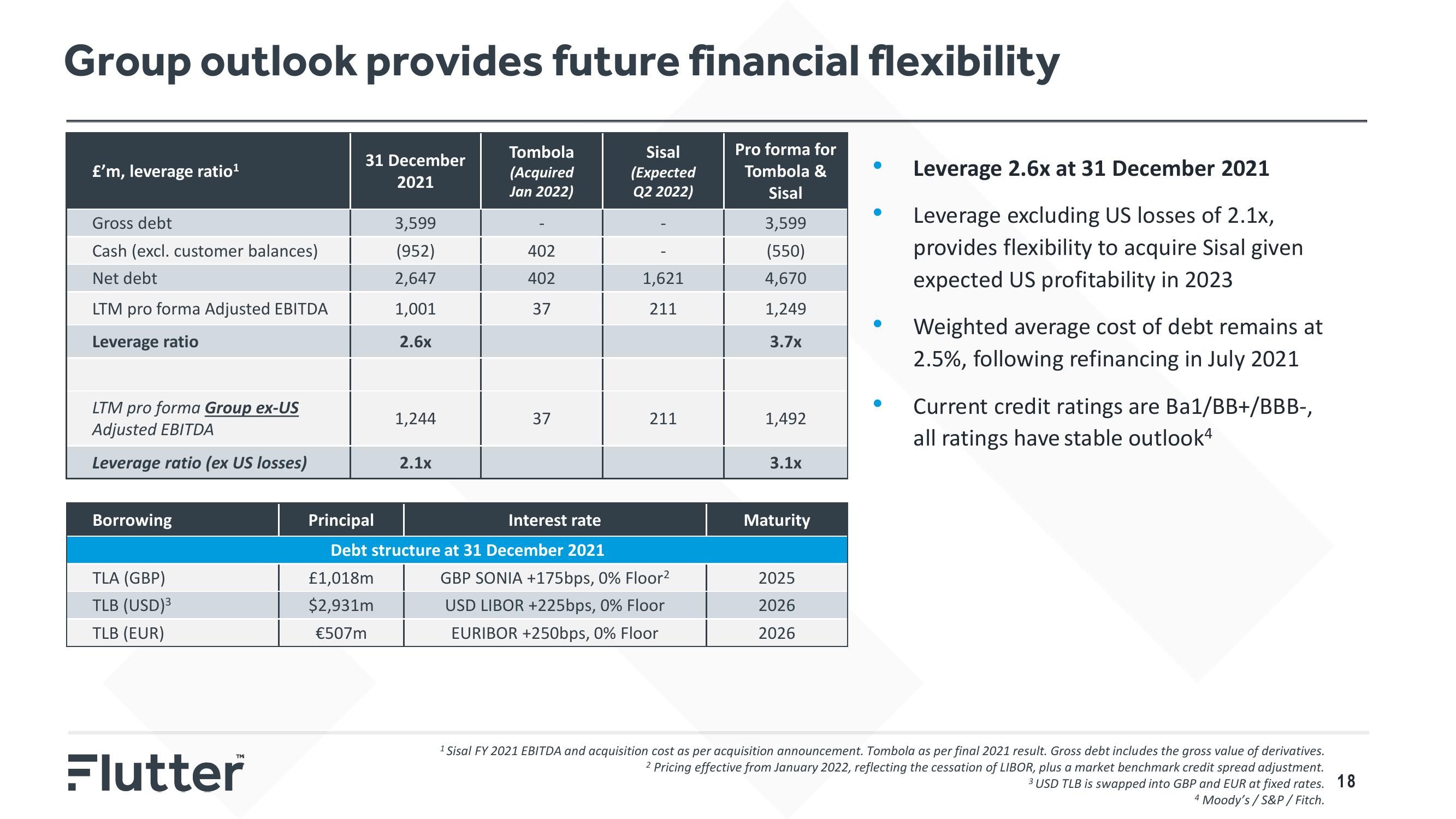

Group outlook provides future financial flexibility

Pro forma for

Tombola &

Sisal

£'m, leverage ratio¹

Gross debt

Cash (excl. customer balances)

Net debt

LTM pro forma Adjusted EBITDA

Leverage ratio

LTM pro forma Group ex-US

Adjusted EBITDA

Leverage ratio (ex US losses)

Borrowing

TLA (GBP)

TLB (USD)³

TLB (EUR)

Flutter

31 December

2021

3,599

(952)

2,647

1,001

2.6x

£1,018m

$2,931m

€507m

1,244

2.1x

Tombola

(Acquired

Jan 2022)

402

402

37

37

Principal

Interest rate

Debt structure at 31 December 2021

Sisal

(Expected

Q2 2022)

1,621

211

211

GBP SONIA +175bps, 0% Floor²

USD LIBOR +225bps, 0% Floor

EURIBOR +250bps, 0% Floor

3,599

(550)

4,670

1,249

3.7x

1,492

3.1x

Maturity

2025

2026

2026

Leverage 2.6x at 31 December 2021

Leverage excluding US losses of 2.1x,

provides flexibility to acquire Sisal given

expected US profitability in 2023

Weighted average cost of debt remains at

2.5%, following refinancing in July 2021

Current credit ratings are Ba1/BB+/BBB-,

all ratings have stable outlook4

¹ Sisal FY 2021 EBITDA and acquisition cost as per acquisition announcement. Tombola as per final 2021 result. Gross debt includes the gross value of derivatives.

2 Pricing effective from January 2022, reflecting the cessation of LIBOR, plus a market benchmark credit spread adjustment.

3 USD TLB is swapped into GBP and EUR at fixed rates. 18

4 Moody's/S&P/ Fitch.View entire presentation