Affirm Results Presentation Deck

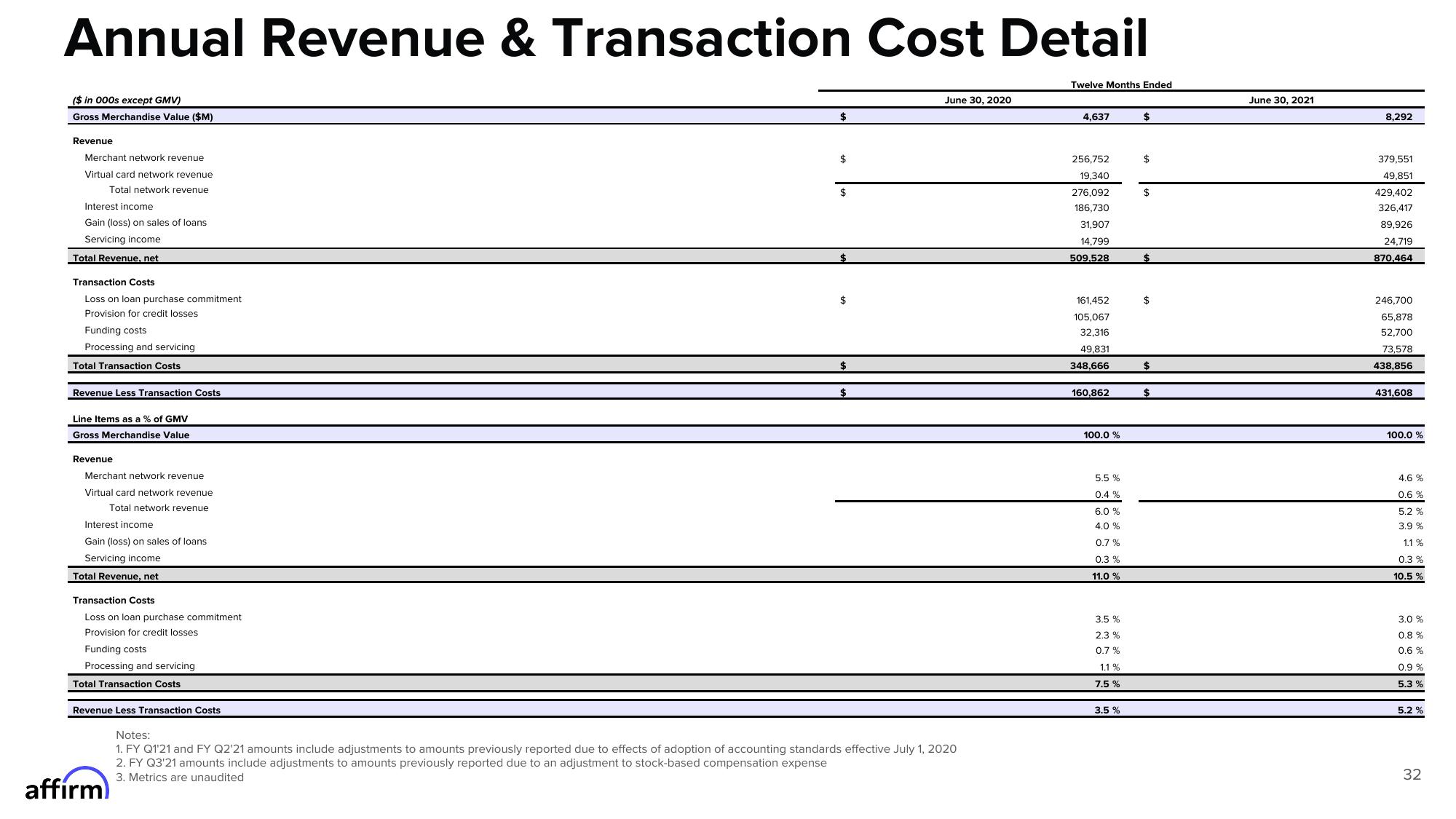

Annual Revenue & Transaction Cost Detail

($ in 000s except GMV)

Gross Merchandise Value ($M)

Revenue

Merchant network revenue

Virtual card network revenue

Total network revenue

Interest income

Gain (loss) on sales of loans

Servicing income

Total Revenue, net

Transaction Costs

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Revenue Less Transaction Costs

Line Items as a % of GMV

Gross Merchandise Value

Revenue

Merchant network revenue

Virtual card network revenue

Total network revenue

Interest income

Gain (loss) on sales of loans

Servicing income

Total Revenue, net

Transaction Costs

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Revenue Less Transaction Costs

affirm

$

$

$

$

$

$

June 30, 2020

Notes:

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020

2. FY Q3'21 amounts include adjustments to amounts previously reported due to an adjustment to stock-based compensation expense

3. Metrics are unaudited

Twelve Months Ended

4,637

256,752

19,340

276,092

186,730

31,907

14,799

509,528

161,452

105,067

32,316

49,831

348,666

160,862

100.0 %

5.5 %

0.4 %

6.0 %

4.0 %

0.7 %

0.3 %

11.0 %

3.5 %

2.3 %

0.7 %

1.1 %

7.5 %

3.5 %

$

$

$

$

$

$

$

June 30, 2021

8,292

379,551

49,851

429,402

326,417

89,926

24,719

870,464

246,700

65,878

52,700

73,578

438,856

431,608

100.0 %

4.6 %

0.6 %

5.2 %

3.9 %

1.1 %

0.3%

10.5 %

3.0 %

0.8%

0.6 %

0.9 %

5.3%

5.2 %

32View entire presentation