Melrose Results Presentation Deck

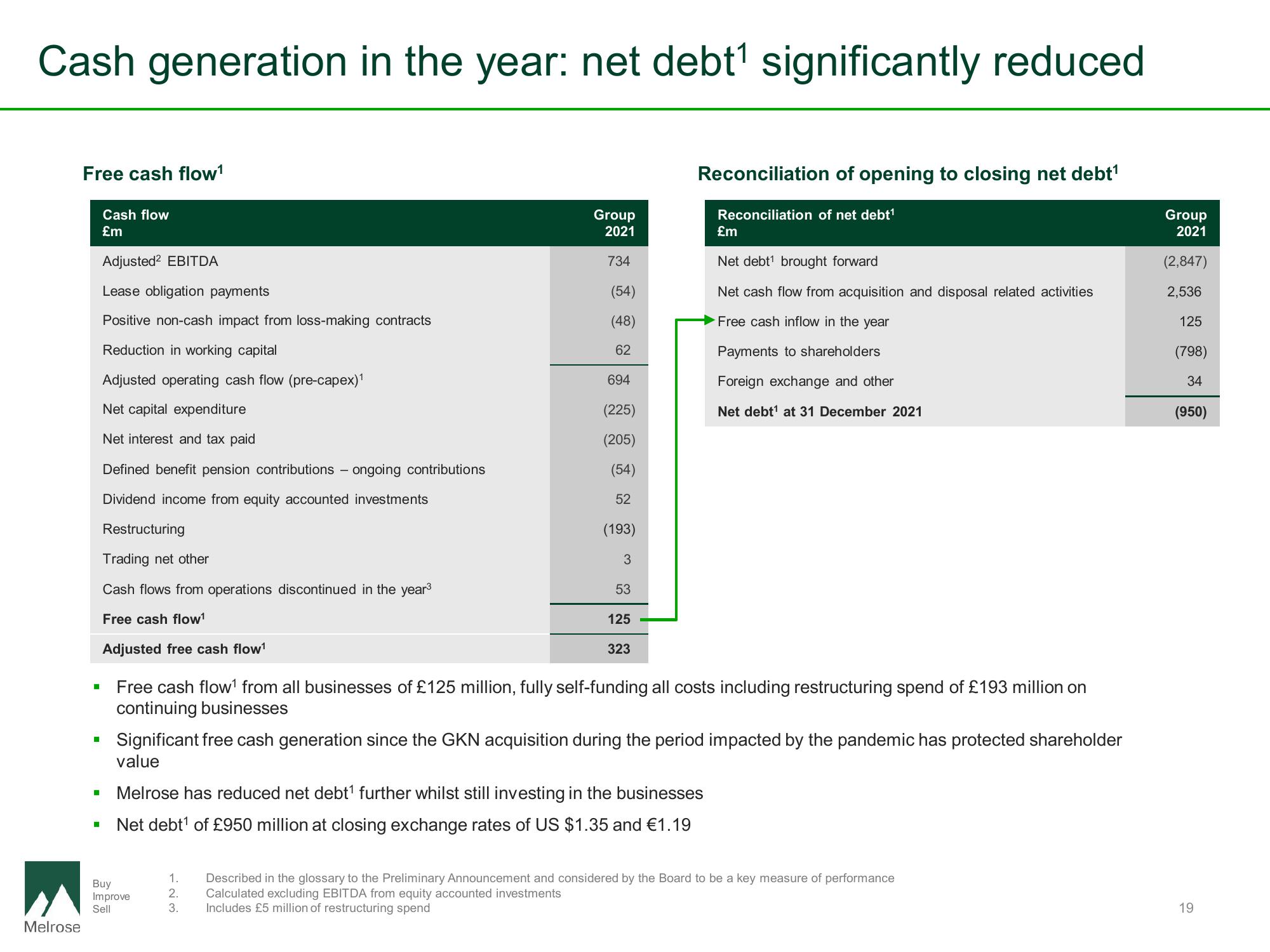

Cash generation in the year: net debt¹ significantly reduced

Melrose

Free cash flow¹

Cash flow

£m

Adjusted² EBITDA

Lease obligation payments

Positive non-cash impact from loss-making contracts

Reduction in working capital

Adjusted operating cash flow (pre-capex)¹

Net capital expenditure

Net interest and tax paid

Defined benefit pension contributions - ongoing contributions

Dividend income from equity accounted investments

Restructuring

Trading net other

Cash flows from operations discontinued in the year³

Free cash flow¹

Adjusted free cash flow¹

■

I

Group

2021

734

Buy

Improve

Sell

(54)

(48)

62

694

(225)

(205)

(54)

52

(193)

3

53

125

323

Reconciliation of opening to closing net debt¹

Melrose has reduced net debt¹ further whilst still investing in the businesses

Net debt¹ of £950 million at closing exchange rates of US $1.35 and €1.19

Reconciliation of net debt¹

Free cash flow¹ from all businesses of £125 million, fully self-funding all costs including restructuring spend of £193 million on

continuing businesses

Significant free cash generation since the GKN acquisition during the period impacted by the pandemic has protected shareholder

value

£m

Net debt¹ brought forward

Net cash flow from acquisition and disposal related activities

Free cash inflow in the year

Payments to shareholders

Foreign exchange and other

Net debt¹ at 31 December 2021

1.

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

Calculated excluding EBITDA from equity accounted investments

2.

3. Includes £5 million of restructuring spend

Group

2021

(2,847)

2,536

125

(798)

34

(950)

19View entire presentation