jetBlue Investor Conference Presentation Deck

APPENDIX C: CALCULATION OF LEVERAGE RATIOS

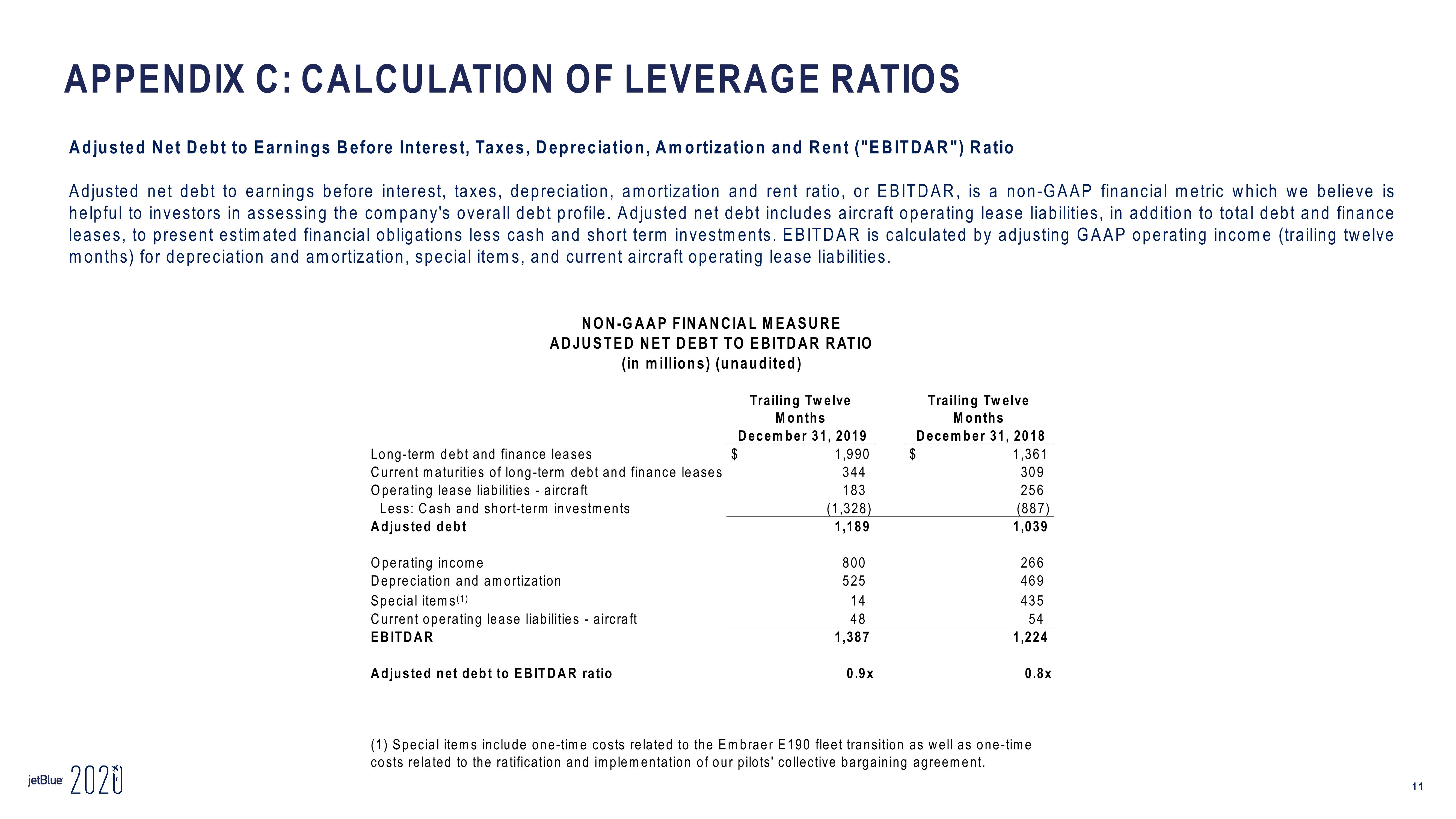

Adjusted Net Debt to Earnings Before Interest, Taxes, Depreciation, Amortization and Rent ("EBITDAR") Ratio

Adjusted net debt to earnings before interest, taxes, depreciation, amortization and rent ratio, or EBITDAR, is a non-GAAP financial metric which we believe is

helpful to investors in assessing the company's overall debt profile. Adjusted net debt includes aircraft operating lease liabilities, in addition to total debt and finance

leases, to present estimated financial obligations less cash and short term investments. EBITDAR is calculated by adjusting GAAP operating income (trailing twelve

months) for depreciation and amortization, special items, and current aircraft operating lease liabilities.

jetBlue 2020

NON-GAAP FINANCIAL MEASURE

ADJUSTED NET DEBT TO EBITDAR RATIO

(in millions) (unaudited)

Long-term debt and finance leases

Current maturities of long-term debt and finance leases

Operating lease liabilities - aircraft

Less: Cash and short-term investments

Adjusted debt

Operating income

Depreciation and amortization

Special items (1)

Current operating lease liabilities - aircraft

EBITDAR

Adjusted net debt to EBITDAR ratio

Trailing Twelve

Months

December 31, 2019

1,990

344

183

(1,328)

1,189

$

800

525

14

48

1,387

0.9x

Trailing Twelve

Months

December 31, 2018

1,361

$

309

256

(887)

1,039

266

469

435

54

1,224

0.8x

(1) Special items include one-time costs related to the Embraer E190 fleet transition as well as one-time

costs related to the ratification and implementation of our pilots' collective bargaining agreement.

11View entire presentation