TPG Results Presentation Deck

4Q'21 Pro Forma GAAP Balance Sheet Notes

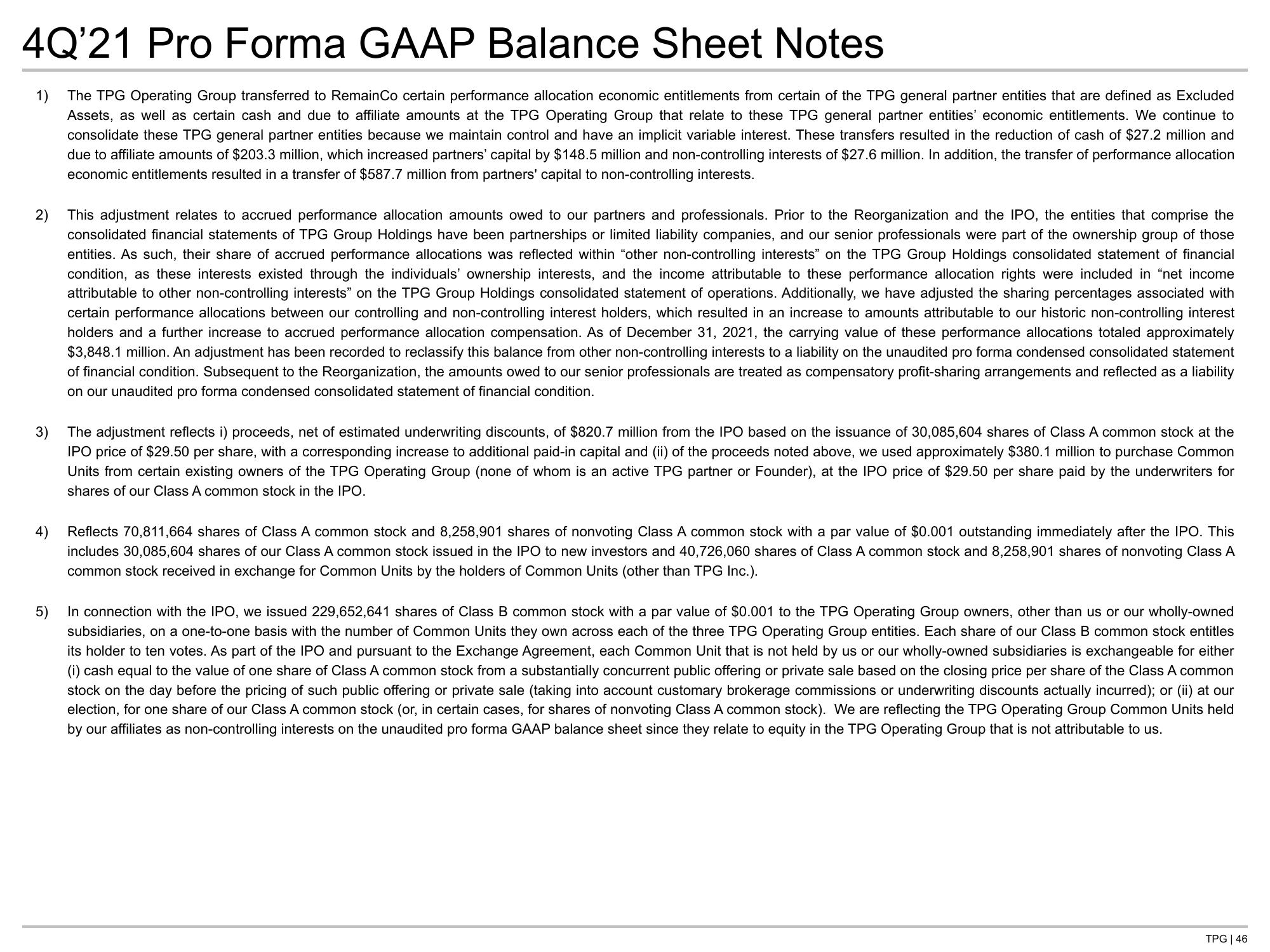

1) The TPG Operating Group transferred to RemainCo certain performance allocation economic entitlements from certain of the TPG general partner entities that are defined as Excluded

Assets, as well as certain cash and due to affiliate amounts at the TPG Operating Group that relate to these TPG general partner entities' economic entitlements. We continue to

consolidate these TPG general partner entities because we maintain control and have an implicit variable interest. These transfers resulted in the reduction of cash of $27.2 million and

2)

due to affiliate amounts of $203.3 million, which increased partners' capital by $148.5 million and non-controlling interests of $27.6 million. In addition, the transfer of performance allocation

economic entitlements resulted in a transfer of $587.7 million from partners' capital to non-controlling interests.

4)

This adjustment relates to accrued performance allocation amounts owed to our partners and professionals. Prior to the Reorganization and the IPO, the entities that comprise the

consolidated financial statements of TPG Group Holdings have been partnerships or limited liability companies, and our senior professionals were part of the ownership group of those

entities. As such, their share of accrued performance allocations was reflected within "other non-controlling interests" on the TPG Group Holdings consolidated statement of financial

condition, as these interests existed through the individuals' ownership interests, and the income attributable to these performance allocation rights were included in "net income

attributable to other non-controlling interests" on the TPG Group Holdings consolidated statement of operations. Additionally have adjusted the sharing percentages associated with

certain performance allocations between our controlling and non-controlling interest holders, which resulted in an increase to amounts attributable to our historic non-controlling interest

holders and a further increase to accrued performance allocation compensation. As of December 31, 2021, the carrying value of these performance allocations totaled approximately

$3,848.1 million. An adjustment has been recorded to reclassify this balance from other non-controlling interests to a liability on the unaudited pro forma condensed consolidated statement

of financial condition. Subsequent to the Reorganization, the amounts owed to our senior professionals are treated as compensatory profit-sharing arrangements and reflected as a liability

on our unaudited pro forma condensed consolidated statement of financial condition.

3)

The adjustment reflects i) proceeds, net of estimated underwriting discounts, of $820.7 million from the IPO based on the issuance of 30,085,604 shares of Class A common stock at the

IPO price of $29.50 per share, with a corresponding increase to additional paid-in capital and (ii) of the proceeds noted above, we used approximately $380.1 million to purchase Common

Units from certain existing owners of the TPG Operating Group (none of whom is an active TPG partner or Founder), at the IPO price of $29.50 per share paid by the underwriters for

shares of our Class A common stock in the IPO.

Reflects 70,811,664 shares of Class A common stock and 8,258,901 shares of nonvoting Class A common stock with a par value of $0.001 outstanding immediately after the IPO. This

includes 30,085,604 shares of our Class A common stock issued in the IPO to new investors and 40,726,060 shares of Class A common stock and 8,258,901 shares of nonvoting Class A

common stock received in exchange for Common Units by the holders of Common Units (other than TPG Inc.).

5)

In connection with the IPO, we issued 229,652,641 shares of Class B common stock with a par value of $0.001 to the TPG Operating Group owners, other than us or our wholly-owned

subsidiaries, on a one-to-one basis with the number of Common Units they own across each of the three TPG Operating Group entities. Each share of our Class B common stock entitles

its holder to ten votes. As part of the IPO and pursuant to the Exchange Agreement, each Common Unit that is not held by us or our wholly-owned subsidiaries is exchangeable for either

(i) cash equal to the value of one share of Class A common stock from a substantially concurrent public offering or private sale based on the closing price per share of the Class A common

stock on the day before the pricing of such public offering or private sale (taking into account customary brokerage commissions or underwriting discounts actually incurred); or (ii) at our

election, for one share of our Class A common stock (or, in certain cases, for shares of nonvoting Class A common stock). We are reflecting the TPG Operating Group Common Units held

by our affiliates as non-controlling interests on the unaudited pro forma GAAP balance sheet since they relate to equity in the TPG Operating Group that is not attributable to us.

TPG | 46View entire presentation