Nano Dimension Mergers and Acquisitions Presentation Deck

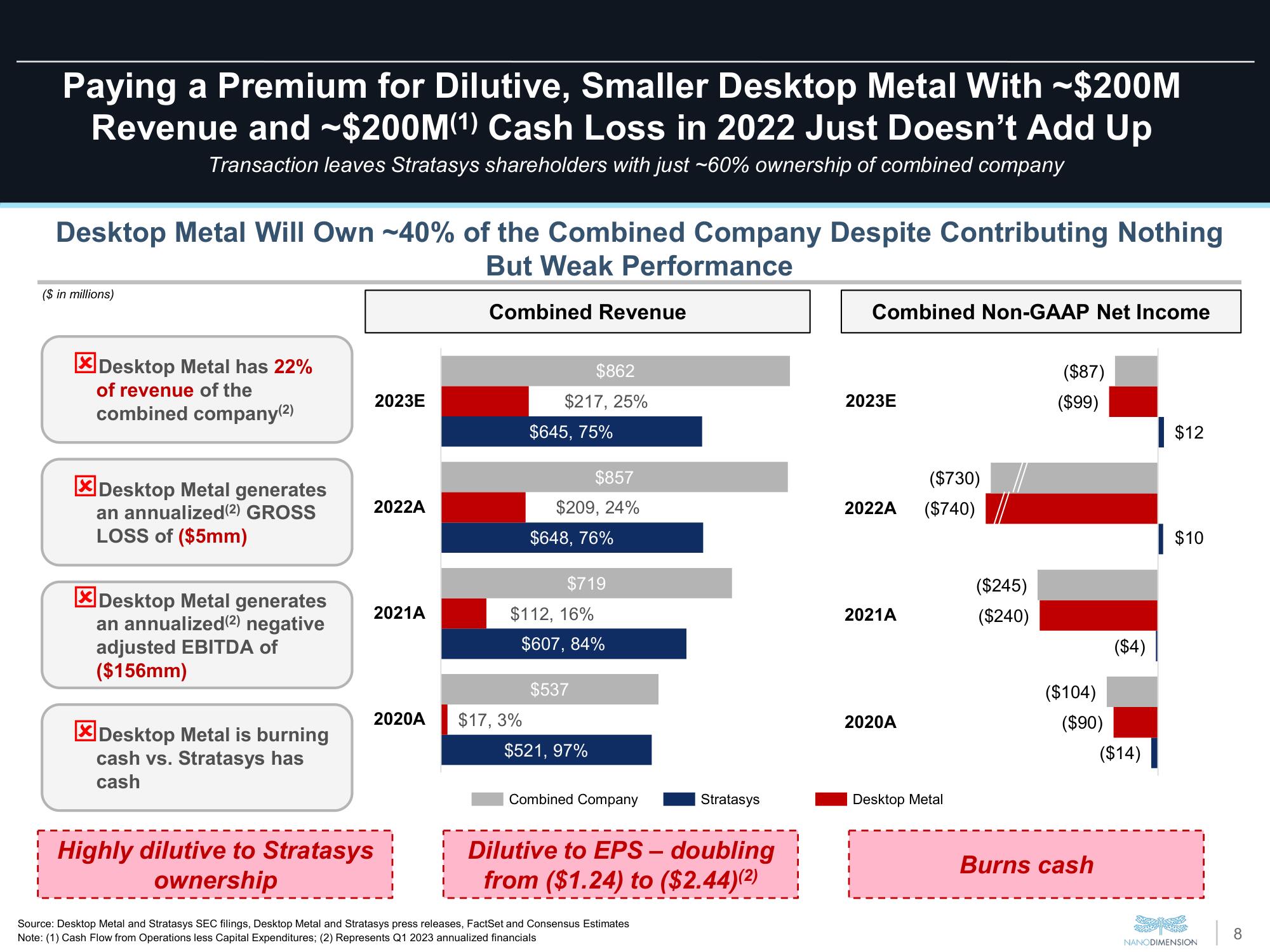

Paying a Premium for Dilutive, Smaller Desktop Metal With →$200M

Revenue and ~$200M(1) Cash Loss in 2022 Just Doesn't Add Up

Transaction leaves Stratasys shareholders with just ~60% ownership of combined company

Desktop Metal Will Own ~40% of the Combined Company Despite Contributing Nothing

But Weak Performance

($ in millions)

Desktop Metal has 22%

of revenue of the

combined company(2)

*Desktop Metal generates

an annualized (2) GROSS

LOSS of ($5mm)

Desktop Metal generates

an annualized (2) negative

adjusted EBITDA of

($156mm)

Desktop Metal is burning

cash vs. Stratasys has

cash

2023E

2022A

2021A

2020A

Highly dilutive to Stratasys

ownership

Combined Revenue

$862

$217, 25%

$17,3%

$645, 75%

$857

$209, 24%

$648, 76%

$719

$112, 16%

$607, 84%

$537

$521, 97%

Combined Company

Stratasys

Dilutive to EPS- doubling

from ($1.24) to ($2.44)(²)

Source: Desktop Metal and Stratasys SEC filings, Desktop Metal and Stratasys press releases, FactSet and Consensus Estimates

Note: (1) Cash Flow from Operations less Capital Expenditures; (2) Represents Q1 2023 annualized financials

Combined Non-GAAP Net Income

2023E

($730)

2022A ($740)

2021A

2020A

Desktop Metal

($245)

($240)

($87)

($99)

($104)

($90)

Burns cash

($4)

($14)

$12

$10

NANODIMENSION

8View entire presentation