Credit Suisse Investment Banking Pitch Book

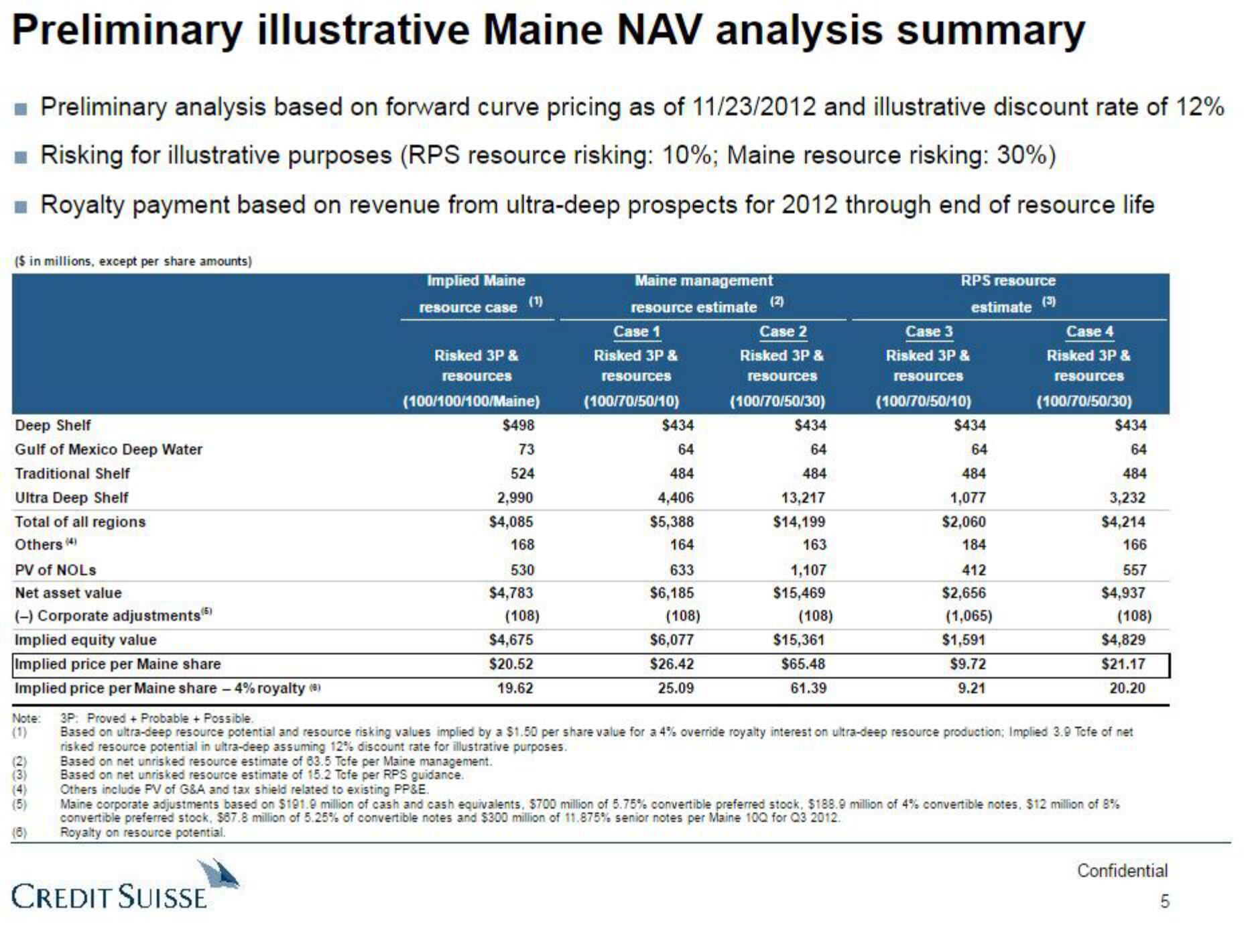

Preliminary illustrative Maine NAV analysis summary

■ Preliminary analysis based on forward curve pricing as of 11/23/2012 and illustrative discount rate of 12%

Risking for illustrative purposes (RPS resource risking: 10%; Maine resource risking: 30%)

Royalty payment based on revenue from ultra-deep prospects for 2012 through end of resource life

($ in millions, except per share amounts)

Deep Shelf

Gulf of Mexico Deep Water

Traditional Shelf

Ultra Deep Shelf

Total of all regions

Others (4)

PV of NOLS

Net asset value

(-) Corporate adjustments (5)

Implied equity value

Implied price per Maine share

Implied price per Maine share - 4% royalty (8)

(2)

(3)

(5)

Implied Maine

resource case (1)

Risked 3P &

CREDIT SUISSE

resources

(100/100/100/Maine)

$498

73

524

2,990

$4,085

168

530

$4,783

(108)

$4,675

$20.52

19.62

Maine management

resource estimate

Case 1

Risked 3P &

resources

(100/70/50/10)

$434

64

484

4,406

$5,388

164

633

$6,185

(108)

$6,077

$26.42

25.09

(2)

Case 2

Risked 3P &

resources

(100/70/50/30)

$434

64

484

13,217

$14,199

163

1,107

$15,469

(108)

$15,361

$65.48

61.39

RPS resource

estimate (3)

Case 3

Risked 3P &

resources

(100/70/50/10)

$434

64

484

1,077

$2,060

184

412

$2,656

(1,065)

$1,591

$9.72

9.21

Case 4

Risked 3P &

resources

(100/70/50/30)

$434

64

484

3,232

$4,214

166

557

$4,937

(108)

(1)

Note: 3P: Proved + Probable + Possible.

Based on ultra-deep resource potential and resource risking values implied by a $1.50 per share value for a 4% override royalty interest on ultra-deep resource production; Implied 3.9 Tofe of net

risked resource potential in ultra-deep assuming 12% discount rate for illustrative purposes.

Based on net unrisked resource estimate of 83.5 Tofe per Maine management.

Based on net unrisked resource estimate of 15.2 Tofe per RPS guidance.

$4,829

$21.17

20.20

Others include PV of G&A and tax shield related to existing PP&E.

Maine corporate adjustments based on $191.9 million of cash and cash equivalents, $700 million of 5.75% convertible preferred stock, $188.9 million of 4% convertible notes, $12 million of 8%

convertible preferred stock, $87.8 million of 5.25% of convertible notes and $300 million of 11.875% senior notes per Maine 100 for Q3 2012.

Royalty on resource potential.

Confidential

5View entire presentation