KKR Real Estate Finance Trust Results Presentation Deck

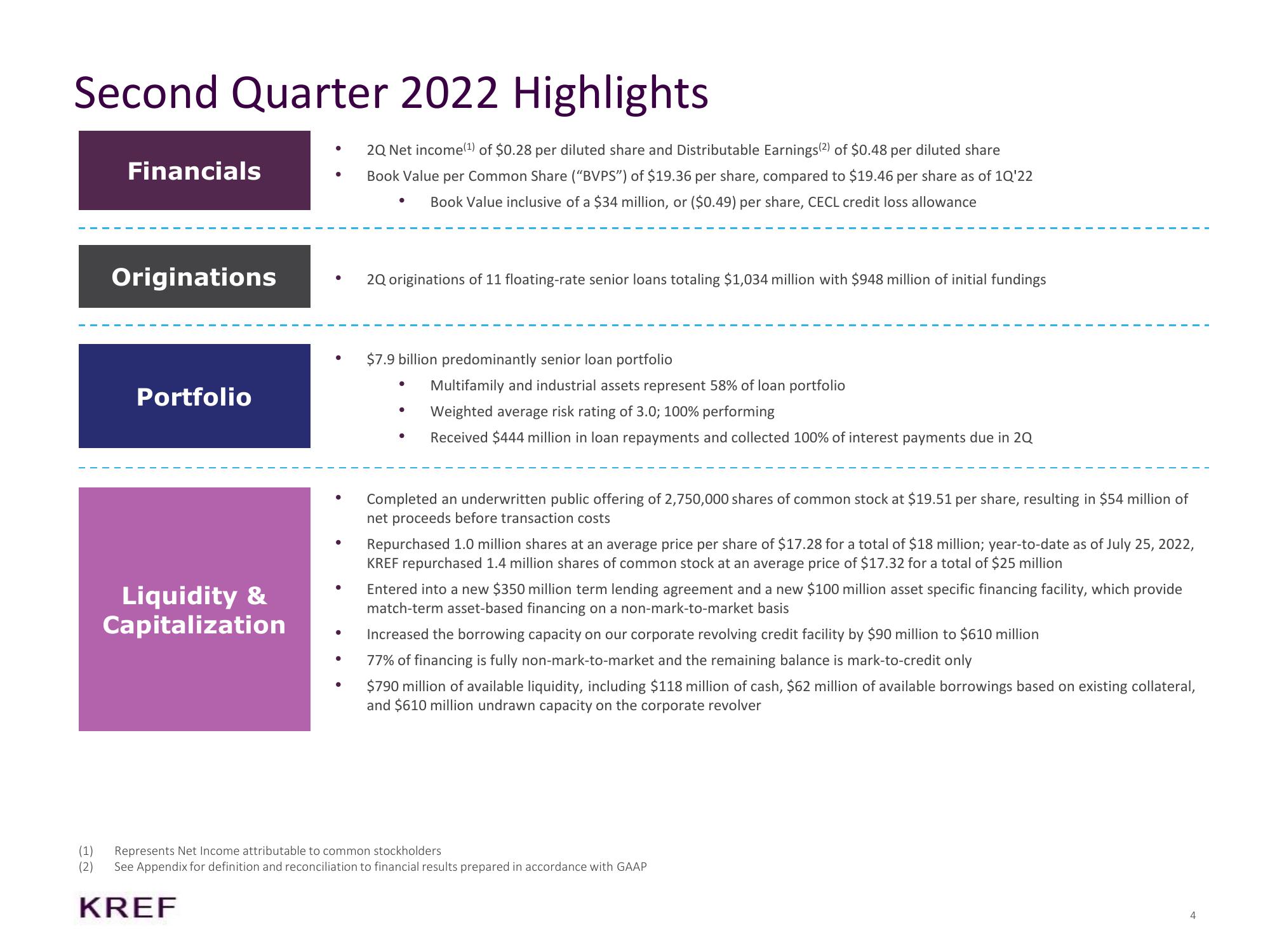

Second Quarter 2022 Highlights

(1)

(2)

Financials

Originations

Portfolio

Liquidity &

Capitalization

.

KREF

●

●

2Q Net income (¹) of $0.28 per diluted share and Distributable Earnings (2) of $0.48 per diluted share

Book Value per Common Share ("BVPS") of $19.36 per share, compared to $19.46 per share as of 1Q'22

Book Value inclusive of a $34 million, or ($0.49) per share, CECL credit loss allowance

2Q originations of 11 floating-rate senior loans totaling $1,034 million with $948 million of initial fundings

$7.9 billion predominantly senior loan portfolio

●

●

●

Multifamily and industrial assets represent 58% of loan portfolio

Weighted average risk rating of 3.0; 100% performing

Received $444 million in loan repayments and collected 100% of interest payments due in 2Q

Completed an underwritten public offering of 2,750,000 shares of common stock at $19.51 per share, resulting in $54 million of

net proceeds before transaction costs

Repurchased 1.0 million shares at an average price per share of $17.28 for a total of $18 million; year-to-date as of July 25, 2022,

KREF repurchased 1.4 million shares of common stock at an average price of $17.32 for a total of $25 million

Entered into a new $350 million term lending agreement and a new $100 million asset specific financing facility, which provide

match-term asset-based financing on a non-mark-to-market basis

Increased the borrowing capacity on our corporate revolving credit facility by $90 million to $610 million

77% of financing is fully non-mark-to-market and the remaining balance is mark-to-credit only

$790 million of available liquidity, including $118 million of cash, $62 million of available borrowings based on existing collateral,

and $610 million undrawn capacity on the corporate revolver

Represents Net Income attributable to common stockholders

See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP

4View entire presentation