Trian Partners Activist Presentation Deck

Attractive Valuation

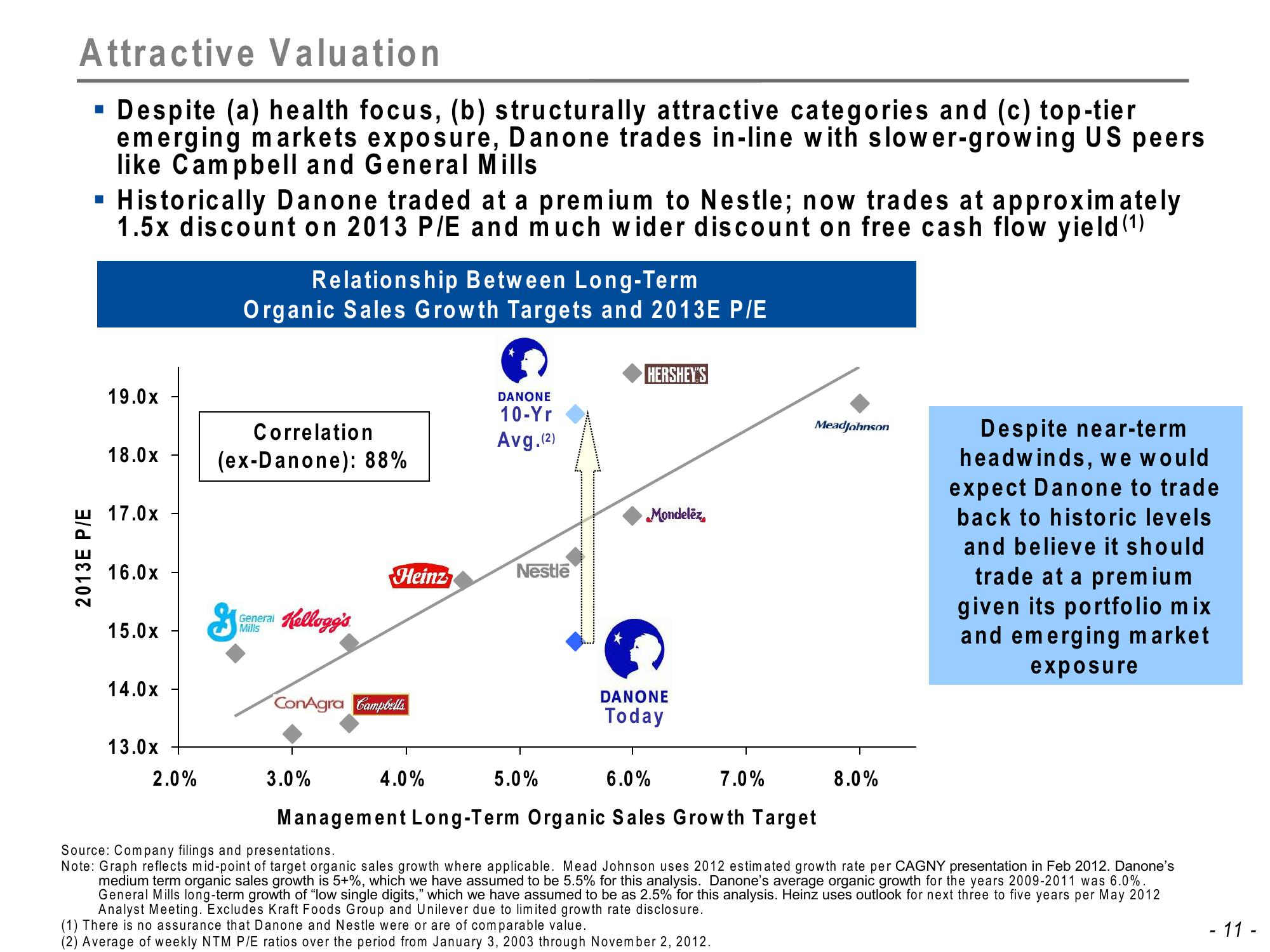

Despite (a) health focus, (b) structurally attractive categories and (c) top-tier

emerging markets exposure, Danone trades in-line with slower-growing US peers

like Campbell and General Mills

2013E P/E

■

Historically Danone traded at a premium to Nestle; now trades at approximately

1.5x discount on 2013 P/E and much wider discount on free cash flow yield (1)

19.0x

18.0x

17.0x

16.0x

15.0x

14.0x

13.0x

2.0%

Relationship Between Long-Term

Organic Sales Growth Targets and 2013E P/E

Correlation

(ex-Danone): 88%

g

General

Mills

Kellogg's

Heinz

ConAgra Campbells

3.0%

DANONE

10-Yr

Avg.(2)

4.0%

Nestle

HERSHEY'S

5.0%

Mondelez,

6.0%

Management Long-Term Organic Sales Growth Target

DANONE

Today

Meadjohnson

7.0%

8.0%

Despite near-term

headwinds, we would

expect Danone to trade

back to historic levels

and believe it should

trade at a premium

given its portfolio mix

and emerging market

exposure

Source: Company filings and presentations.

Note: Graph reflects mid-point of target organic sales growth where applicable. Mead Johnson uses 2012 estimated growth rate per CAGNY presentation in Feb 2012. Danone's

medium term organic sales growth is 5+%, which we have assumed to be 5.5% for this analysis. Danone's average organic growth for the years 2009-2011 was 6.0%.

General Mills long-term growth of "low single digits," which we have assumed to be as 2.5% for this analysis. Heinz uses outlook for next three to five years per May 2012

Analyst Meeting. Excludes Kraft Foods Group and Unilever due to limited growth rate disclosure.

(1) There is no assurance that Danone and Nestle were or are of comparable value.

(2) Average of weekly NTM P/E ratios over the period from January 3, 2003 through November 2, 2012.

- 11 -View entire presentation