Comcast Results Presentation Deck

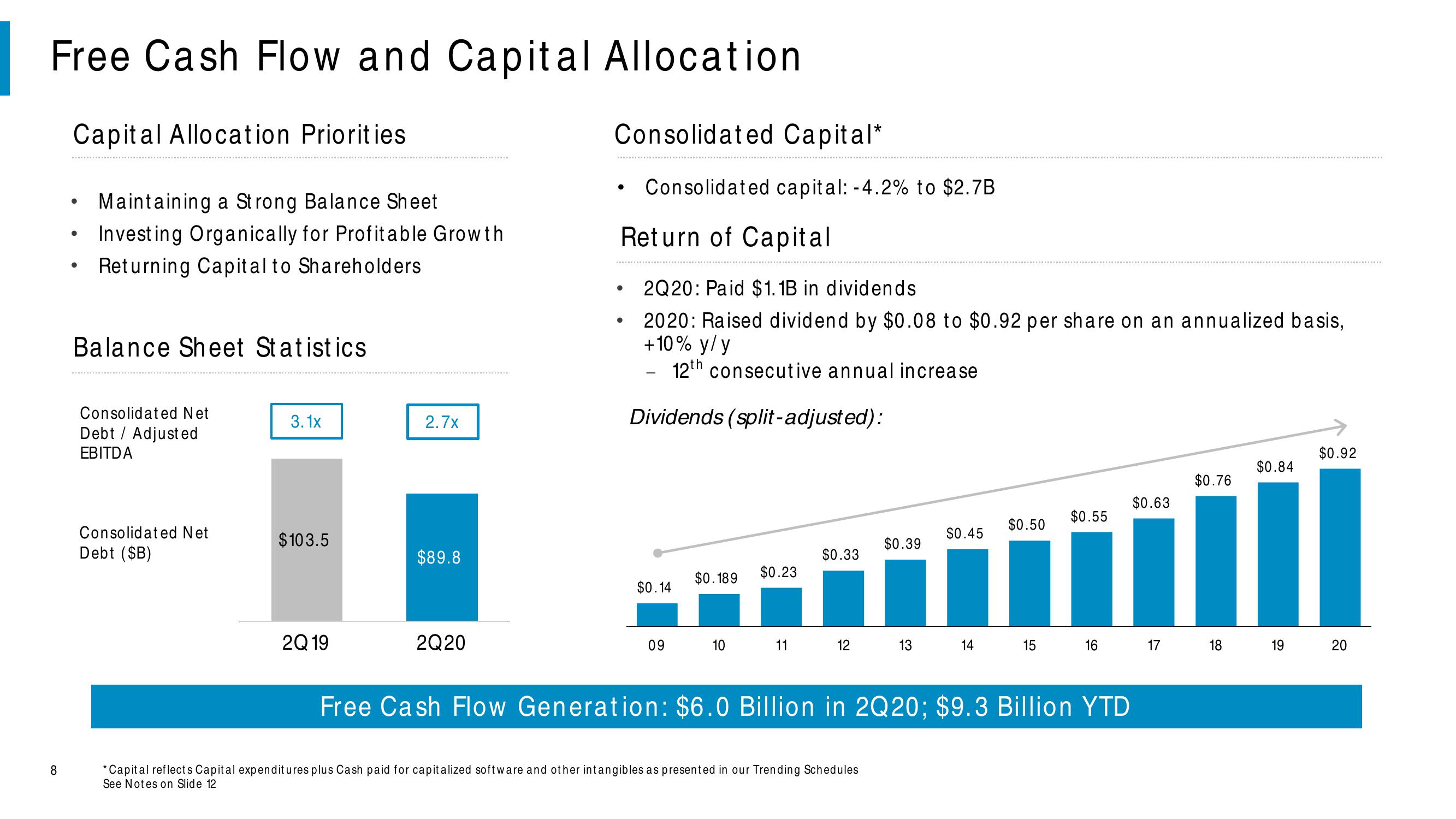

Free Cash Flow and Capital Allocation

Capital Allocation Priorities.

8

●

Maintaining a Strong Balance Sheet

Investing Organically for Profitable Growth

Returning Capital to Shareholders

Balance Sheet Statistics

Consolidated Net

Debt / Adjusted

EBITDA

Consolidated Net

Debt ($B)

3.1x

$103.5

2Q 19

2.7x

$89.8

2Q20

Consolidated Capital*

Consolidated capital: -4.2% to $2.7B

Return of Capital

2Q20: Paid $1.1B in dividends

2020: Raised dividend by $0.08 to $0.92 per share on an annualized basis,

+10% y/y

12th consecutive annual increase

●

●

Dividends (split-adjusted):

$0.14

$0.189

$0.23

$0.33

$0.39

09 10 11 12 13

*Capital reflects Capital expenditures plus Cash paid for capitalized software and other intangibles as presented in our Trending Schedules

See Notes on Slide 12

$0.45

$0.50

$0.55

Free Cash Flow Generation: $6.0 Billion in 2Q20; $9.3 Billion YTD

$0.63

$0.76

$0.84

$0.92

14 15 16 17 18 19 20View entire presentation