BAT Results Presentation Deck

سرا

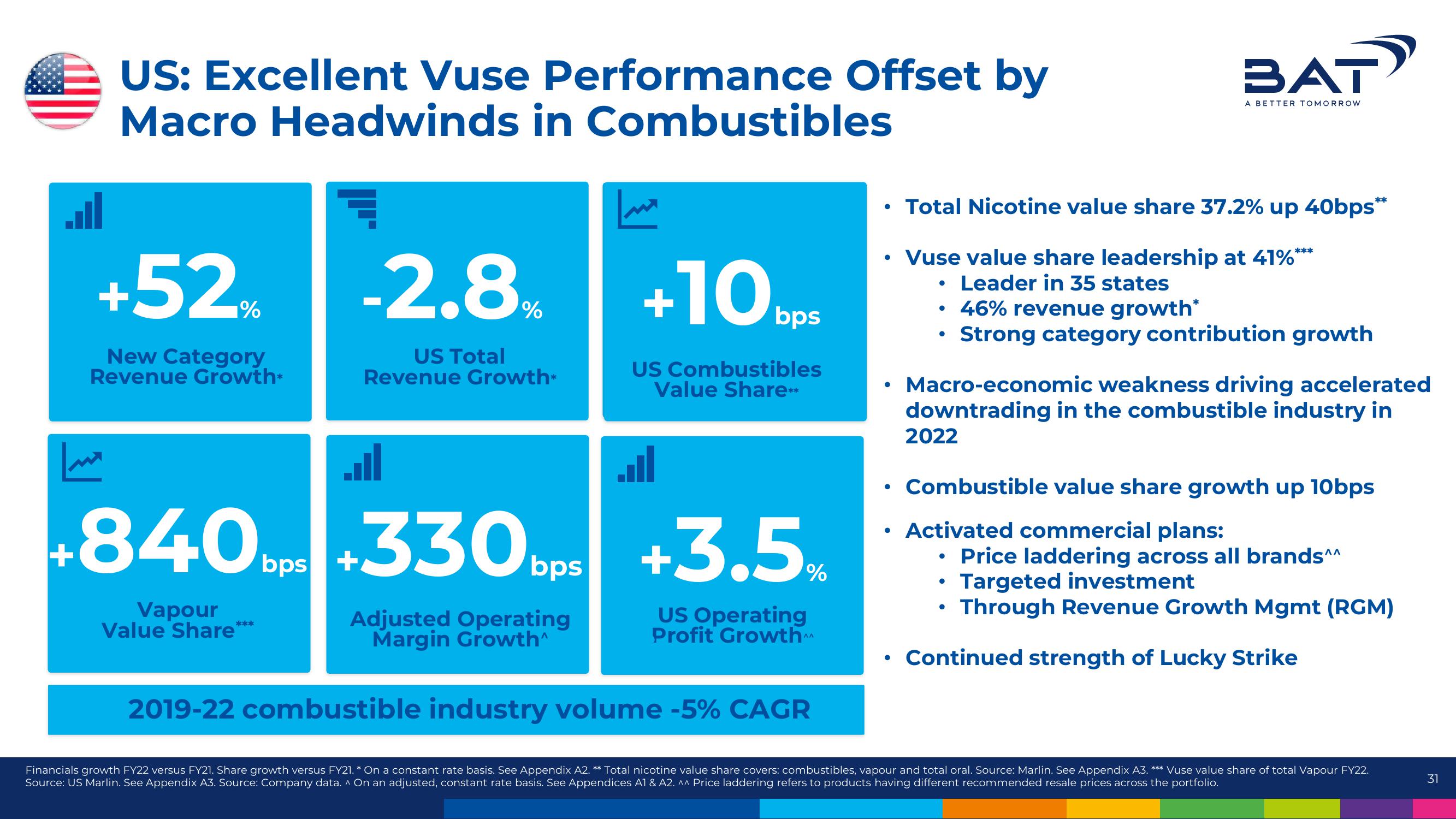

US: Excellent Vuse Performance Offset by

Macro Headwinds in Combustibles

▼

+52%

New Category

Revenue Growth*

+

+840bps

Vapour

Value Share*

***

-2.8

US Total

Revenue Growth*

bps +

%

+330 bps

Adjusted Operating

Margin Growth^

میرا

+10bps

US Combustibles

Value Share**

+3.5%

US Operating

Profit Growth

●

●

• Total Nicotine value share 37.2% up 40bps**

●

●

●

Vuse value share leadership at 41%*

Leader in 35 states

• 46% revenue growth*

Strong category contribution growth

BAT

2022

A BETTER TOMORROW

Macro-economic weakness driving accelerated

downtrading in the combustible industry in

●

***

Combustible value share growth up 10bps

Activated commercial plans:

●

Price laddering across all brands^^

Targeted investment

• Through Revenue Growth Mgmt (RGM)

• Continued strength of Lucky Strike

2019-22 combustible industry volume -5% CAGR

Financials growth FY22 versus FY21. Share growth versus FY21. * On a constant rate basis. See Appendix A2. ** Total nicotine value share covers: combustibles, vapour and total oral. Source: Marlin. See Appendix A3. *** Vuse value share of total Vapour FY22.

Source: US Marlin. See Appendix A3. Source: Company data. ^ On an adjusted, constant rate basis. See Appendices A1 & A2. ^^ Price laddering refers to products having different recommended resale prices across the portfolio.

31View entire presentation