View SPAC Presentation Deck

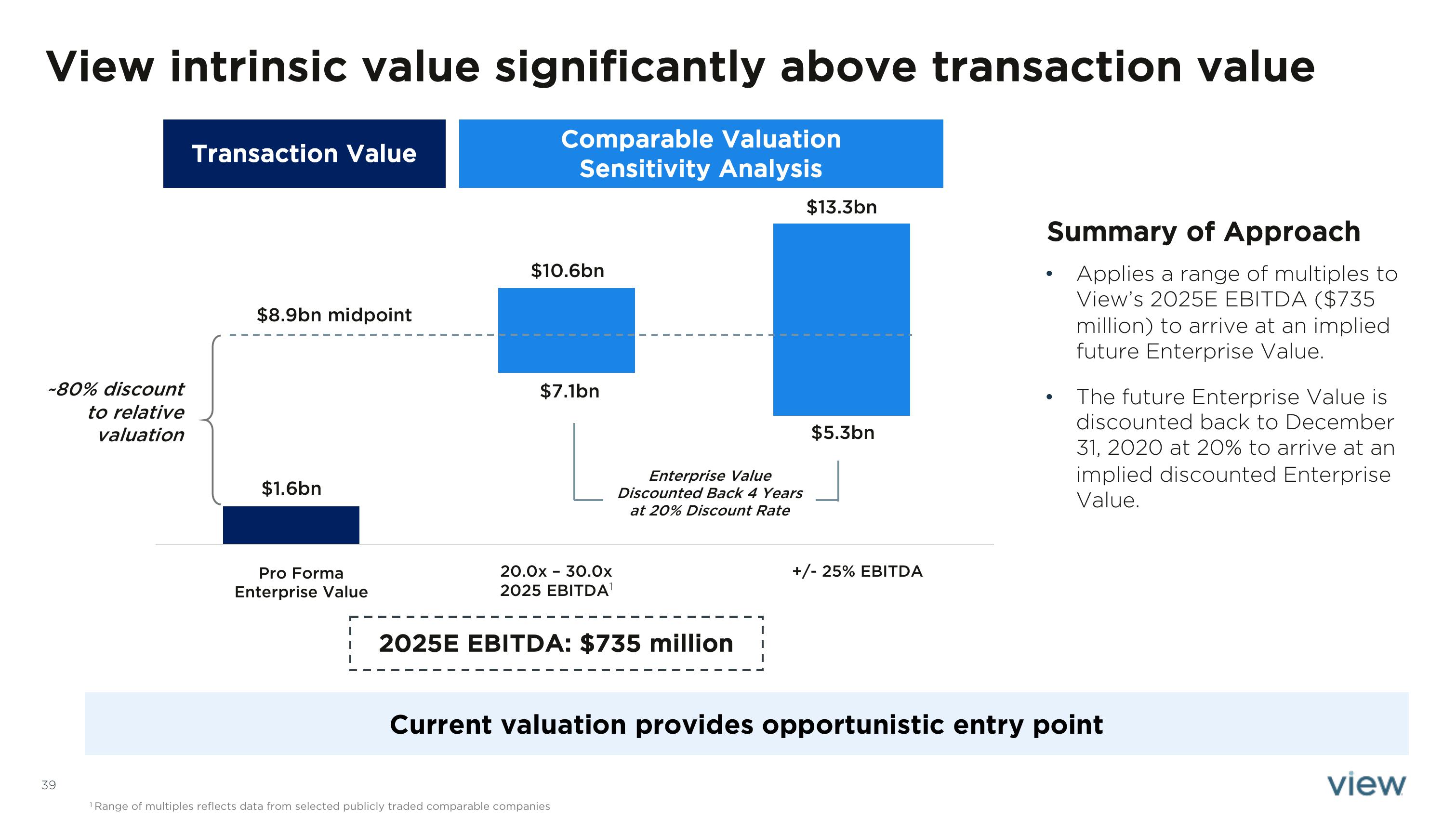

View intrinsic value significantly above transaction value

Comparable Valuation

Sensitivity Analysis

~80% discount

to relative

valuation

39

Transaction Value

$8.9bn midpoint

$1.6bn

Pro Forma

Enterprise Value

$10.6bn

$7.1bn

20.0x - 30.0x

2025 EBITDA¹

Enterprise Value

Discounted Back 4 Years

at 20% Discount Rate

2025E EBITDA: $735 million

¹ Range of multiples reflects data from selected publicly traded comparable companies

$13.3bn

$5.3bn

+/- 25% EBITDA

Summary of Approach

Applies a range of multiples to

View's 2025E EBITDA ($735

million) to arrive at an implied

future Enterprise Value.

The future Enterprise Value is

discounted back to December

31, 2020 at 20% to arrive at an

implied discounted Enterprise

Value.

Current valuation provides opportunistic entry point

viewView entire presentation