Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

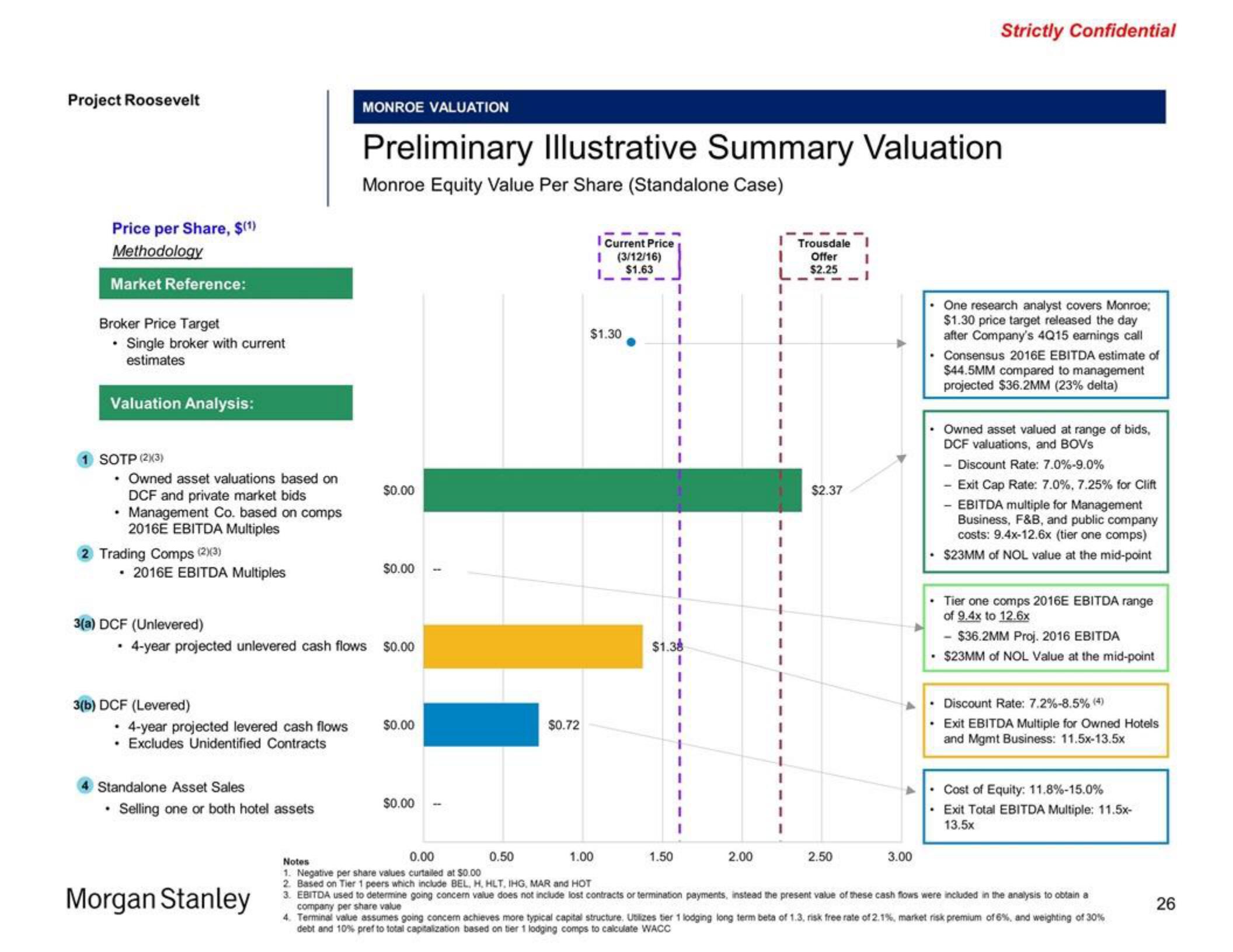

Price per Share, $(1)

Methodology

Market Reference:

Broker Price Target

• Single broker with current

estimates

Valuation Analysis:

SOTP (2)(3)

• Owned asset valuations based on

DCF and private market bids

• Management Co. based on comps

2016E EBITDA Multiples

Trading Comps (2)(3)

• 2016E EBITDA Multiples

3(a) DCF (Unlevered)

3(b) DCF (Levered)

MONROE VALUATION

Preliminary Illustrative Summary Valuation

Monroe Equity Value Per Share (Standalone Case)

• 4-year projected unlevered cash flows $0.00

Standalone Asset Sales

• Selling one or both hotel assets

$0.00

Morgan Stanley

$0.00

• 4-year projected levered cash flows $0.00

Excludes Unidentified Contracts

$0.00

1

$0.72

0.50

0.00

Notes

1. Negative per share values curtailed at $0.00

2. Based on Tier 1 peers which include BEL, H, HLT, IHG, MAR and HOT

$1.30

1.00

I Current Price

I (3/12/16)

$1.63

$1.38

1

I

1

1.50

1

2.00

I Trousdale

Offer

$2.25

1

$2.37

2.50

3.00

Strictly Confidential

One research analyst covers Monroe;

$1.30 price target released the day

after Company's 4Q15 earnings call

Consensus 2016E EBITDA estimate of

$44.5MM compared to management

projected $36.2MM (23% delta)

Owned asset valued at range of bids,

DCF valuations, and BOVS

Discount Rate: 7.0%-9.0%

- Exit Cap Rate: 7.0%, 7.25% for Clift

- EBITDA multiple for Management

Business, F&B, and public company

costs: 9.4x-12.6x (tier one comps)

$23MM of NOL value at the mid-point

• Tier one comps 2016E EBITDA range

of 9.4x to 12.6x

$36.2MM Proj. 2016 EBITDA

• $23MM of NOL Value at the mid-point

Discount Rate: 7.2% -8.5% (4)

Exit EBITDA Multiple for Owned Hotels

and Mgmt Business: 11.5x-13.5x

Cost of Equity: 11.8%-15.0%

Exit Total EBITDA Multiple: 11.5x-

13.5x

3. EBITDA used to determine going concem value does not include lost contracts or termination payments, instead the present value of these cash flows were included in the analysis to obtain a

company per share value

4. Terminal value assumes going concem achieves more typical capital structure. Utilizes tier 1 lodging long term beta of 1.3, risk free rate of 2.1%, market risk premium of 6%, and weighting of 30%

debt and 10% pref to total capitalization based on tier 1 lodging comps to calculate WACC

26View entire presentation