WeWork Restructuring Presentation Deck

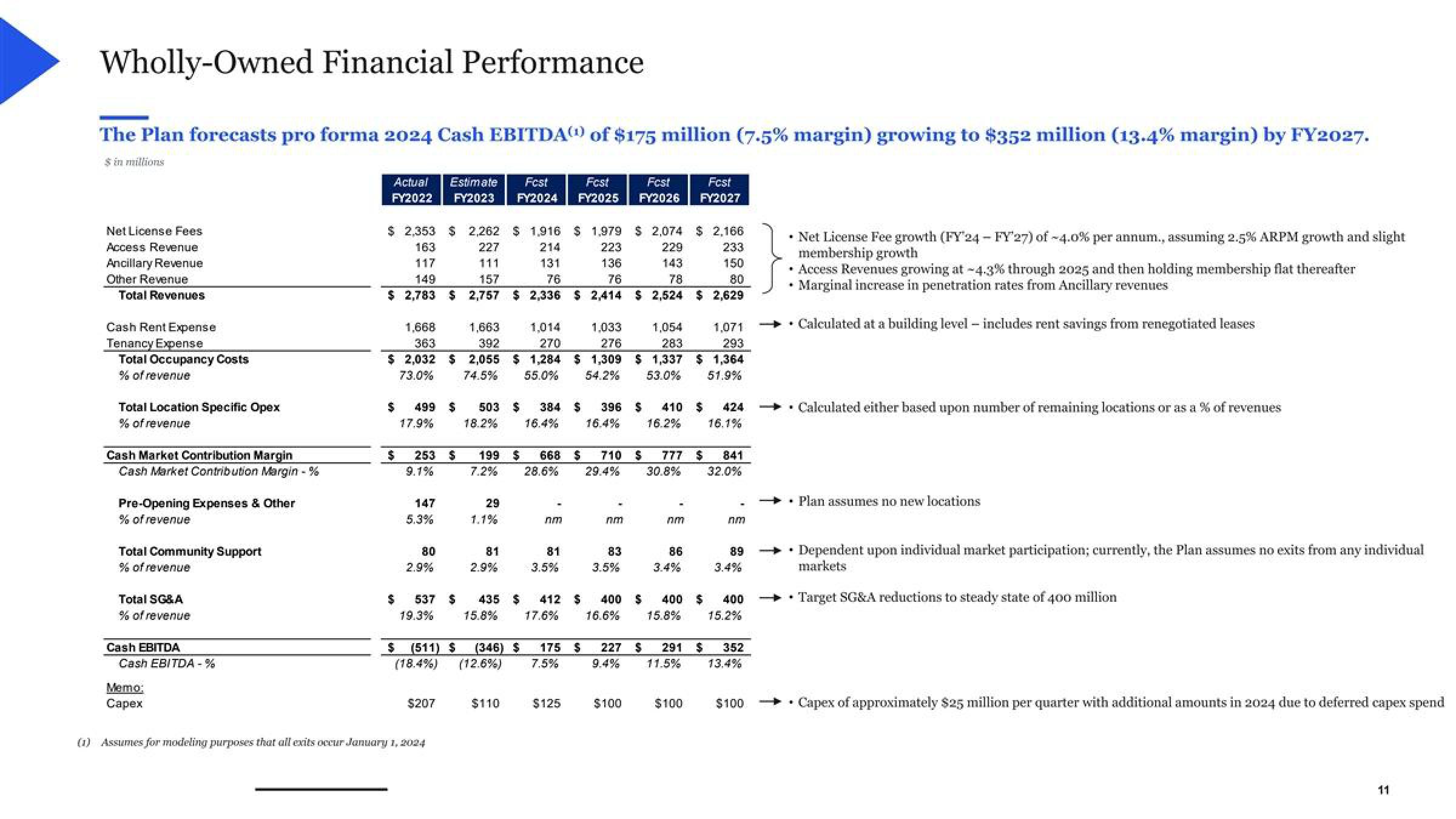

Wholly-Owned Financial Performance

The Plan forecasts pro forma 2024 Cash EBITDA) of $175 million (7.5% margin) growing to $352 million (13.4% margin) by FY2027.

$ in millions

Net License Fees

Access Revenue

Ancillary Revenue

Other Revenue

Total Revenues

Cash Rent Expense

Tenancy Expense

Total Occupancy Costs

% of revenue

Total Location Specific Opex

% of revenue

Cash Market Contribution Margin

Cash Market Contribution Margin - %

Pre-Opening Expenses & Other

% of revenue

Total Community Support

% of revenue

Total SG&A

% of revenue

Cash EBITDA

Cash EBITDA-%

Memo:

Capex

Actual Estimate Fest Fest

Fest

FY2022 FY2023 FY2024 FY2025 FY2026

$ 2,353 $ 2,262 $ 1,916 $ 1,979 $ 2,074 $ 2,166

163

227

214

223

229

233

117

131

136

143

150

111

157

149

76

76

78

80

$ 2,783 $ 2,757 $ 2,336 $ 2,414 $ 2,524 $ 2,629

1,668

363

1,663

392

1,014

270

$ 2,032 $ 2,055 $ 1,284

73.0%

55.0%

74.5%

253 $

9.1%

147

5.3%

499 $ 503 $ 384 S 396 S 410 $ 424

17.9% 18.2% 16.4% 16.4% 16.2% 16.1%

80

2.9%

537 $

19.3%

$ (511) $

(18.4%)

$207

(1) Assumes for modeling purposes that all exits occur January 1, 2024

29

81

435 S

15.8%

199 $ 668 $ 710 S 777 $ 841

7.2% 28.6%

29.4%

30.8%

32.0%

(346) $

(12.6%)

$110

nm

81

3.5%

1,033

276

$ 1,309 $ 1,337

54.2% 53.0%

175 $

7.5%

$125

nm

1,054

283

83

3.5%

9.4%

Am

$100

Fest

FY2027

86

3.4%

227 S 291

11.5%

412 $ 400 S 400 $ 400

16.6%

17.6%

15.8%

15.2%

1,071

293

$ 1,364

51.9%

$100

89

3.4%

352

13.4%

$100

* Net License Fee growth (FY 24 - FY'27) of -4.0% per annum., assuming 2.5% ARPM growth and slight

membership growth

+ Access Revenues growing at -4.3% through 2025 and then holding membership flat thereafter

Marginal increase in penetration rates from Ancillary revenues

•

• Calculated at a building level - includes rent savings from renegotiated leases

• Calculated either based upon number of remaining locations or as a % of revenues

▪

·

Plan assumes no new locations.

·

Dependent upon individual market participation; currently, the Plan assumes no exits from

markets

• Target SG&A reductions to steady state of 400 million

any

individual

Capex of approximately $25 million per quarter with additional amounts in 2024 due to deferred capex spend

11View entire presentation