Tudor, Pickering, Holt & Co Investment Banking

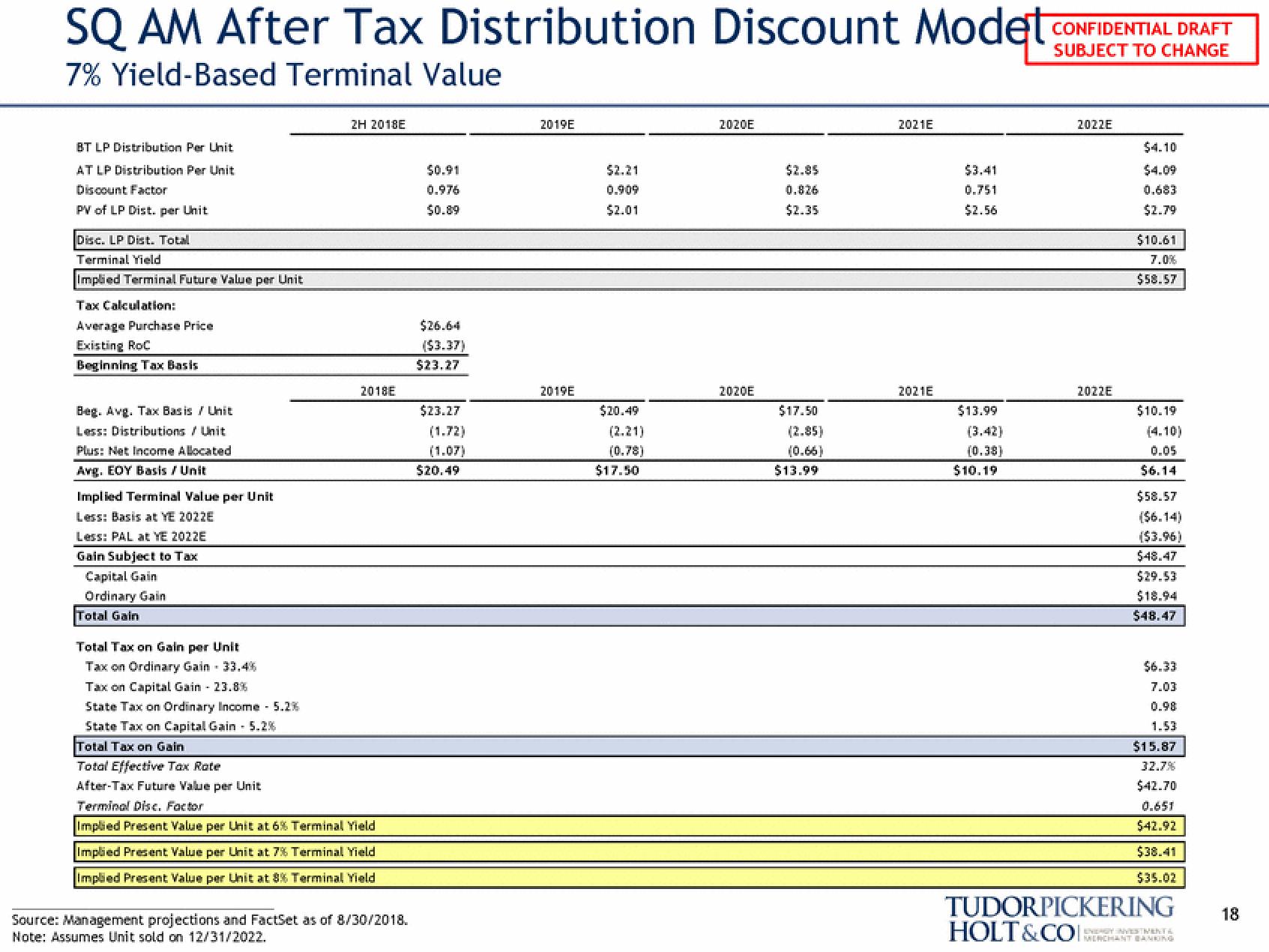

SQ AM After Tax Distribution Discount Modet

7% Yield-Based Terminal Value

BT LP Distribution Per Unit

AT LP Distribution Per Unit

Discount Factor

PV of LP Dist. per Unit

Disc. LP Dist. Total

Terminal Yield

Implied Terminal Future Value per Unit

Tax Calculation:

Average Purchase Price

Existing RoC

Beginning Tax Basis

Beg. Avg. Tax Basis / Unit

Less: Distributions / Unit

Plus: Net Income Allocated

Avg. EOY Basis / Unit

Implied Terminal Value per Unit

Less: Basis at YE 2022E

Less: PAL at YE 2022E

Gain Subject to Tax

Capital Gain

Ordinary Gain

Total Gain

Total Tax on Gain per Unit

Tax on Ordinary Gain - 33.4%

Tax on Capital Gain - 23.8%

State Tax on Ordinary Income - 5.2%

State Tax on Capital Gain 5.2%

Total Tax on Gain

Total Effective Tax Rate

2H 2018E

2018E

After-Tax Future Value per Unit

Terminal Dise, Factor

Implied Present Value per Unit at 6% Terminal Yield

Implied Present Value per Unit at 7% Terminal Yield

Implied Present Value per Unit at 8% Terminal Yield

Source: Management projections and FactSet as of 8/30/2018.

Note: Assumes Unit sold on 12/31/2022.

$0.91

0.976

$0.89

$26.64

($3.37)

$23.27

$23.27

(1.72)

(1.07)

$20.49

2019E

2019E

$2.21

0.909

$2.01

$20.49

(2.21)

(0.78)

$17.50

2020E

2020E

$2.85

0.826

$2.35

$17.50

(2.85)

(0.66)

$13.99

2021E

2021E

$3.41

0.751

$2.56

$13.99

(0.38)

$10.19

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2022E

2022E

$4.10

0.683

$2.79

$10.61

7.0%

$58.57

$10.19

(4.10)

0.05

$6.14

$58.57

($6.14)

($3.96)

$48.47

$29.53

$18.94

$48.47

$6.33

7.03

0.98

1.53

$15.87

32.7%

$42.70

0.651

$42.92

$38.41

$35.02

TUDORPICKERING 18

HOLT&COCHANT BANKINGView entire presentation