KKR Real Estate Finance Trust Investor Presentation Deck

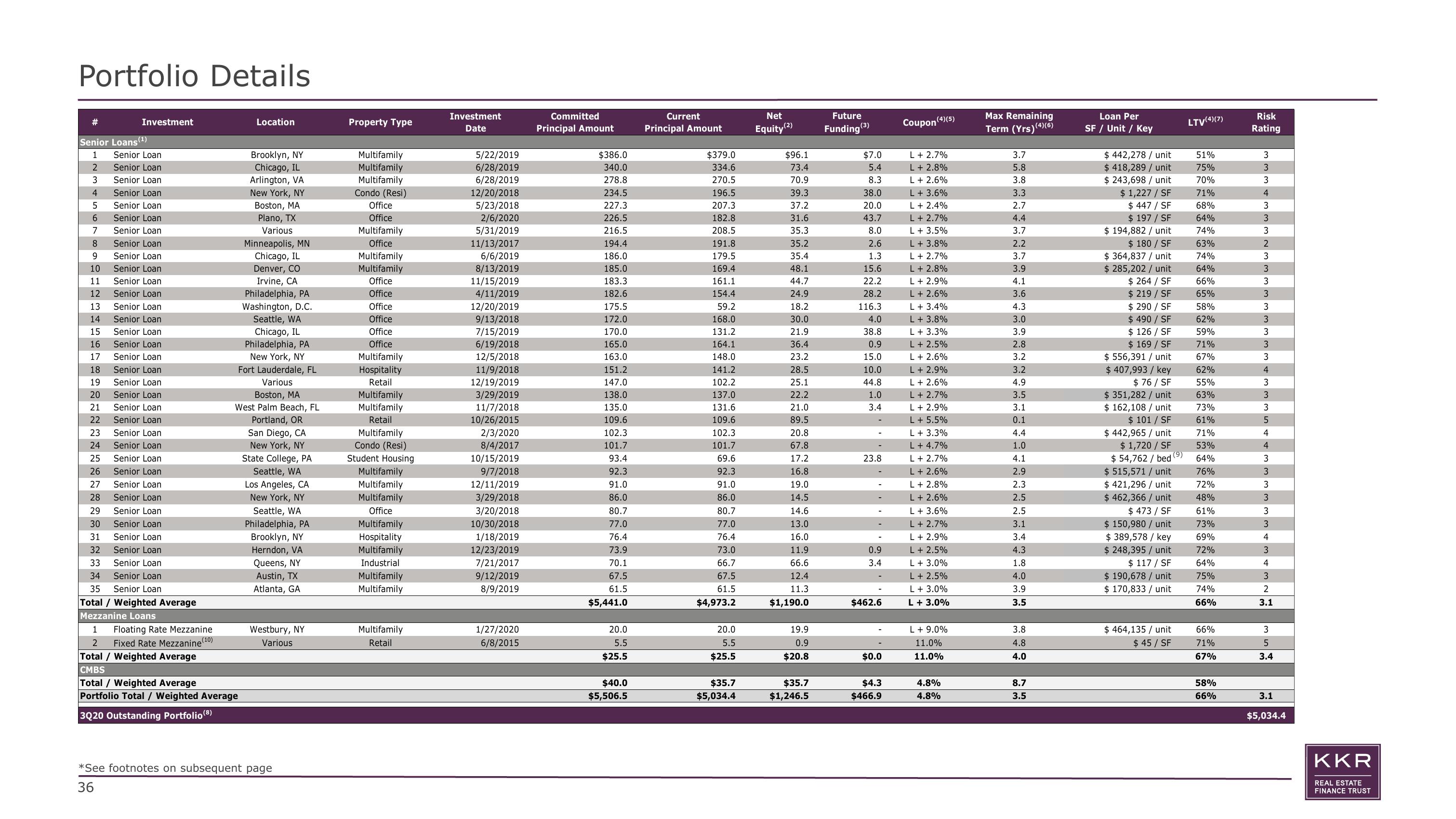

Portfolio Details

#

Senior Loans (1)

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

Senior Loan

10 Senior Loan

11 Senior Loan

Senior Loan

12

13

Senior Loan

14 Senior Loan

15 Senior Loan

16 Senior Loan

17 Senior Loan

18 Senior Loan

19

Senior Loan

20

Senior Loan

21

Senior Loan

22

Senior Loan

23

Senior Loan

24

Senior Loan

25

Senior Loan

26

Senior Loan

27

Senior Loan

28

Senior Loan

29

Senior Loan

30

Senior Loan

31

Senior Loan

32 Senior Loan

33 Senior Loan

34

Senior Loan

35 Senior Loan

Total / Weighted Average

Mezzanine Loans

HHEESSA ENH

Investment

4

9

Floating Rate Mezzanine

Fixed Rate Mezzanine (10)

Location

Brooklyn, NY

Chicago, IL

Arlington, VA

New York, NY

Boston, MA

Plano, TX

Various

Minneapolis, MN

Chicago, IL

Denver, CO

Irvine, CA

Philadelphia, PA

Washington, D.C.

Seattle, WA

Chicago, IL

Philadelphia, PA

New York, NY

Fort Lauderdale, FL

Various

1

2

Total / Weighted Average

CMBS

Total / Weighted Average

Portfolio Total / Weighted Average

3Q20 Outstanding Portfolio (8)

Boston, MA

West Palm Beach, FL

Portland, OR

San Diego, CA

New York, NY

State College, PA

Seattle, WA

Los Angeles, CA

New York, NY

Seattle, WA

Philadelphia, PA

Brooklyn, NY

Herndon, VA

Queens, NY

Austin, TX

Atlanta, GA

Westbury, NY

Various

*See footnotes on subsequent page

36

Property Type

Multifamily

Multifamily

Multifamily

Condo (Resi)

Office

Office

Multifamily

Office

Multifamily

Multifamily

Office

Office

Office

Office

Office

Office

Multifamily

Hospitality

Retail

Multifamily

Multifamily

Retail

Multifamily

Condo (Resi)

Student Housing

Multifamily

Multifamily

Multifamily

Office

Multifamily

Hospitality

Multifamily

Industrial

Multifamily

Multifamily

Multifamily

Retail

Investment

Date

5/22/2019

6/28/2019

6/28/2019

12/20/2018

5/23/2018

2/6/2020

5/31/2019

11/13/2017

6/6/2019

8/13/2019

11/15/2019

4/11/2019

12/20/2019

9/13/2018

7/15/2019

6/19/2018

12/5/2018

11/9/2018

12/19/2019

3/29/2019

11/7/2018

10/26/2015

2/3/2020

8/4/2017

10/15/2019

9/7/2018

12/11/2019

3/29/2018

3/20/2018

10/30/2018

1/18/2019

12/23/2019

7/21/2017

9/12/2019

8/9/2019

1/27/2020

6/8/2015

Committed

Principal Amount

$386.0

340.0

278.8

234.5

227.3

226.5

216.5

194.4

186.0

185.0

183.3

182.6

175.5

172.0

170.0

165.0

163.0

151.2

147.0

138.0

135.0

109.6

102.3

101.7

93.4

92.3

91.0

86.0

80.7

77.0

76.4

73.9

70.1

67.5

61.5

$5,441.0

20.0

5.5

$25.5

$40.0

$5,506.5

Current

Principal Amount

$379.0

334.6

270.5

196.5

207.3

182.8

208.5

191.8

179.5

169.4

161.1

154.4

59.2

168.0

131.2

164.1

148.0

141.2

102.2

137.0

131.6

109.6

102.3

101.7

69.6

92.3

91.0

86.0

80.7

77.0

76.4

73.0

66.7

67.5

61.5

$4,973.2

20.0

5.5

$25.5

$35.7

$5,034.4

Net

Equity (2)

$96.1

73.4

70.9

39.3

37.2

31.6

35.3

35.2

35.4

48.1

44.7

24.9

18.2

30.0

21.9

36.4

23.2

28.5

25.1

22.2

21.0

89.5

20.8

67.8

17.2

16.8

19.0

14.5

14.6

13.0

16.0

11.9

66.6

12.4

11.3

$1,190.0

19.9

0.9

$20.8

$35.7

$1,246.5

Future

Funding

(3)

$7.0

5.4

8.3

38.0

20.0

43.7

8.0

2.6

1.3

15.6

22.2

28.2

116.3

4.0

38.8

0.9

15.0

10.0

44.8

1.0

3.4

23.8

0.9

3.4

-

$462.6

$0.0

$4.3

$466.9

Coupon (4) (5)

L + 2.7%

L + 2.8%

L + 2.6%

L + 3.6%

L+2.4%

L + 2.7%

L + 3.5%

L + 3.8%

L+2.7%

L + 2.8%

L + 2.9%

L + 2.6%

L + 3.4%

L + 3.8%

L + 3.3%

L+2.5%

L + 2.6%

L + 2.9%

L + 2.6%

L + 2.7%

L + 2.9%

L + 5.5%

L + 3.3%

L + 4.7%

L + 2.7%

L + 2.6%

L + 2.8%

L + 2.6%

L + 3.6%

L + 2.7%

L + 2.9%

L + 2.5%

L + 3.0%

L + 2.5%

L + 3.0%

L + 3.0%

L + 9.0%

11.0%

11.0%

4.8%

4.8%

Max Remaining

Term (Yrs) (4) (6)

3.7

5.8

3.8

3.3

2.7

4.4

3.7

2.2

3.7

3.9

4.1

3.6

4.3

3.0

3.9

2.8

3.2

3.2

4.9

3.5

3.1

0.1

4.4

1.0

4.1

2.9

2.3

2.5

2.5

3.1

3.4

4.3

1.8

4.0

3.9

3.5

3.8

4.8

4.0

8.7

3.5

Loan Per

SF / Unit / Key

$ 442,278 / unit

$ 418,289 / unit

$ 243,698 / unit

$ 1,227 / SF

$ 447 / SF

$ 197 / SF

$ 194,882 / unit

$ 180 / SF

$364,837 / unit

$285,202 / unit

$ 264 / SF

$219/ SF

$ 290 / SF

$ 490 / SF

$ 126 / SF

$ 169 / SF

$ 556,391 / unit

$ 407,993 / key

$76 / SF

$ 351,282 / unit

$ 162,108 / unit

$ 101 / SF

$ 442,965 / unit

$ 1,720 / SF

$ 54,762 / bed

$ 515,571 / unit

$ 421,296 / unit

$ 462,366 / unit

$ 473 / SF

$ 150,980 / unit

$ 389,578 / key

$ 248,395 / unit

$ 117 / SF

$ 190,678 / unit

$ 170,833 / unit

$ 464,135 / unit

$ 45/ SF

(9)

LTV(4)(7)

51%

75%

70%

71%

68%

64%

74%

63%

74%

64%

66%

65%

58%

62%

59%

71%

67%

62%

55%

63%

73%

61%

71%

53%

64%

76%

72%

48%

61%

73%

69%

72%

64%

75%

74%

66%

66%

71%

67%

58%

66%

Risk

Rating

3

3

3

4

3

3

3

2

3

3

3

3

3

3

3

3

3

4

3

3

3

5

4

4

3

3

3

3

3

3

4

3

4

3

2

3.1

3

5

3.4

3.1

$5,034.4

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation