WeWork Investor Presentation Deck

I

(1)

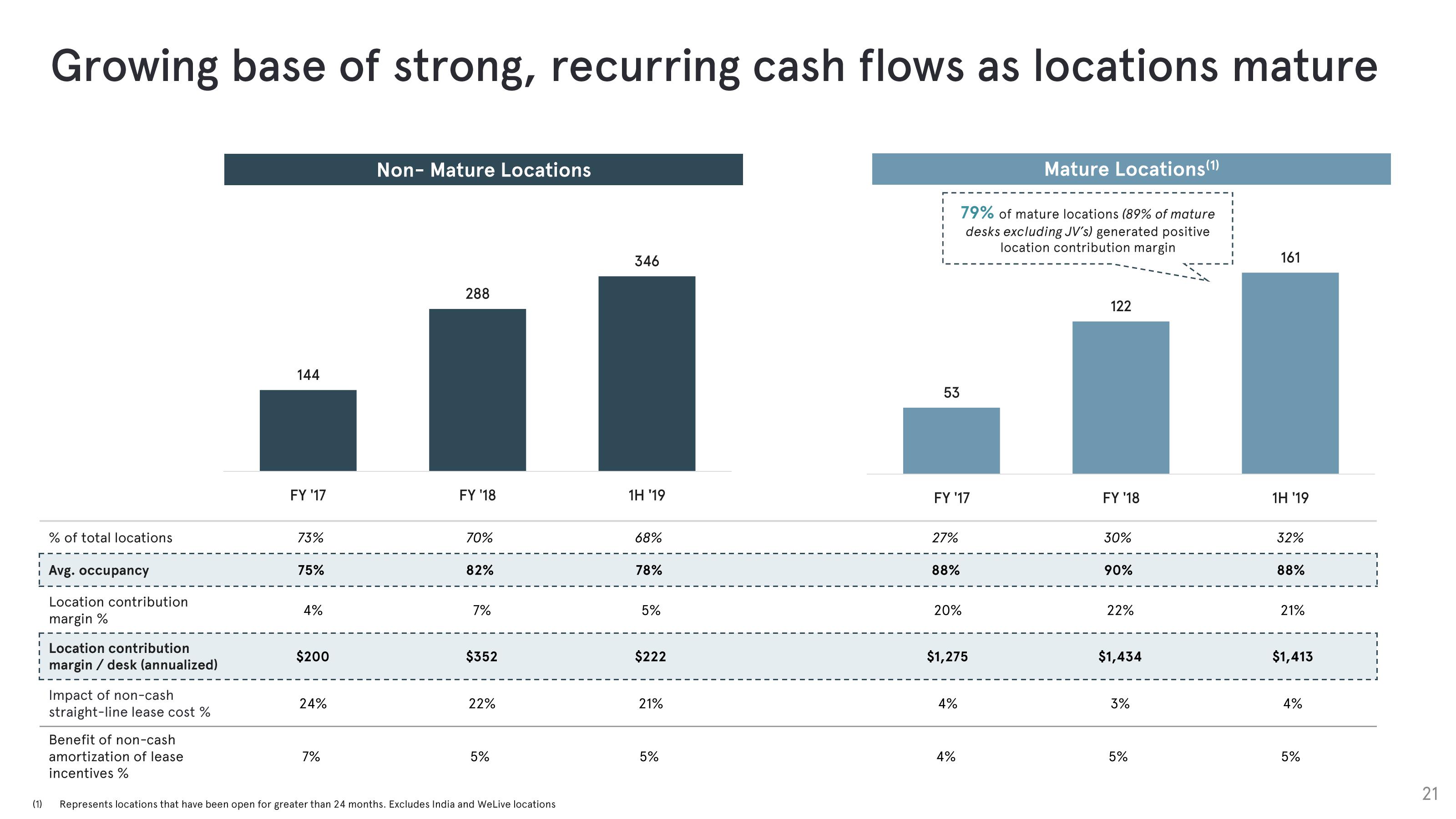

Growing base of strong, recurring cash flows as locations mature

% of total locations

Avg. occupancy

Location contribution

margin %

Location contribution

margin / desk (annualized)

Impact of non-cash

straight-line lease cost %

Benefit of non-cash

amortization of lease

incentiv %

144

FY '17

73%

75%

4%

$200

24%

7%

Non- Mature Locations

288

FY '18

70%

82%

7%

$352

22%

5%

Represents locations that have been open for greater than 24 months. Excludes India and WeLive locations

346

1H '19

68%

78%

5%

$222

21%

5%

53

FY '17

27%

88%

Mature Locations (1)

79% of mature locations (89% of mature

desks excluding JV's) generated positive

location contribution margin

20%

$1,275

4%

4%

122

FY '18

30%

90%

22%

$1,434

3%

5%

I

161

1H '19

32%

88%

21%

$1,413

4%

5%

21View entire presentation