Samsara Investor Day Presentation Deck

70

Ⓒ Samsara Inc.

samsara

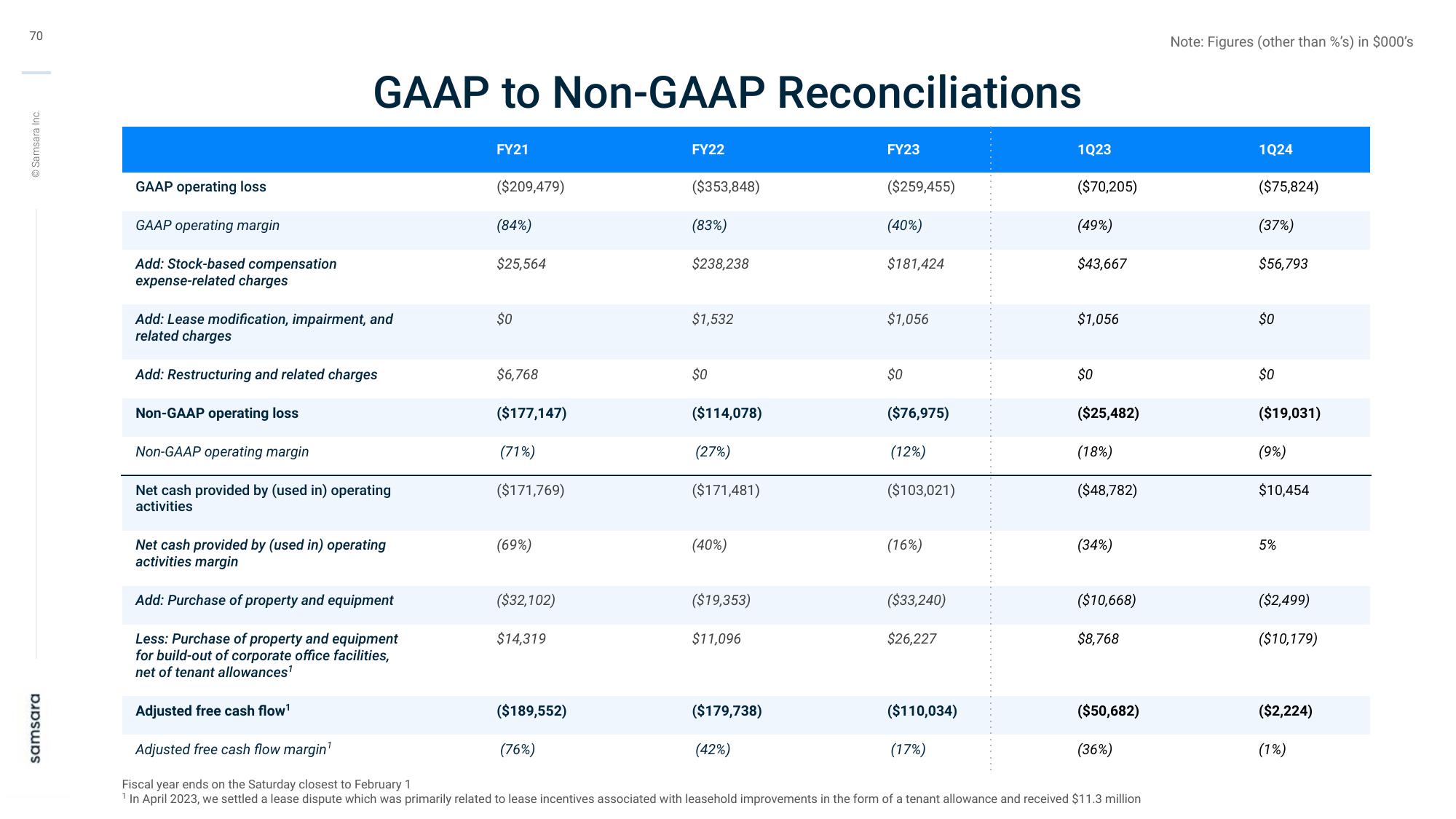

GAAP operating loss

GAAP operating margin

Add: Stock-based compensation

expense-related charges

GAAP to Non-GAAP Reconciliations

Add: Lease modification, impairment, and

related charg

Add: Restructuring and related charges

Non-GAAP operating loss

Non-GAAP operating margin

Net cash provided by (used in) operating

activities

Net cash provided by (used in) operating

activities margin

Add: Purchase of property and equipment

Less: Purchase of property and equipment

for build-out of corporate office facilities,

net of tenant allowances¹

FY21

($209,479)

(84%)

$25,564

$0

$6,768

($177,147)

(71%)

($171,769)

(69%)

($32,102)

$14,319

($189,552)

FY22

(76%)

($353,848)

(83%)

$238,238

$1,532

$0

($114,078)

(27%)

($171,481)

(40%)

($19,353)

$11,096

($179,738)

FY23

(42%)

($259,455)

(40%)

$181,424

$1,056

$0

($76,975)

(12%)

($103,021)

(16%)

($33,240)

$26,227

1Q23

($110,034)

(17%)

($70,205)

(49%)

$43,667

$1,056

$0

($25,482)

(18%)

Adjusted free cash flow¹

Adjusted free cash flow margin¹

Fiscal year ends on the Saturday closest to February 1

1 In April 2023, we settled a lease dispute which was primarily related to lease incentives associated with leasehold improvements in the form of a tenant allowance and received $11.3 million

($48,782)

(34%)

($10,668)

$8,768

($50,682)

(36%)

Note: Figures (other than %'s) in $000's

1024

($75,824)

(37%)

$56,793

$0

$0

($19,031)

(9%)

$10,454

5%

($2,499)

($10,179)

($2,224)

(1%)View entire presentation