BioAtla IPO Presentation Deck

Offering Summary

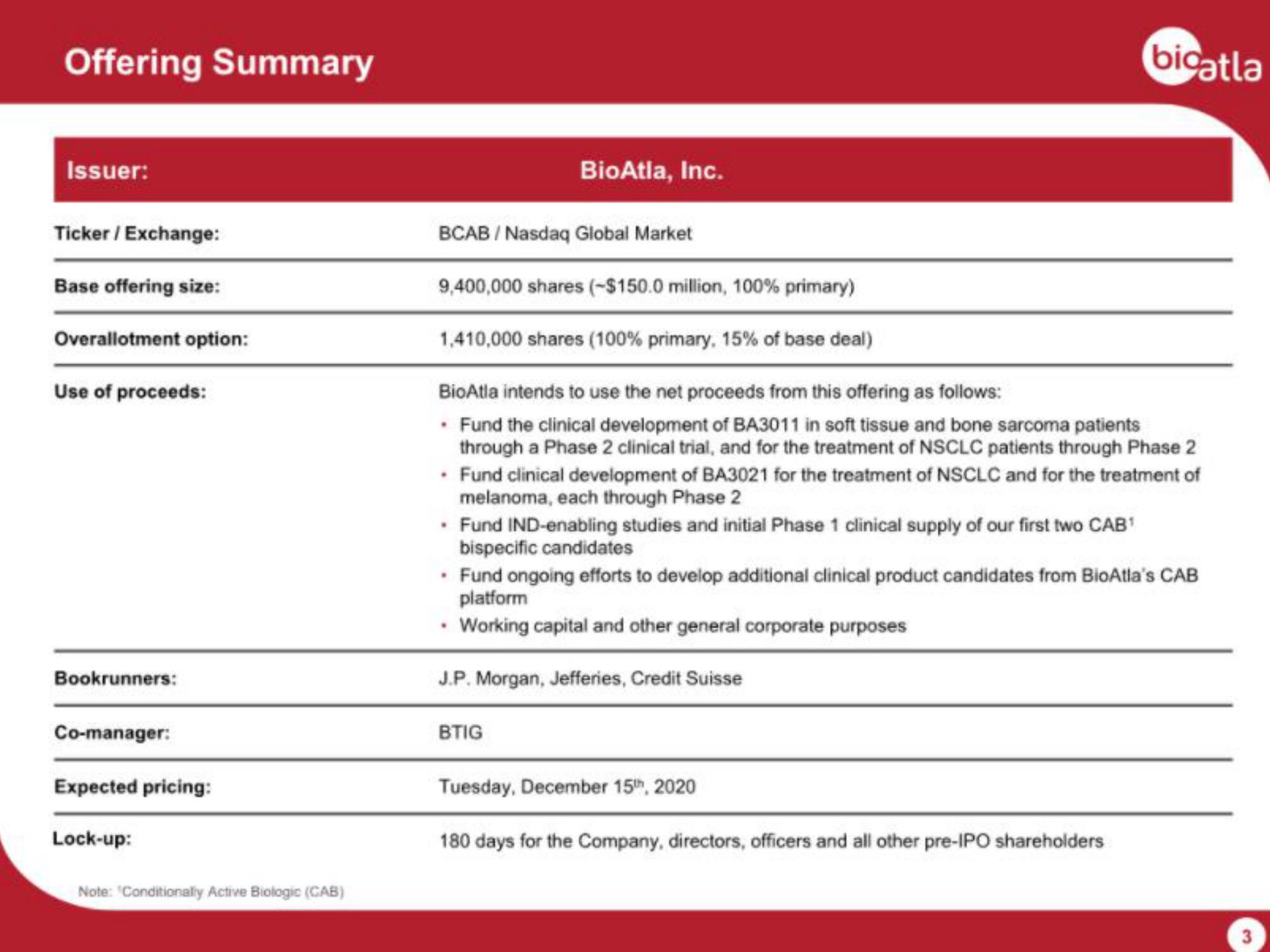

Issuer:

Ticker/ Exchange:

Base offering size:

Overallotment option:

Use of proceeds:

Bookrunners:

Co-manager:

Expected pricing:

Lock-up:

Note: Conditionally Active Biologic (CAB)

BioAtla, Inc.

BCAB/Nasdaq Global Market

9,400,000 shares (-$150.0 million, 100% primary)

1,410,000 shares (100% primary, 15% of base deal)

BioAtla intends to use the net proceeds from this offering as follows:

• Fund the clinical development of BA3011 in soft tissue and bone sarcoma patients

through a Phase 2 clinical trial, and for the treatment of NSCLC patients through Phase 2

bicatla

• Fund clinical development of BA3021 for the treatment of NSCLC and for the treatment of

melanoma, each through Phase 2

• Fund IND-enabling studies and initial Phase 1 clinical supply of our first two CAB¹

bispecific candidates

BTIG

• Fund ongoing efforts to develop additional clinical product candidates from BioAtla's CAB

platform

• Working capital and other general corporate purposes

J.P. Morgan, Jefferies, Credit Suisse

Tuesday, December 15th, 2020

180 days for the Company, directors, officers and all other pre-IPO shareholdersView entire presentation