Ready Capital Investor Presentation Deck

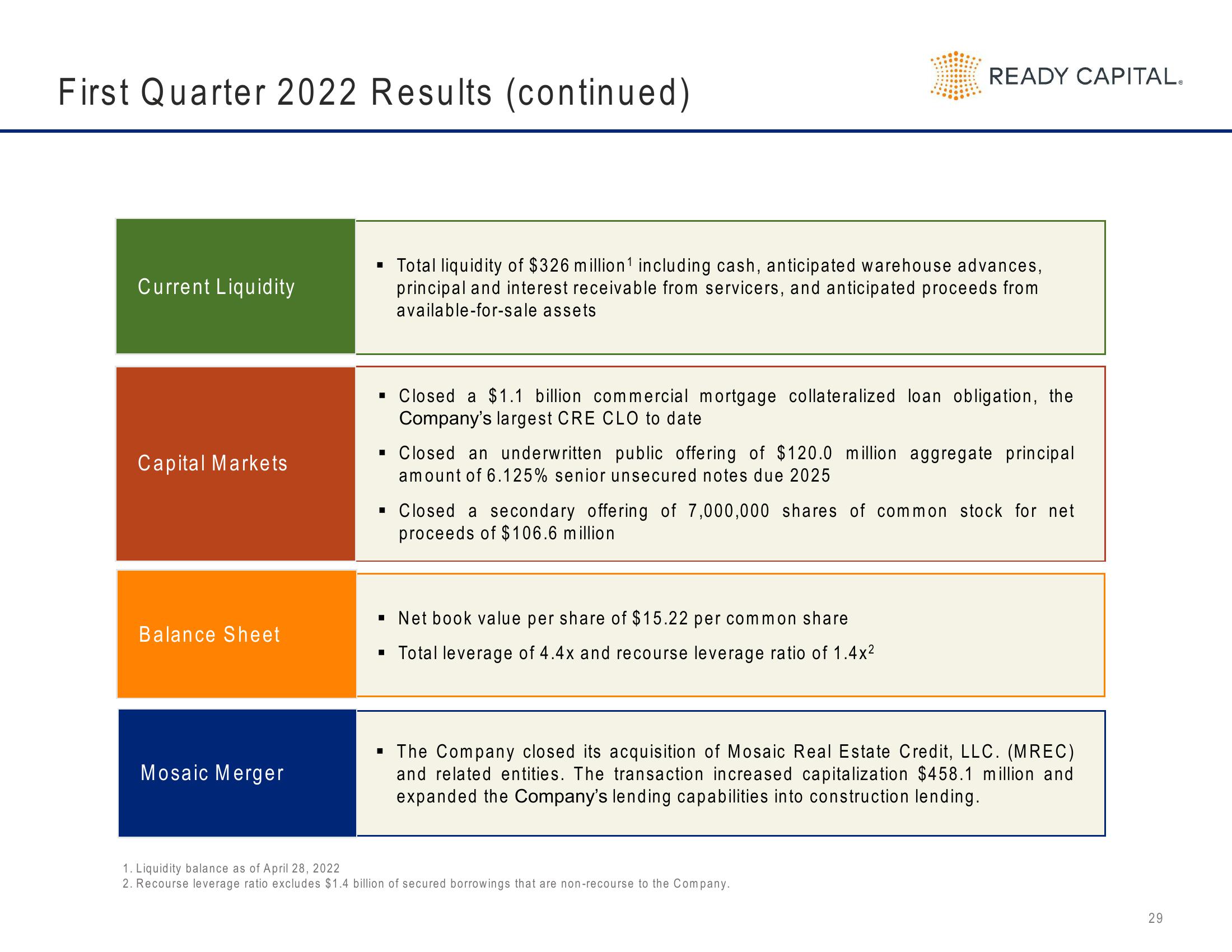

First Quarter 2022 Results (continued)

Current Liquidity

Capital Markets

Balance Sheet

Mosaic Merger

▪ Total liquidity of $326 million¹ including cash, anticipated warehouse advances,

principal and interest receivable from servicers, and anticipated proceeds from

available-for-sale assets

READY CAPITAL.

▪ Closed a $1.1 billion commercial mortgage collateralized loan obligation, the

Company's largest CRE CLO to date

▪ Closed an underwritten public offering of $120.0 million aggregate principal

amount of 6.125% senior unsecured notes due 2025

■ Closed a secondary offering of 7,000,000 shares of common stock for net

proceeds of $106.6 million

▪ Net book value per share of $15.22 per common share

▪ Total leverage of 4.4x and recourse leverage ratio of 1.4x²

▪ The Company closed its acquisition of Mosaic Real Estate Credit, LLC. (MREC)

and related entities. The transaction increased capitalization $458.1 million and

expanded the Company's lending capabilities into construction lending.

1. Liquidity balance as of April 28, 2022

2. Recourse leverage ratio excludes $1.4 billion of secured borrowings that are non-recourse to the Company.

29View entire presentation