Cboe Results Presentation Deck

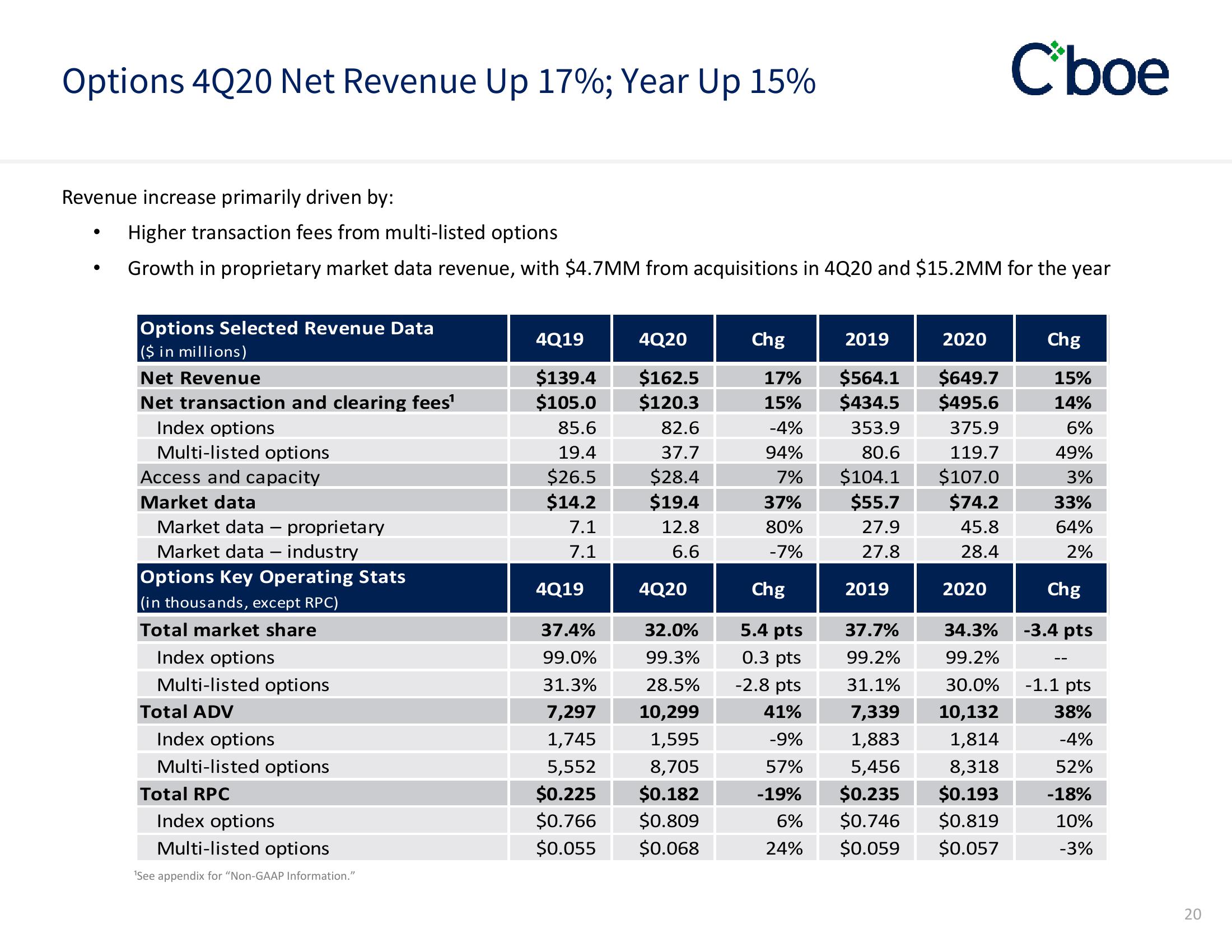

Options 4Q20 Net Revenue Up 17%; Year Up 15%

Revenue increase primarily driven by:

●

Higher transaction fees from multi-listed options

Growth in proprietary market data revenue, with $4.7MM from acquisitions in 4Q20 and $15.2MM for the year

Options Selected Revenue Data

($ in millions)

Net Revenue

Net transaction and clearing fees¹

Index options

Multi-listed options

Access and capacity

Market data

Market data - proprietary

Market data - industry

Options Key Operating Stats

(in thousands, except RPC)

Total market share

Index options

Multi-listed options

Total ADV

Index options

Multi-listed options

Total RPC

Index options

Multi-listed options

¹See appendix for "Non-GAAP Information."

4Q19

$139.4

$105.0

85.6

19.4

$26.5

$14.2

7.1

7.1

4Q19

4Q20

$162.5

$120.3

82.6

37.7

$28.4

$19.4

12.8

6.6

4Q20

37.4%

32.0%

99.0%

99.3%

31.3%

28.5%

7,297

10,299

1,745

1,595

5,552

8,705

$0.225

$0.182

$0.766 $0.809

$0.055 $0.068

Chg

17%

15%

-4%

94%

7%

37%

80%

-7%

Chg

5.4 pts

0.3 pts

-2.8 pts

41%

-9%

57%

-19%

6%

24%

2019

$564.1

$434.5

353.9

80.6

$104.1

$55.7

27.9

27.8

2019

2020

$649.7

$495.6

375.9

119.7

$107.0

$74.2

45.8

28.4

2020

Cboe

37.7%

34.3%

99.2%

99.2%

31.1%

30.0%

7,339

10,132

1,883

1,814

5,456

8,318

$0.235

$0.193

$0.746 $0.819

$0.059 $0.057

Chg

15%

14%

6%

49%

3%

33%

64%

2%

Chg

-3.4 pts

-1.1 pts

38%

-4%

52%

-18%

10%

-3%

20View entire presentation