Rigetti SPAC Presentation Deck

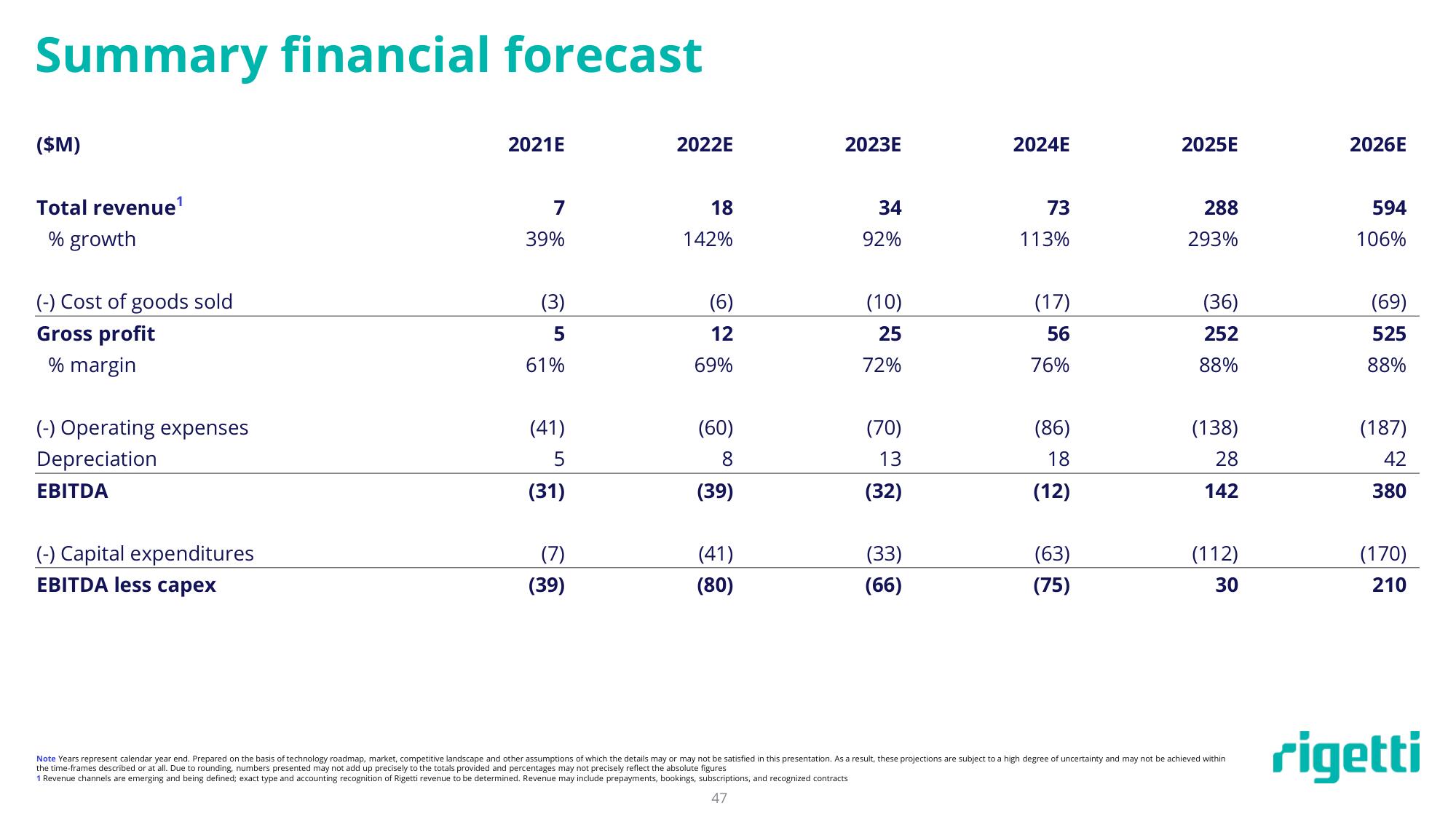

Summary financial forecast

($M)

Total revenue¹

% growth

(-) Cost of goods sold

Gross profit

% margin

(-) Operating expenses

Depreciation

EBITDA

(-) Capital expenditures

EBITDA less capex

2021E

7

39%

(3)

5

61%

(41)

5

(31)

(7)

(39)

2022E

18

142%

(6)

12

69%

(60)

8

(39)

(41)

(80)

2023E

34

92%

(10)

25

72%

(70)

13

(32)

(33)

(66)

2024E

73

113%

(17)

56

76%

(86)

18

(12)

(63)

(75)

2025E

288

293%

(36)

252

88%

(138)

28

142

(112)

30

Note Years represent calendar year end. Prepared on the basis of technology roadmap, market, competitive landscape and other assumptions of which the details may or may not be satisfied in this presentation. As a result, these projections are subject to a high degree of uncertainty and may not be achieved within

the time-frames described or at all. Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures

1 Revenue channels are emerging and being defined; exact type and accounting recognition of Rigetti revenue to be determined. Revenue may include prepayments, bookings, subscriptions, and recognized contracts

47

2026E

594

106%

(69)

525

88%

(187)

42

380

(170)

210

rigettiView entire presentation