Investor Presentation

capitalization

AR

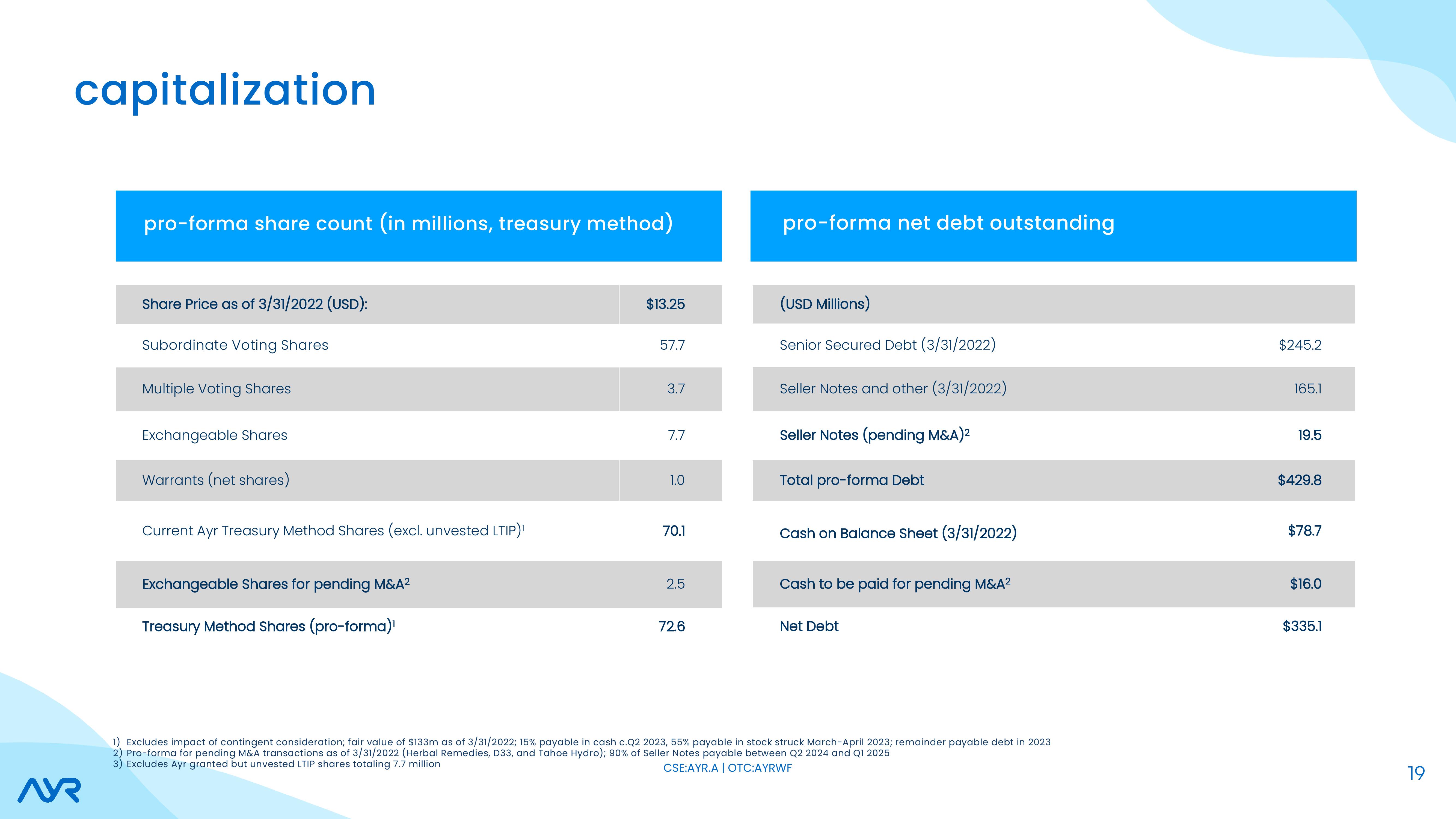

pro-forma share count (in millions, treasury method)

Share Price as of 3/31/2022 (USD):

Subordinate Voting Shares

Multiple Voting Shares

Exchangeable Shares

Warrants (net shares)

Current Ayr Treasury Method Shares (excl. unvested LTIP)¹

Exchangeable Shares for pending M&A²

Treasury Method Shares (pro-forma)¹

$13.25

57.7

3.7

7.7

1.0

70.1

2.5

72.6

pro-forma net debt outstanding

(USD Millions)

Senior Secured Debt (3/31/2022)

Seller Notes and other (3/31/2022)

Seller Notes (pending M&A)²

Total pro-forma Debt

Cash on Balance Sheet (3/31/2022)

Cash to be paid for pending M&A²

Net Debt

1) Excludes impact of contingent consideration; fair value of $133m as of 3/31/2022; 15% payable in cash c.Q2 2023, 55% payable in stock struck March-April 2023; remainder payable debt in 2023

2) Pro-forma for pending M&A transactions as of 3/31/2022 (Herbal Remedies, D33, and Tahoe Hydro); 90% of Seller Notes payable between Q2 2024 and Q1 2025

3) Excludes Ayr granted but unvested LTIP shares totaling 7.7 million

CSE:AYR.A | OTC:AYRWF

$245.2

165.1

19.5

$429.8

$78.7

$16.0

$335.1

19View entire presentation