Evercore Investment Banking Pitch Book

Overview of Proposed Transaction and Process Summary

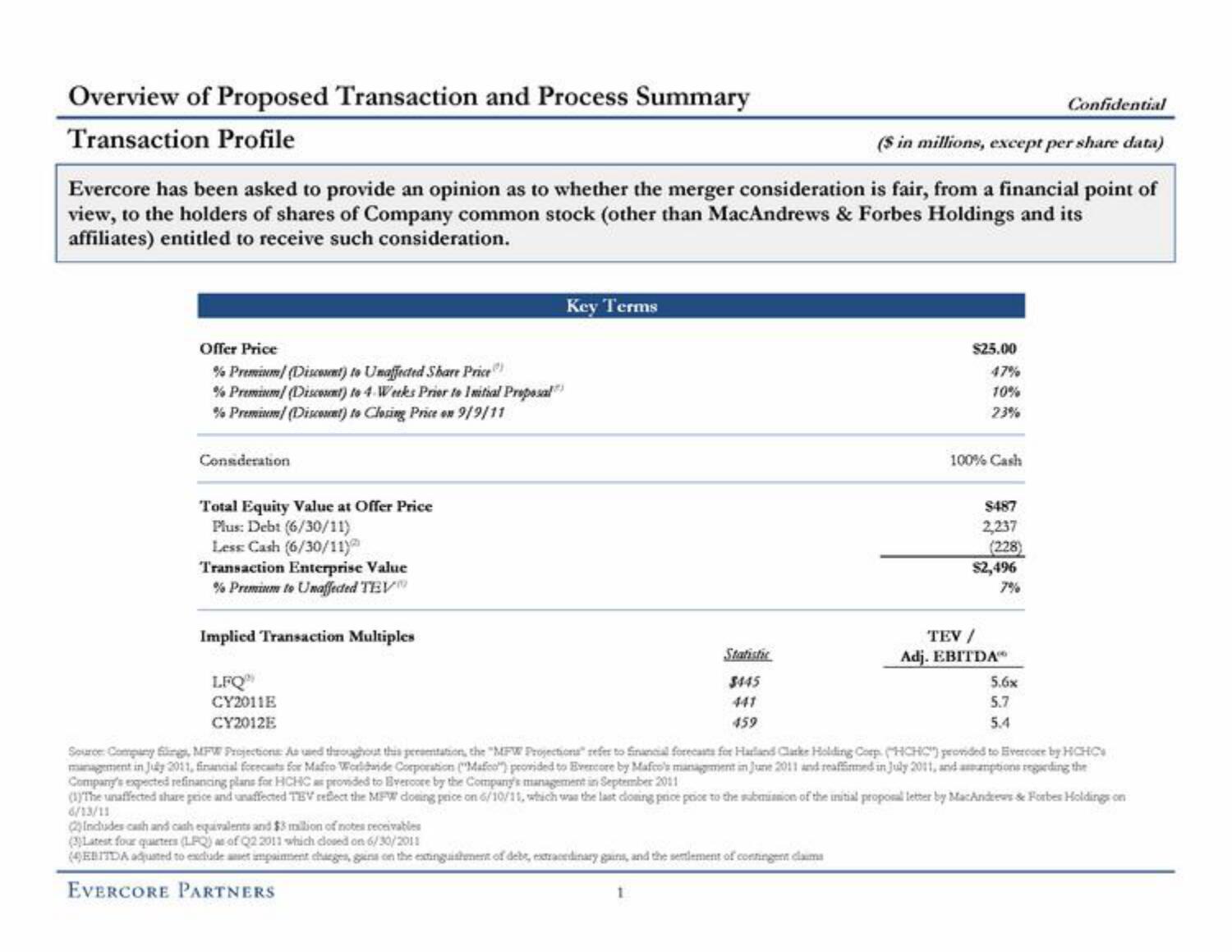

Transaction Profile

($ in millions, except per share data)

Evercore has been asked to provide an opinion as to whether the merger consideration is fair, from a financial point of

view, to the holders of shares of Company common stock (other than MacAndrews & Forbes Holdings and its

affiliates) entitled to receive such consideration.

Offer Price

% Premium/ (Discount) to Unaffected Share Price

% Premium/ (Discount) to 4 Weeks Prior to Initial Proposal

% Premium/ (Discount) to Closing Price on 9/9/11

Consideration

Total Equity Value at Offer Price

Plus: Debt (6/30/11)

Less: Cash (6/30/11)

Transaction Enterprise Value

% Premium to Unaffected TEV

Implied Transaction Multiples

LFQ

CY2011E

CY2012E

Key Terms

Statistic

$445

441

459

Includes cash and cash equivalents and $3 million of notes receivables

(3) Latest four quarters (LPQ) as of Q2 2011 which closed on 6/30/2011

(4)EBITDA adjusted to exclude aer impaiment charges, gains on the extinguishment of debt, extracedinary gains, and the settlement of contingern claims

EVERCORE PARTNERS

1

$25.00

47%

10%

23%

100% Cash

$487

2,237

(228)

$2,496

7%

TEV /

Adj. EBITDA*

Confidential

5.6x

5.7

5.4

Source Company Slings, MFW Projections As used throughout this persentation, the "MFW Projections" refer to financial forecasts for Harland Clarke Holding Corp. (HCHC) provided to Evercore by HCHC

management in July 2011, financial forecasts for Mafto Worldwide Corporation ("Mafeo") provided to Evercore by Mafco's management in June 2011 and reaffirmed in July 2011, and amumptions regarding the

Company's expected refinancing plans for HCHC as provided to Evercore by the Company's management in September 2011

(1)The unaffected share price and unaffected "TEV reflect the MFW dosing price on 6/10/11, which was the last closing price price to the submission of the initial proposal letter by MacAndrews & Forbes Holdings on

6/13/11View entire presentation