Cyxtera SPAC Presentation Deck

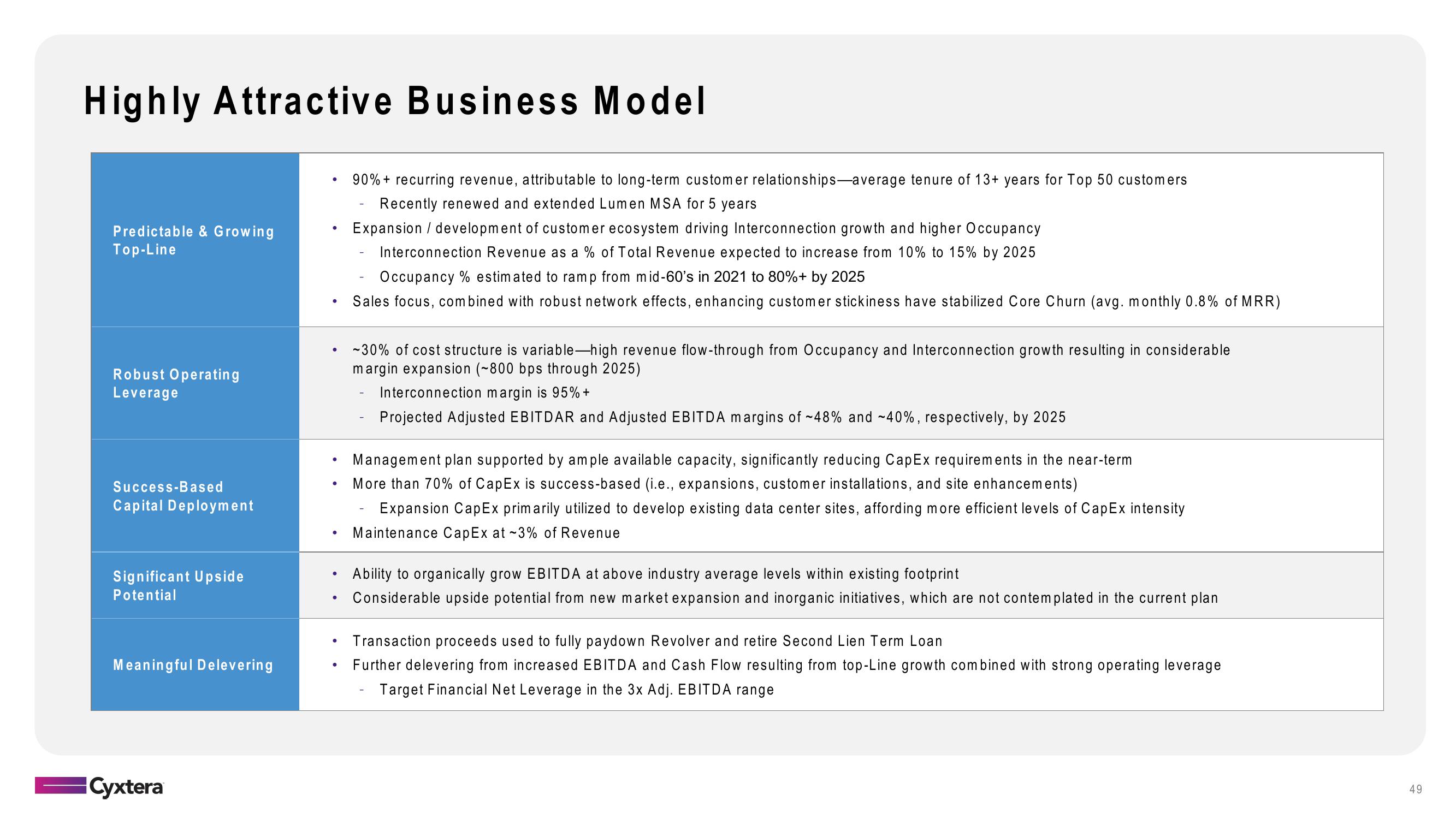

Highly Attractive Business Model

Predictable & Growing

Top-Line

Robust Operating

Leverage

Success-Based

Capital Deployment

Significant Upside

Potential

Meaningful Delevering

Cyxtera

●

●

●

90% + recurring revenue, attributable to long-term customer relationships-average tenure of 13+ years for Top 50 customers

Recently renewed and extended Lumen MSA for 5 years

Expansion development of customer ecosystem driving Interconnection growth and higher Occupancy

Interconnection Revenue as a % of Total Revenue expected to increase from 10% to 15% by 2025

Occupancy % estimated to ramp from mid-60's in 2021 to 80%+ by 2025

Sales focus, combined with robust network effects, enhancing customer stickiness have stabilized Core Churn (avg. monthly 0.8% of MRR)

-30% of cost structure is variable-high revenue flow-through from Occupancy and Interconnection growth resulting in considerable

margin expansion (~800 bps through 2025)

Interconnection margin is 95% +

Projected Adjusted EBITDAR and Adjusted EBITDA margins of ~48% and ~40%, respectively, by 2025

Management plan supported by ample available capacity, significantly reducing CapEx requirements in the near-term

More than 70% of CapEx is success-based (i.e., expansions, customer installations, and site enhancements)

Expansion CapEx primarily utilized to develop existing data center sites, affording more efficient levels of CapEx intensity

Maintenance CapEx at -3% of Revenue

Ability to organically grow EBITDA at above industry average levels within existing footprint

Considerable upside potential from new market expansion and inorganic initiatives, which are not contemplated in the current plan

Transaction proceeds used to fully paydown Revolver and retire Second Lien Term Loan

Further delevering from increased EBITDA and Cash Flow resulting from top-Line growth combined with strong operating leverage

Target Financial Net Leverage in the 3x Adj. EBITDA range

49View entire presentation