Kenvue IPO Presentation Deck

PRINTING, COPYING, AND DISTRIBUTION OF

ROADSHOW MATERIALS IS STRICTLY PROHIBITED

IP ADDRESS: 95.24.50.50

EMAIL

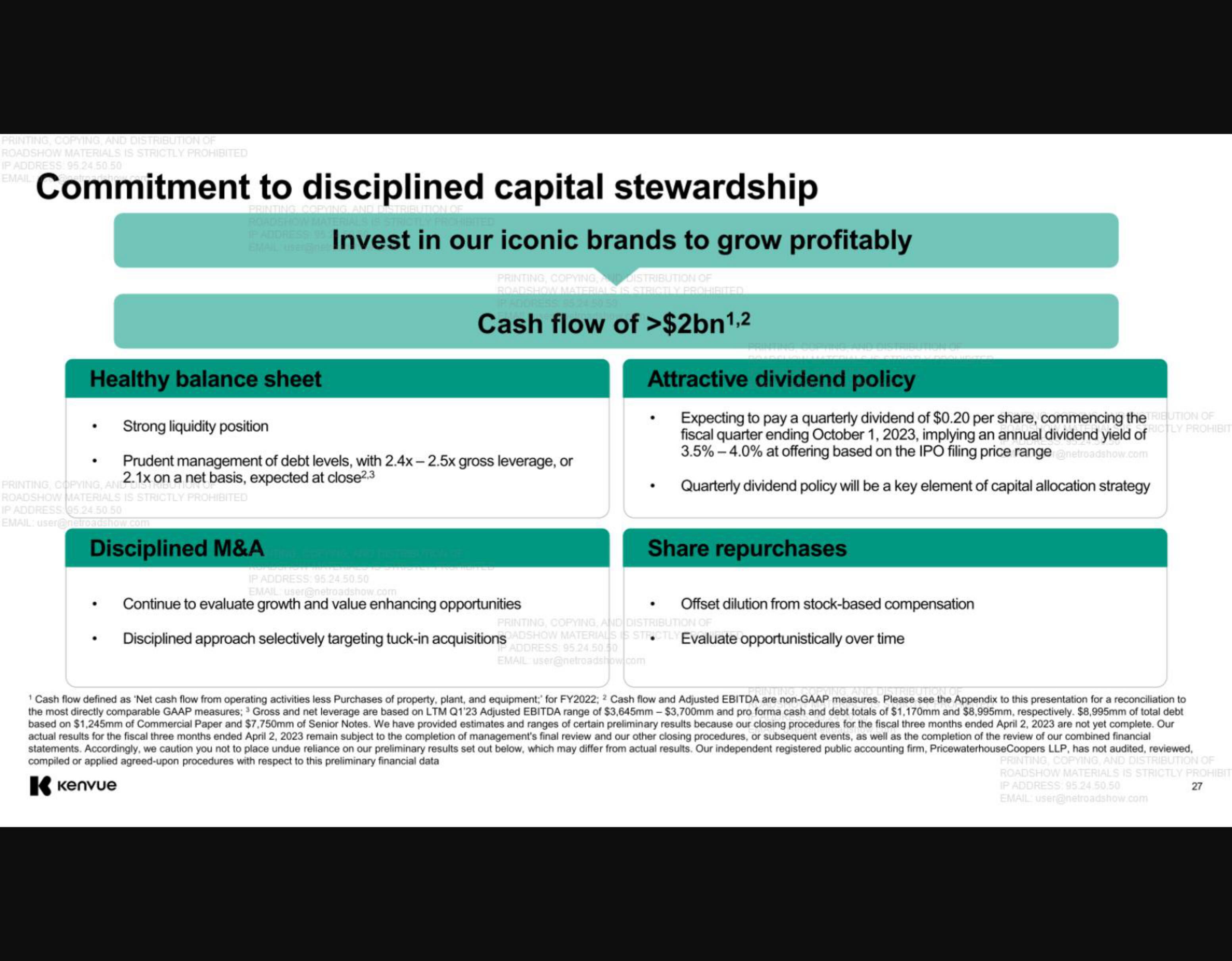

Commitment to disciplined capital stewardship

PRINTING

Healthy balance sheet

EMAIL users

PRINTING COPYING, AND DISTRIBUT

ROADSHOW MATERIALS IS STRICTLY PROHIBITED

IP ADDRESS 95.24.50.50

EMAIL: [email protected]

.

Strong liquidity position

Prudent management of debt levels, with 2.4x-2.5x gross leverage, or

2.1x on a net basis, expected at close2.3

Disciplined M&A

Invest in our iconic brands to grow profitably

PRINTING, COPYINGDISTRIBUTION OF

ROADSHOW MATERIALS IS STRICTLY PROHIBITED

Cash flow of >$2bn¹,2

IP ADDRESS: 95.24.50.50

EMAIL: [email protected]

Continue to evaluate growth and value enhancing opportunities

Attractive dividend policy

Expecting to pay a quarterly dividend of $0.20 per share, commencing the TRIBUTION OF

fiscal quarter ending October 1, 2023, implying an annual dividend yield of RICTLY PROHIBIT

3.5% -4.0% at offering based on the IPO filing price range @netroadshow.com

Quarterly dividend policy will be a key element of capital allocation strategy

Share repurchases

Offset dilution from stock-based compensation

PRINTING, COPYING, AND DISTRIBUTION OF

• Disciplined approach selectively targeting tuck-in acquisitions ADSHOW MATERIALS IS STRICTLY Evaluate opportunistically over time

ADDRESS: 95.24.50.50

EMAIL [email protected]

¹ Cash flow defined as 'Net cash flow from operating activities less Purchases of property, plant, and equipment;' for FY2022; 2 Cash flow and Adjusted EBITDA are non-GAAP measures. Please see the Appendix to this presentation for a reconciliation to

the most directly comparable GAAP measures; ³ Gross and net leverage are based on LTM Q1'23 Adjusted EBITDA range of $3,645mm - $3,700mm and pro forma cash and debt totals of $1,170mm and $8,995mm, respectively. $8,995mm of total debt

based on $1,245mm of Commercial Paper and $7,750mm of Senior Notes. We have provided estimates and ranges of certain preliminary results because our closing procedures for the fiscal three months ended April 2, 2023 are not yet complete. Our

actual results for the fiscal three months ended April 2, 2023 remain subject to the completion of management's final review and our other closing procedures, or subsequent events, as well as the completion of the review of our combined financial

statements. Accordingly, we caution you not to place undue reliance on our preliminary results set out below, which may differ from actual results. Our independent registered public accounting firm, PricewaterhouseCoopers LLP, has not audited, reviewed,

compiled or applied agreed-upon procedures with respect to this preliminary financial data

K Kenvue

PRINTING, COPYING, AND DISTRIBUTION OF

ROADSHOW MATERIALS IS STRICTLY PROHIBIT

IP ADDRESS: 95.24.50.50

27

EMAIL: [email protected]View entire presentation