Benson Hill Investor Presentation Deck

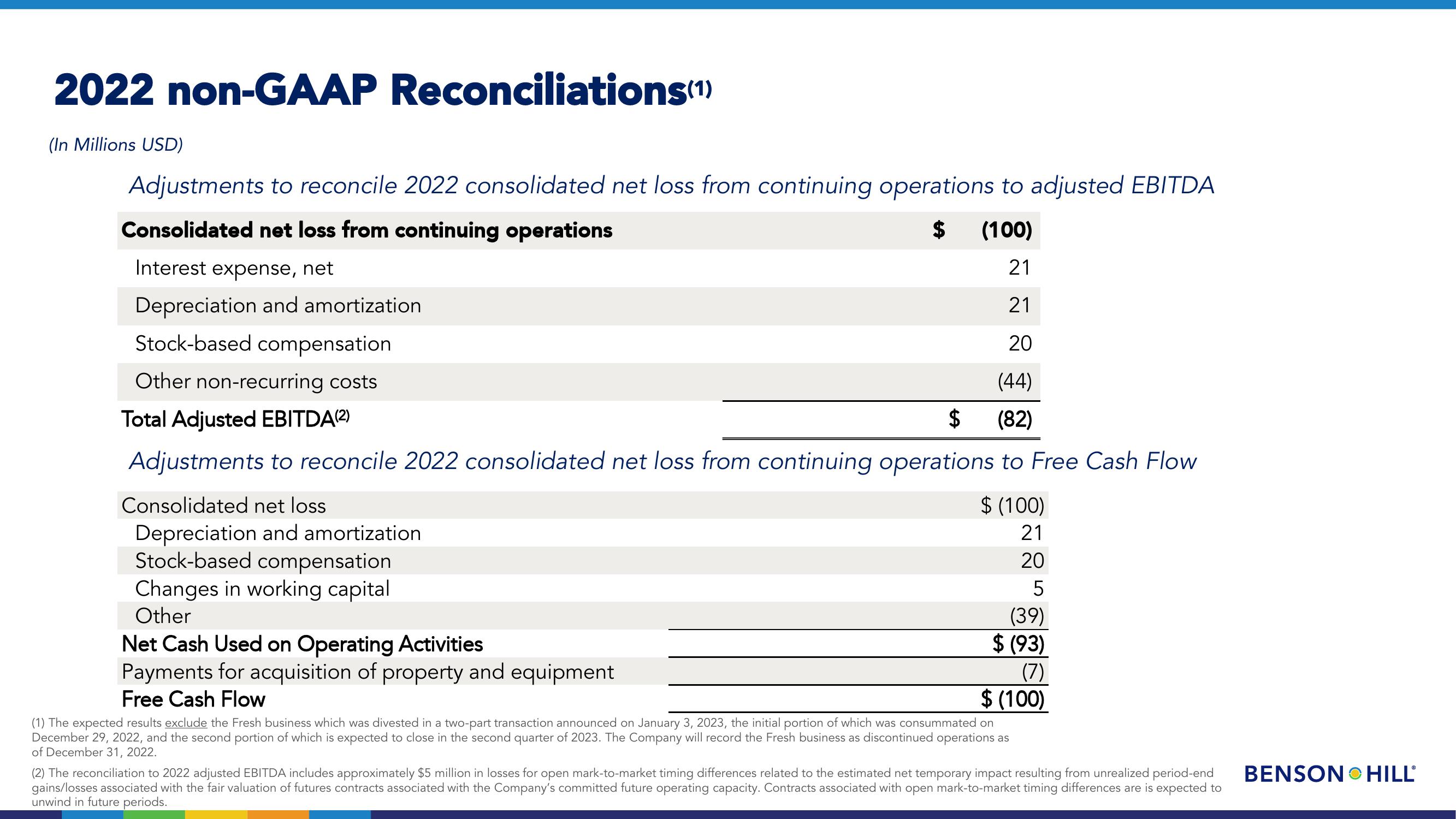

2022 non-GAAP Reconciliations(¹)

(In Millions USD)

Adjustments to reconcile 2022 consolidated net loss from continuing operations to adjusted EBITDA

Consolidated net loss from continuing operations

(100)

$

Interest expense, net

21

21

20

Other non-recurring costs

(44)

Total Adjusted EBITDA(2)

$

(82)

Adjustments to reconcile 2022 consolidated net loss from continuing operations to Free Cash Flow

$ (100)

21

20

5

(39)

$ (93)

(7)

Depreciation and amortization

Stock-based compensation

Consolidated net loss

Depreciation and amortization

Stock-based compensation

Changes in working capital

Other

Net Cash Used on Operating Activities

Payments for acquisition of property and equipment

Free Cash Flow

$ (100)

(1) The expected results exclude the Fresh business which was divested in a two-part transaction announced on January 3, 2023, the initial portion of which was consummated on

December 29, 2022, and the second portion of which is expected to close in the second quarter of 2023. The Company will record the Fresh business as discontinued operations as

of December 31, 2022.

(2) The reconciliation to 2022 adjusted EBITDA includes approximately $5 million in losses for open mark-to-market timing differences related to the estimated net temporary impact resulting from unrealized period-end BENSON HILL

gains/losses associated with the fair valuation of futures contracts associated with the Company's committed future operating capacity. Contracts associated with open mark-to-market timing differences are is expected to

unwind in future periods.View entire presentation