Pathward Financial Investor Presentation Deck

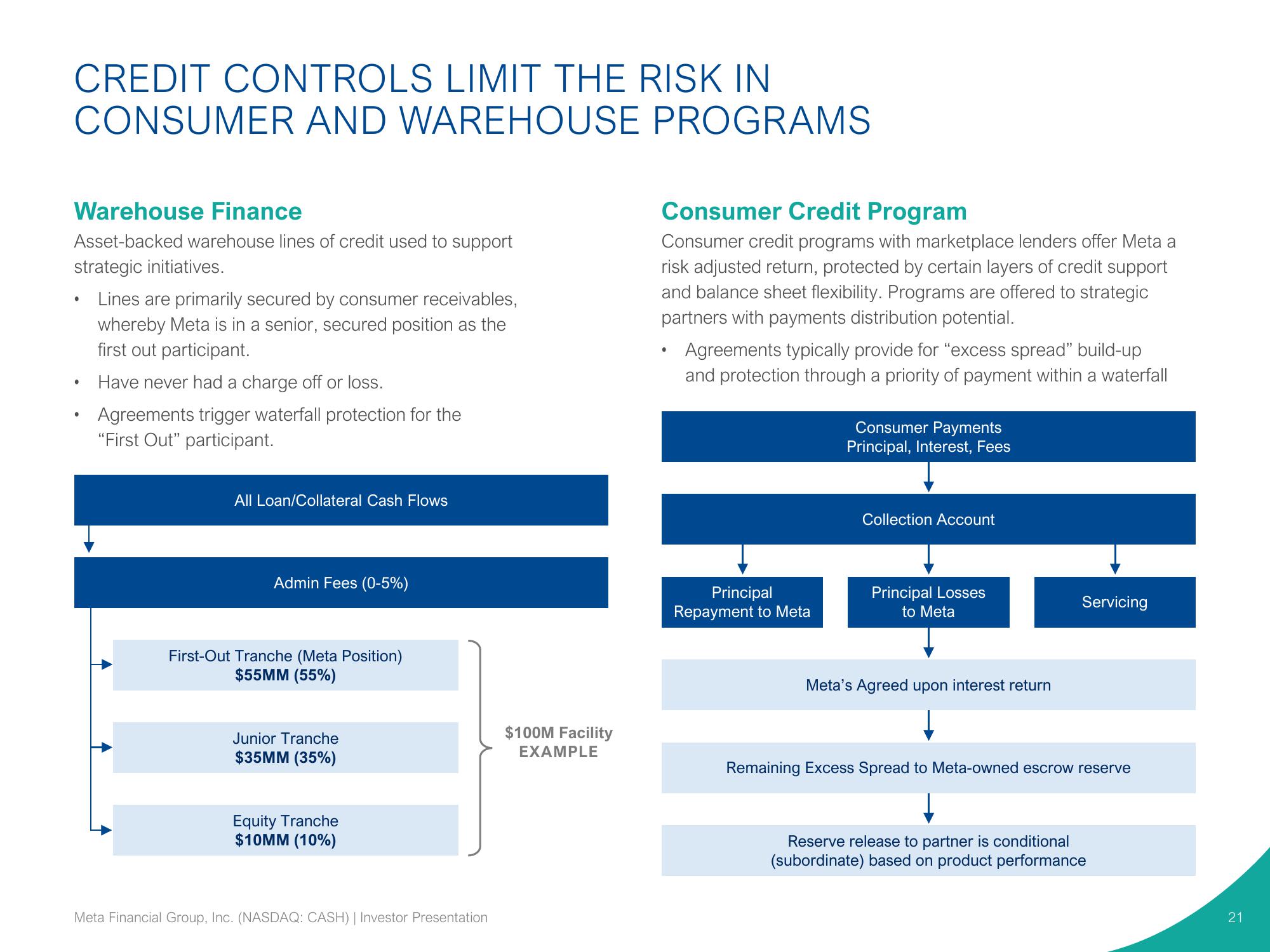

CREDIT CONTROLS LIMIT THE RISK IN

CONSUMER AND WAREHOUSE PROGRAMS

Warehouse Finance

Asset-backed warehouse lines of credit used to support

strategic initiatives.

Lines are primarily secured by consumer receivables,

whereby Meta is in a senior, secured position as the

first out participant.

Have never had a charge off or loss.

Agreements trigger waterfall protection for the

"First Out" participant.

●

●

All Loan/Collateral Cash Flows

Admin Fees (0-5%)

First-Out Tranche (Meta Position)

$55MM (55%)

Junior Tranche

$35MM (35%)

Equity Tranche

$10MM (10%)

Meta Financial Group, Inc. (NASDAQ: CASH) | Investor Presentation

$100M Facility

EXAMPLE

Consumer Credit Program

Consumer credit programs with marketplace lenders offer Meta a

risk adjusted return, protected by certain layers of credit support

and balance sheet flexibility. Programs are offered to strategic

partners with payments distribution potential.

●

Agreements typically provide for "excess spread" build-up

and protection through a priority of payment within a waterfall

Principal

Repayment to Meta

Consumer Payments

Principal, Interest, Fees

Collection Account

Principal Losses

to Meta

Meta's Agreed upon interest return

Servicing

Remaining Excess Spread to Meta-owned escrow reserve

Reserve release to partner is conditional

(subordinate) based on product performance

21View entire presentation