CorpAcq SPAC Presentation Deck

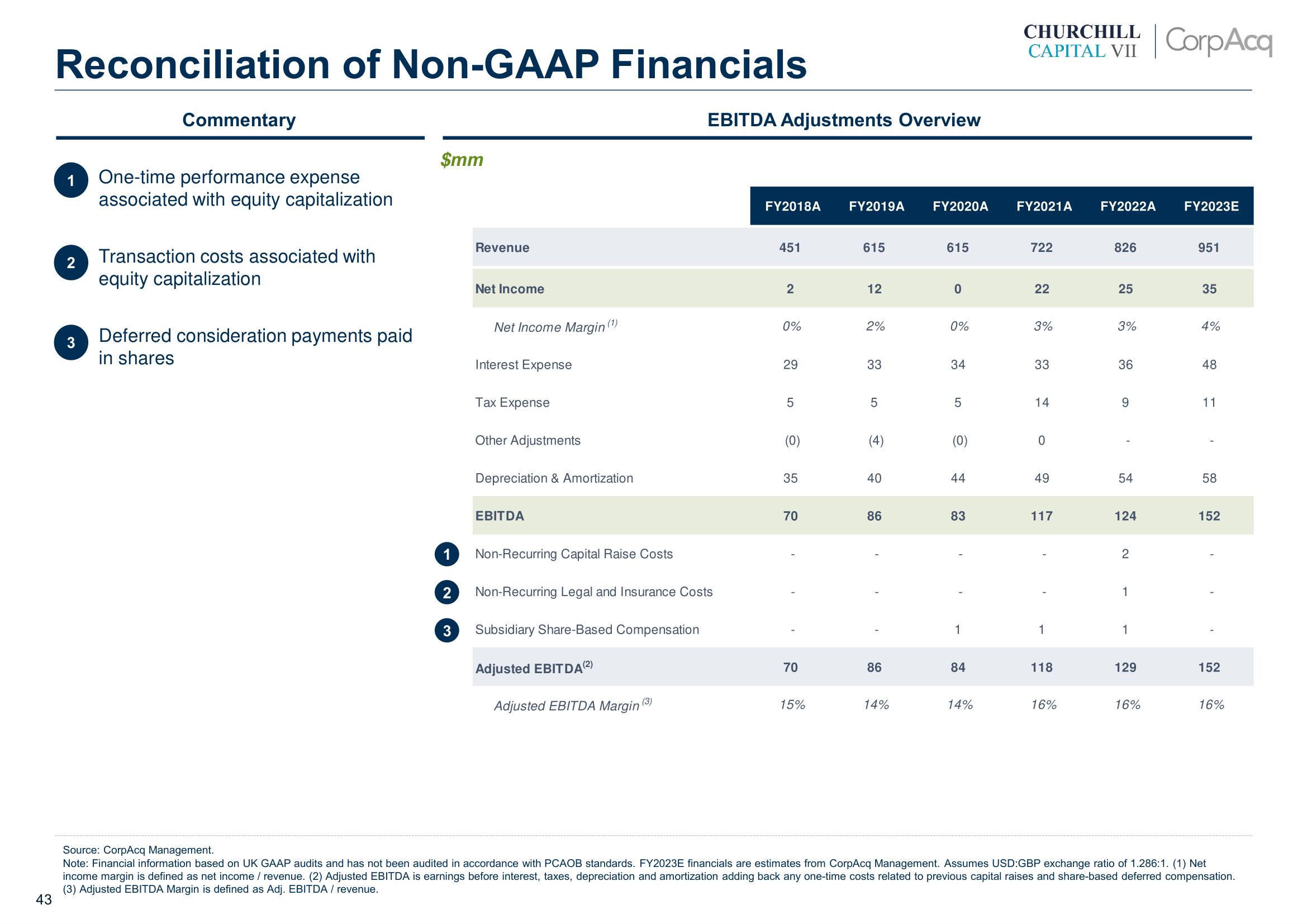

Reconciliation of Non-GAAP Financials

1

2

3

Commentary

One-time performance expense

associated with equity capitalization

Transaction costs associated with

equity capitalization

Deferred consideration payments paid

in shares

$mm

1

2

3

Revenue

Net Income

Net Income Margin (¹)

Interest Expense

Tax Expense

Other Adjustments

Depreciation & Amortization

EBITDA

Non-Recurring Capital Raise Costs

Non-Recurring Legal and Insurance Costs

Subsidiary Share-Based Compensation

Adjusted EBITDA (²)

Adjusted EBITDA Margin

EBITDA Adjustments Overview

(3)

FY2018A

451

2

0%

29

5

(0)

35

70

70

15%

FY2019A FY2020A

615

12

2%

33

LO

5

(4)

40

86

86

14%

615

0

0%

34

5

(0)

44

83

1

84

14%

CHURCHILL

CAPITAL VII

FY2021A FY2022A FY2023E

722

22

3%

33

14

0

49

117

1

118

16%

826

25

3%

36

9

54

124

2

1

1

129

CorpAcq

16%

951

35

4%

48

11

58

152

1

152

16%

Source: CorpAcq Management.

Note: Financial information based on UK GAAP audits and has not been audited in accordance with PCAOB standards. FY2023E financials are estimates from CorpAcq Management. Assumes USD:GBP exchange ratio of 1.286:1. (1) Net

income margin is defined as net income / revenue. (2) Adjusted EBITDA is earnings before interest, taxes, depreciation and amortization adding back any one-time costs related to previous capital raises and share-based deferred compensation.

(3) Adjusted EBITDA Margin is defined as Adj. EBITDA/ revenue.

43View entire presentation