Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

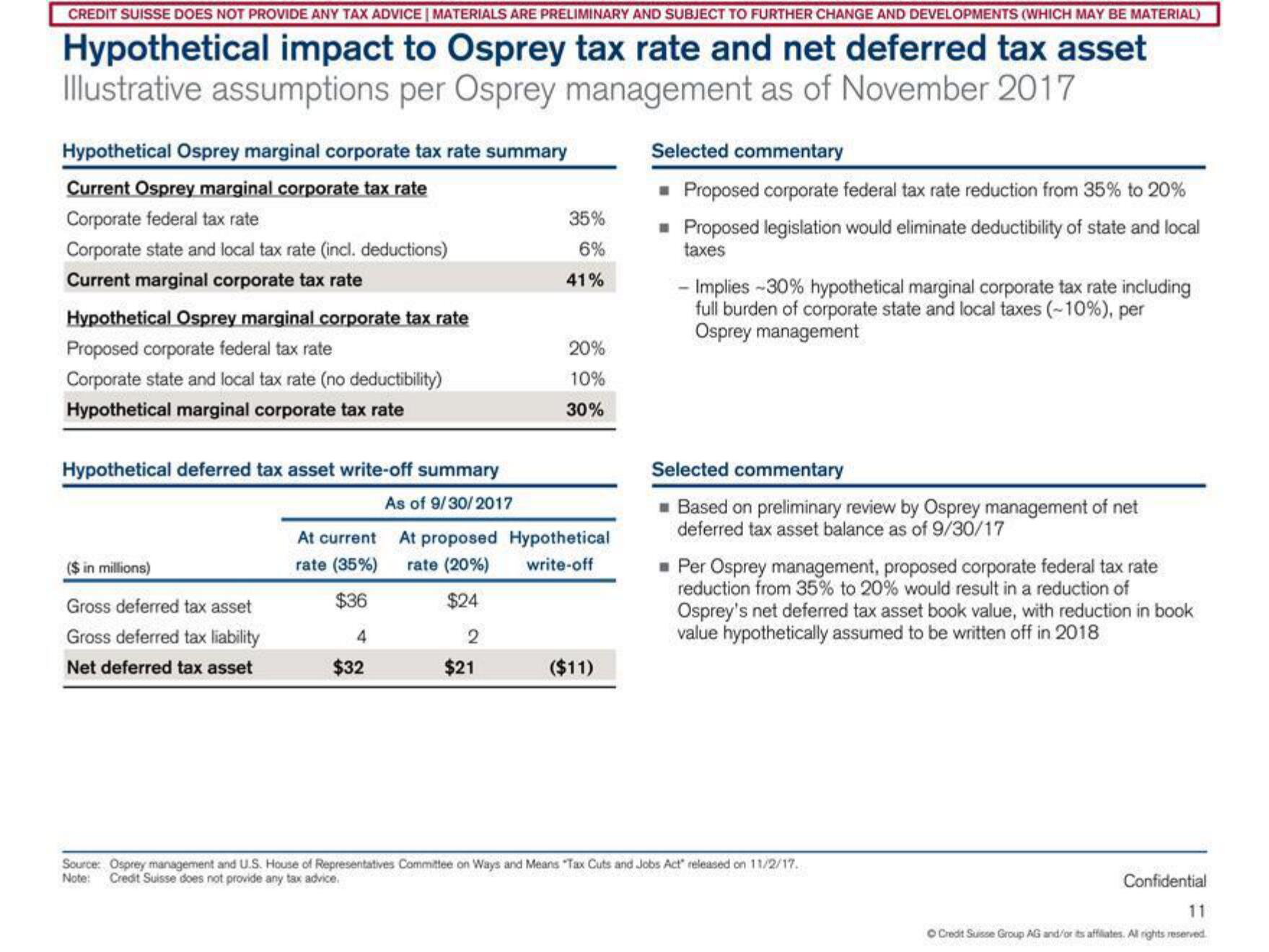

Hypothetical impact to Osprey tax rate and net deferred tax asset

Illustrative assumptions per Osprey management as of November 2017

Hypothetical Osprey marginal corporate tax rate summary

Current Osprey marginal corporate tax rate

Corporate federal tax rate

Corporate state and local tax rate (incl. deductions)

Current marginal corporate tax rate

Hypothetical Osprey marginal corporate tax rate

Proposed corporate federal tax rate

Corporate state and local tax rate (no deductibility)

Hypothetical marginal corporate tax rate

Hypothetical deferred tax asset write-off summary

As of 9/30/2017

($ in millions)

Gross deferred tax asset

Gross deferred tax liability

Net deferred tax asset

At current

rate (35%)

$36

4

$32

2

35%

6%

41%

At proposed Hypothetical

rate (20%) write-off

$24

$21

20%

10%

30%

($11)

Selected commentary

■ Proposed corporate federal tax rate reduction from 35% to 20%

■ Proposed legislation would eliminate deductibility of state and local

taxes

- Implies -30% hypothetical marginal corporate tax rate including

full burden of corporate state and local taxes (-10%), per

Osprey management

Selected commentary

Based on preliminary review by Osprey management of net

deferred tax asset balance as of 9/30/17

■ Per Osprey management, proposed corporate federal tax rate

reduction from 35% to 20% would result in a reduction of

Osprey's net deferred tax asset book value, with reduction in book

value hypothetically assumed to be written off in 2018

Source: Osprey management and U.S. House of Representatives Committee on Ways and Means "Tax Cuts and Jobs Act" released on 11/2/17.

Note: Credit Suisse does not provide any tax advice.

Confidential

11

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation