View SPAC Presentation Deck

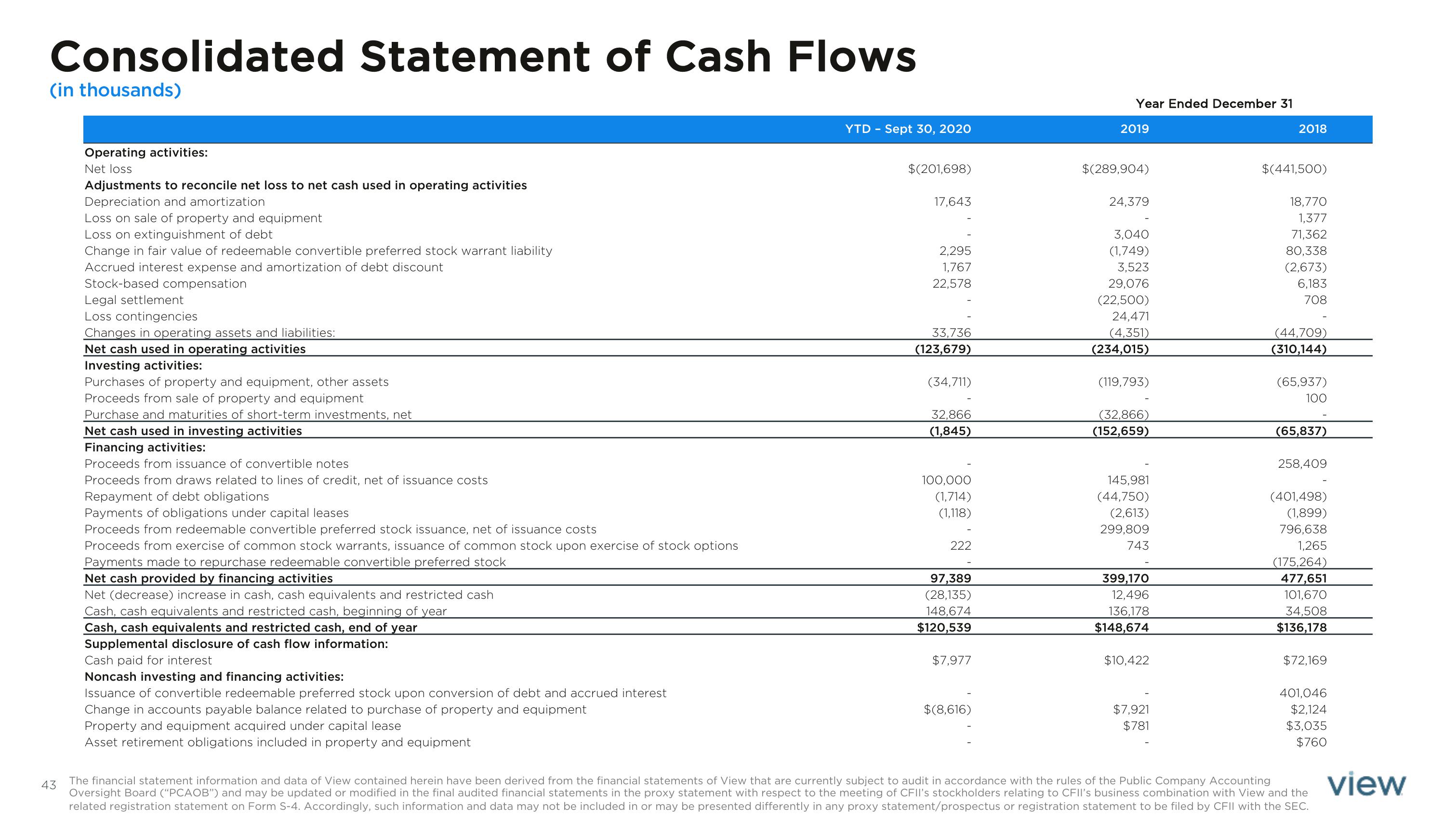

Consolidated Statement of Cash Flows

(in thousands)

43

Operating activities:

Net loss

Adjustments to reconcile net loss to net cash used in operating activities

Depreciation and amortization

Loss on sale of property and equipment

Loss on extinguishment of debt

Change in fair value of redeemable convertible preferred stock warrant liability

Accrued interest expense and amortization of debt discount

Stock-based compensation

Legal settlement

Loss contingencies

Changes in operating assets and liabilities:

Net cash used in operating activities

Investing activities:

Purchases of property and equipment, other assets

Proceeds from sale of property and equipment

Purchase and maturities of short-term investments, net

Net cash used in investing activities

Financing activities:

Proceeds from issuance of convertible notes

Proceeds from draws related to lines of credit, net of issuance costs

Repayment of debt obligations

Payments of obligations under capital leases

Proceeds from redeemable convertible preferred stock issuance, net of issuance costs

Proceeds from exercise of common stock warrants, issuance of common stock upon exercise of stock options

Payments made to repurchase redeemable convertible preferred stock

Net cash provided by financing activities

Net (decrease) increase in cash, cash equivalents and restricted cash

Cash, cash equivalents and restricted cash, beginning of year

Cash, cash equivalents and restricted cash, end of year

Supplemental disclosure of cash flow information:

Cash paid for interest

Noncash investing and financing activities:

Issuance of convertible redeemable preferred stock upon conversion of debt and accrued interest

Change in accounts payable balance related to purchase of property and equipment

Property and equipment acquired under capital lease

Asset retirement obligations included in property and equipment

YTD - Sept 30, 2020

$(201,698)

17,643

2,295

1,767

22,578

33,736

(123,679)

(34,711)

32,866

(1,845)

100,000

(1,714)

(1,118)

222

97,389

(28,135)

148,674

$120,539

$7,977

$(8,616)

Year Ended December 31

2019

$(289,904)

24,379

3,040

(1,749)

3,523

29,076

(22,500)

24,471

(4,351)

(234,015)

(119,793)

(32,866)

(152,659)

145,981

(44,750)

(2,613)

299,809

743

399,170

12,496

136,178

$148,674

$10,422

$7,921

$781

2018

$(441,500)

18,770

1,377

71,362

80,338

(2,673)

6,183

708

(44,709)

(310,144)

(65,937)

100

(65,837)

258,409

(401,498)

(1,899)

796,638

1,265

(175,264)

477,651

101,670

34,508

$136,178

$72,169

401,046

$2,124

$3,035

$760

The financial statement information and data of View contained herein have been derived from the financial statements of View that are currently subject to audit in accordance with the rules of the Public Company Accounting

Oversight Board ("PCAOB") and may be updated or modified in the final audited financial statements in the proxy statement with respect to the meeting of CFII's stockholders relating to CFII's business combination with View and the

related registration statement on Form S-4. Accordingly, such information and data may not be included in or may be presented differently in any proxy statement/prospectus or registration statement to be filed by CFII with the SEC.

viewView entire presentation