Endeavour Mining Results Presentation Deck

★

WAHGNION, BURKINA FASO

Greater focus on waste stripping

Q1-2022 vs Q4-2021 INSIGHTS

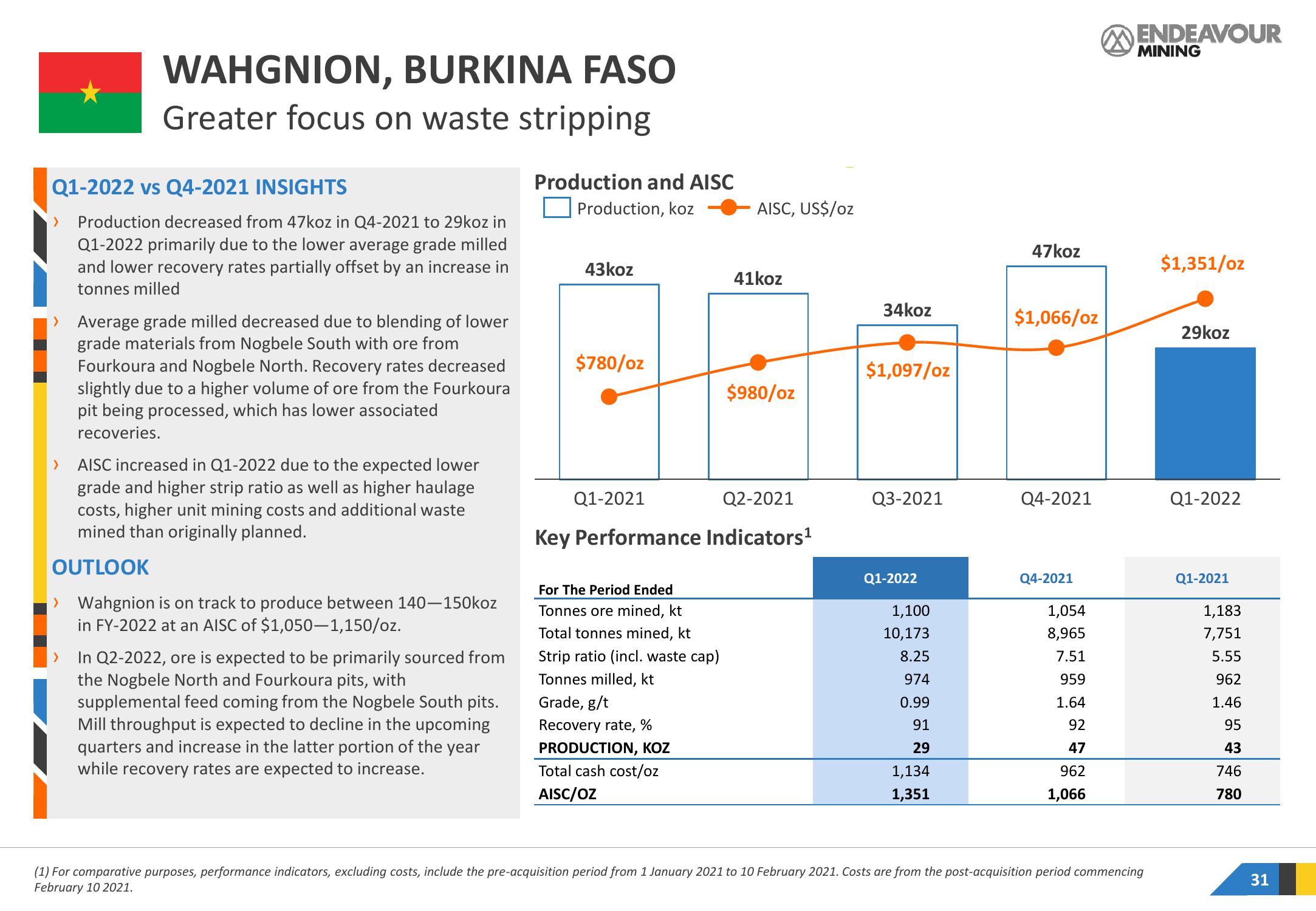

> Production decreased from 47koz in Q4-2021 to 29koz in

Q1-2022 primarily due to the lower average grade milled

and lower recovery rates partially offset by an increase in

tonnes milled

> Average grade milled decreased due to blending of lower

grade materials from Nogbele South with ore from

Fourkoura and Nogbele North. Recovery rates decreased

slightly due to a higher volume of ore from the Fourkoura

pit being processed, which has lower associated

recoveries.

> AISC increased in Q1-2022 due to the expected lower

grade and higher strip ratio as well as higher haulage

costs, higher unit mining costs and additional waste

mined than originally planned.

OUTLOOK

> Wahgnion is on track to produce between 140-150koz

in FY-2022 at an AISC of $1,050-1,150/oz.

>

In Q2-2022, ore is expected to be primarily sourced from

the Nogbele North and Fourkoura pits, with

supplemental feed coming from the Nogbele South pits.

Mill throughput is expected to decline in the upcoming

quarters and increase in the latter portion of the year

while recovery rates are expected to increase.

Production and AISC

Production, koz

43koz

$780/oz

Q1-2021

AISC, US$/oz

For The Period Ended

Tonnes ore mined, kt

Total tonnes mined, kt

Strip ratio (incl. waste cap)

Tonnes milled, kt

Grade, g/t

Recovery rate, %

PRODUCTION, KOZ

Total cash cost/oz

AISC/OZ

41koz

$980/oz

Q2-2021

Key Performance Indicators¹

34koz

$1,097/oz

Q3-2021

Q1-2022

1,100

10,173

8.25

974

0.99

91

29

1,134

1,351

47koz

$1,066/oz

Q4-2021

Q4-2021

1,054

8,965

7.51

959

1.64

92

47

962

1,066

ENDEAVOUR

MINING

(1) For comparative purposes, performance indicators, excluding costs, include the pre-acquisition period from 1 January 2021 to 10 February 2021. Costs are from the post-acquisition period commencing

February 10 2021.

$1,351/oz

29koz

Q1-2022

Q1-2021

1,183

7,751

5.55

962

1.46

95

43

746

780

31View entire presentation