Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

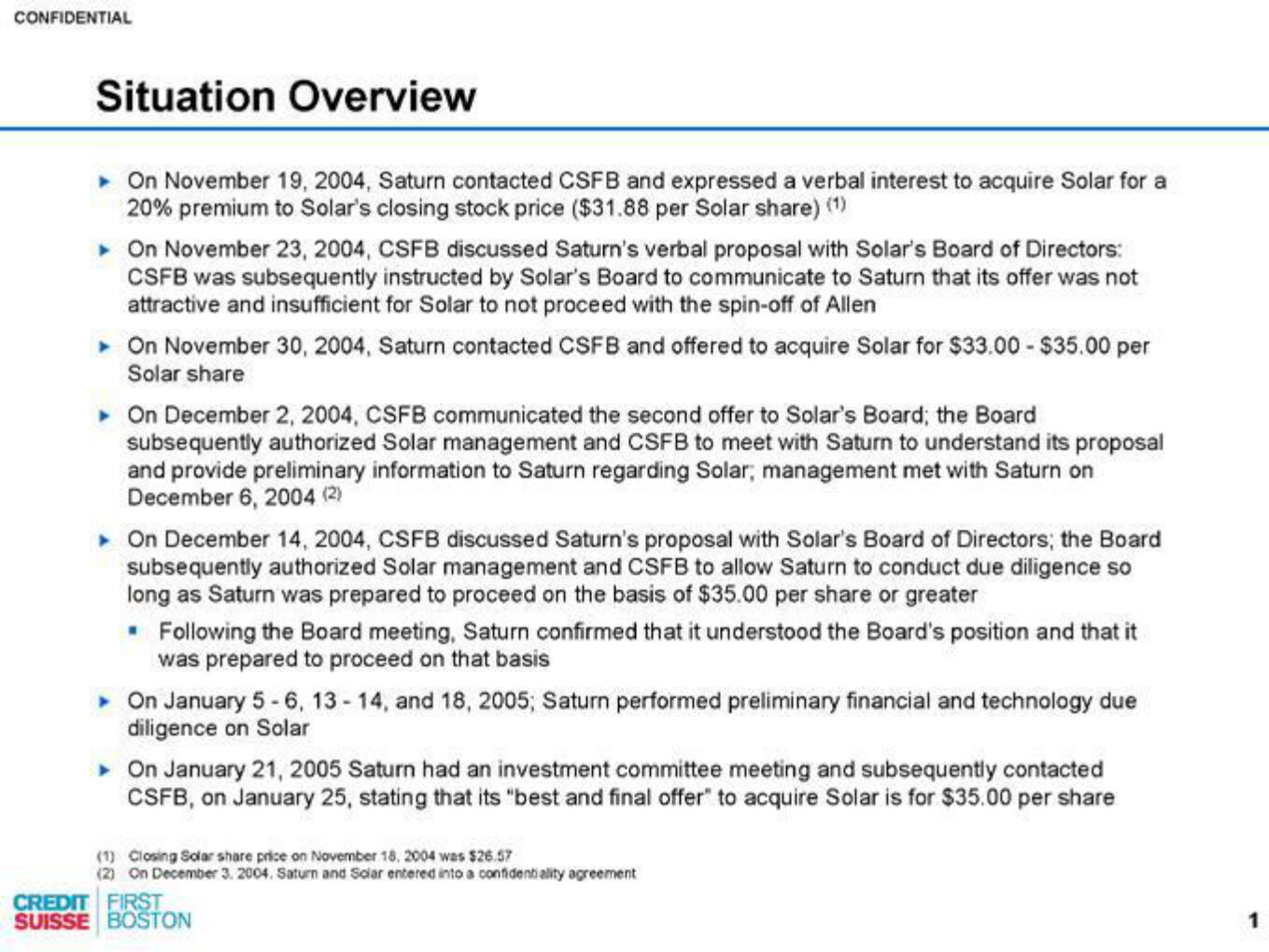

Situation Overview

On November 19, 2004, Saturn contacted CSFB and expressed a verbal interest to acquire Solar for a

20% premium to Solar's closing stock price ($31.88 per Solar share) (¹)

▸ On November 23, 2004, CSFB discussed Saturn's verbal proposal with Solar's Board of Directors:

CSFB was subsequently instructed by Solar's Board to communicate to Saturn that its offer was not

attractive and insufficient for Solar to not proceed with the spin-off of Allen

▸ On November 30, 2004, Saturn contacted CSFB and offered to acquire Solar for $33.00 - $35.00 per

Solar share

▸ On December 2, 2004, CSFB communicated the second offer to Solar's Board; the Board

subsequently authorized Solar management and CSFB to meet with Saturn to understand its proposal

and provide preliminary information to Saturn regarding Solar, management met with Saturn on

December 6, 2004 (2)

▸ On December 14, 2004, CSFB discussed Saturn's proposal with Solar's Board of Directors; the Board

subsequently authorized Solar management and CSFB to allow Saturn to conduct due diligence so

long as Saturn was prepared to proceed on the basis of $35.00 per share or greater

. Following the Board meeting, Saturn confirmed that it understood the Board's position and that it

was prepared to proceed on that basis

On January 5-6, 13-14, and 18, 2005; Saturn performed preliminary financial and technology due

diligence on Solar

▸ On January 21, 2005 Saturn had an investment committee meeting and subsequently contacted

CSFB, on January 25, stating that its "best and final offer" to acquire Solar is for $35.00 per share

(1) Closing Solar share price on November 18, 2004 was $26.57

(2) On December 3, 2004. Saturn and Solar entered into a confidentiality agreement

CREDIT FIRST

SUISSE BOSTON

1View entire presentation