Ready Capital Investor Presentation Deck

Waterfall - A Successful & Proven Asset Manager

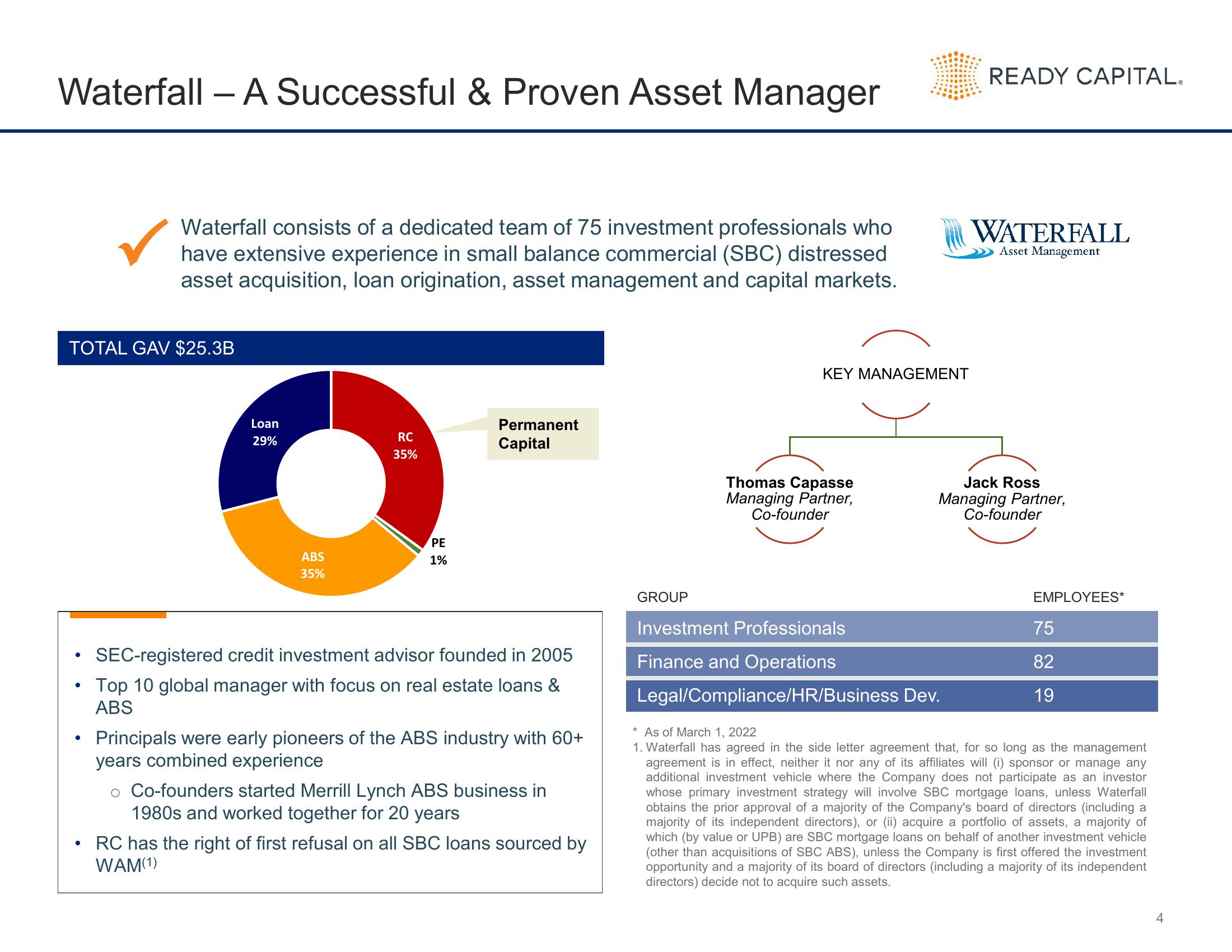

Waterfall consists of a dedicated team of 75 investment professionals who

have extensive experience in small balance commercial (SBC) distressed

asset acquisition, loan origination, asset management and capital markets.

TOTAL GAV $25.3B

Loan

29%

ABS

35%

RC

35%

PE

1%

Permanent

Capital

SEC-registered credit investment advisor founded in 2005

Top 10 global manager with focus on real estate loans &

ABS

Principals were early pioneers of the ABS industry with 60+

years combined experience

Co-founders started Merrill Lynch ABS business in

1980s and worked together for 20 years

RC has the right of first refusal on all SBC loans sourced by

WAM(1)

GROUP

KEY MANAGEMENT

Thomas Capasse

Managing Partner,

Co-founder

READY CAPITAL.

Investment Professionals

Finance and Operations

Legal/Compliance/HR/Business Dev.

WATERFALL

Asset Management

Jack Ross

Managing Partner,

Co-founder

EMPLOYEES*

75

82

19

* As of March 1, 2022

1. Waterfall has agreed in the side letter agreement that, for so long as the management

agreement is in effect, neither it nor any of its affiliates will (i) sponsor or manage any

additional investment vehicle where the Company does not participate as an investor

whose primary investment strategy will involve SBC mortgage loans, unless Waterfall

obtains the prior approval of a majority of the Company's board of directors (including a

majority of its independent directors), or (ii) acquire a portfolio of assets, a majority of

which (by value or UPB) are SBC mortgage loans on behalf of another investment vehicle

(other than acquisitions of SBC ABS), unless the Company is first offered the investment

opportunity and a majority of its board of directors (including a majority of its independent

directors) decide not to acquire such assets.

4View entire presentation