Aptiv Overview

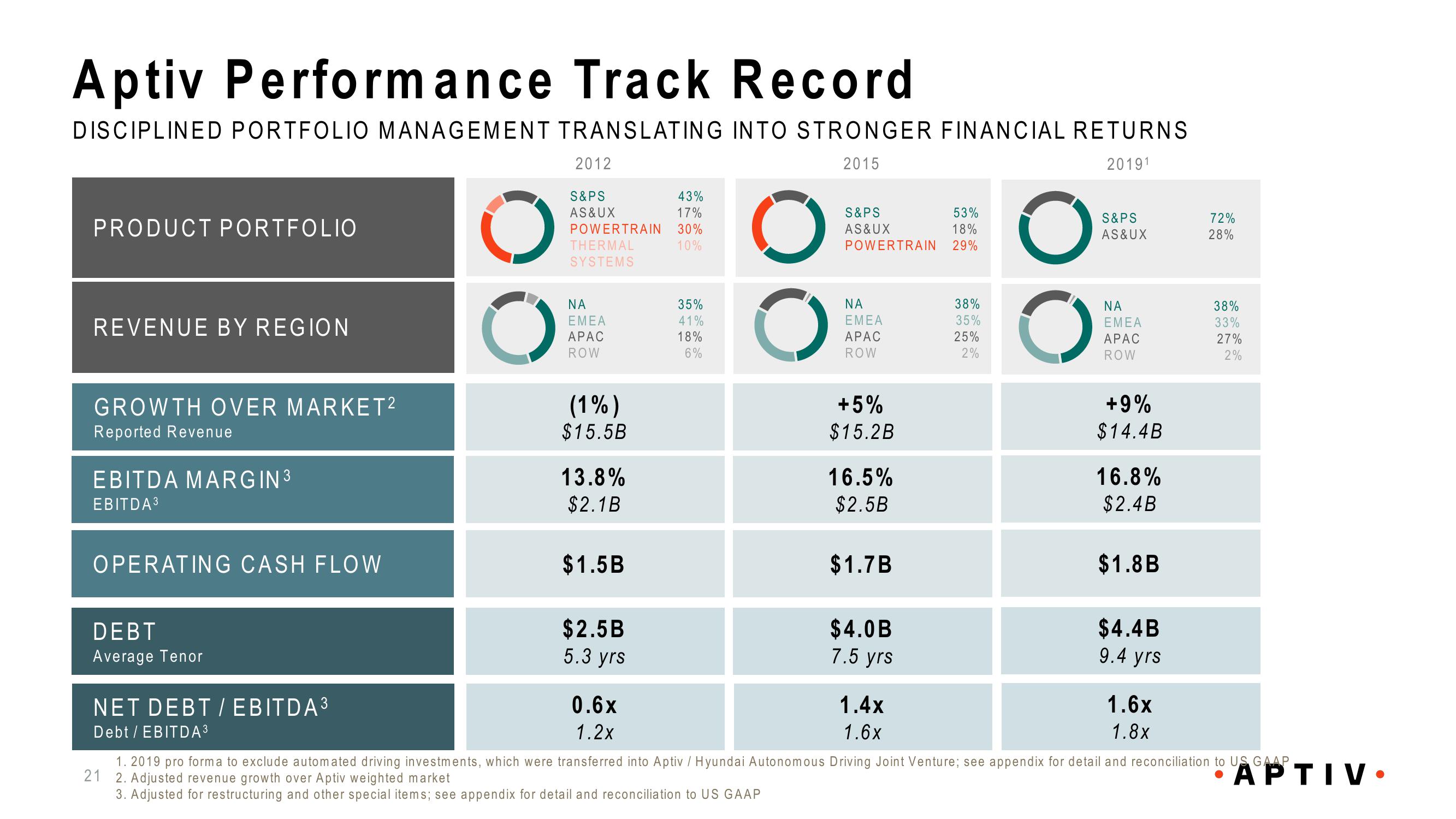

Aptiv Performance Track Record

DISCIPLINED PORTFOLIO MANAGEMENT TRANSLATING INTO STRONGER FINANCIAL RETURNS

2015

20191

PRODUCT PORTFOLIO

REVENUE BY REGION

GROWTH OVER MARKET²

Reported Revenue

EBITDA MARGIN ³

EBITDA ³

OPERATING CASH FLOW

DEBT

Average Tenor

NET DEBT/EBITDA 3

Debt / EBITDA³

O

O

2012

S&PS

AS&UX

POWERTRAIN

THERMAL

SYSTEMS

ΝΑ

ΕΜΕΑ

APAC

ROW

(1%)

$15.5B

13.8%

$2.1B

$1.5B

$2.5B

5.3 yrs

0.6x

1.2x

43%

17%

30%

10%

35%

41%

18%

6%

O

O

S&PS

AS&UX

POWERTRAIN

ΝΑ

ΕΜΕΑ

APAC

ROW

+5%

$15.2B

16.5%

$2.5B

$1.7B

$4.0B

7.5 yrs

1.4x

1.6x

53%

18%

29%

38%

35%

25%

2%

O

S&PS

AS&UX

ΝΑ

EMEA

APAC

ROW

+9%

$14.4B

16.8%

$2.4B

$1.8B

$4.4B

9.4 yrs

1.6x

1.8x

72%

28%

38%

33%

27%

2%

1. 2019 pro forma to exclude automated driving investments, which were transferred into Aptiv / Hyundai Autonomous Driving Joint Venture; see appendix for detail and reconciliation to US GAAP

21 2. Adjusted revenue growth over Aptiv weighted market

APTIV.

3. Adjusted for restructuring and other special items; see appendix for detail and reconciliation to US GAAPView entire presentation