UiPath IPO Presentation Deck

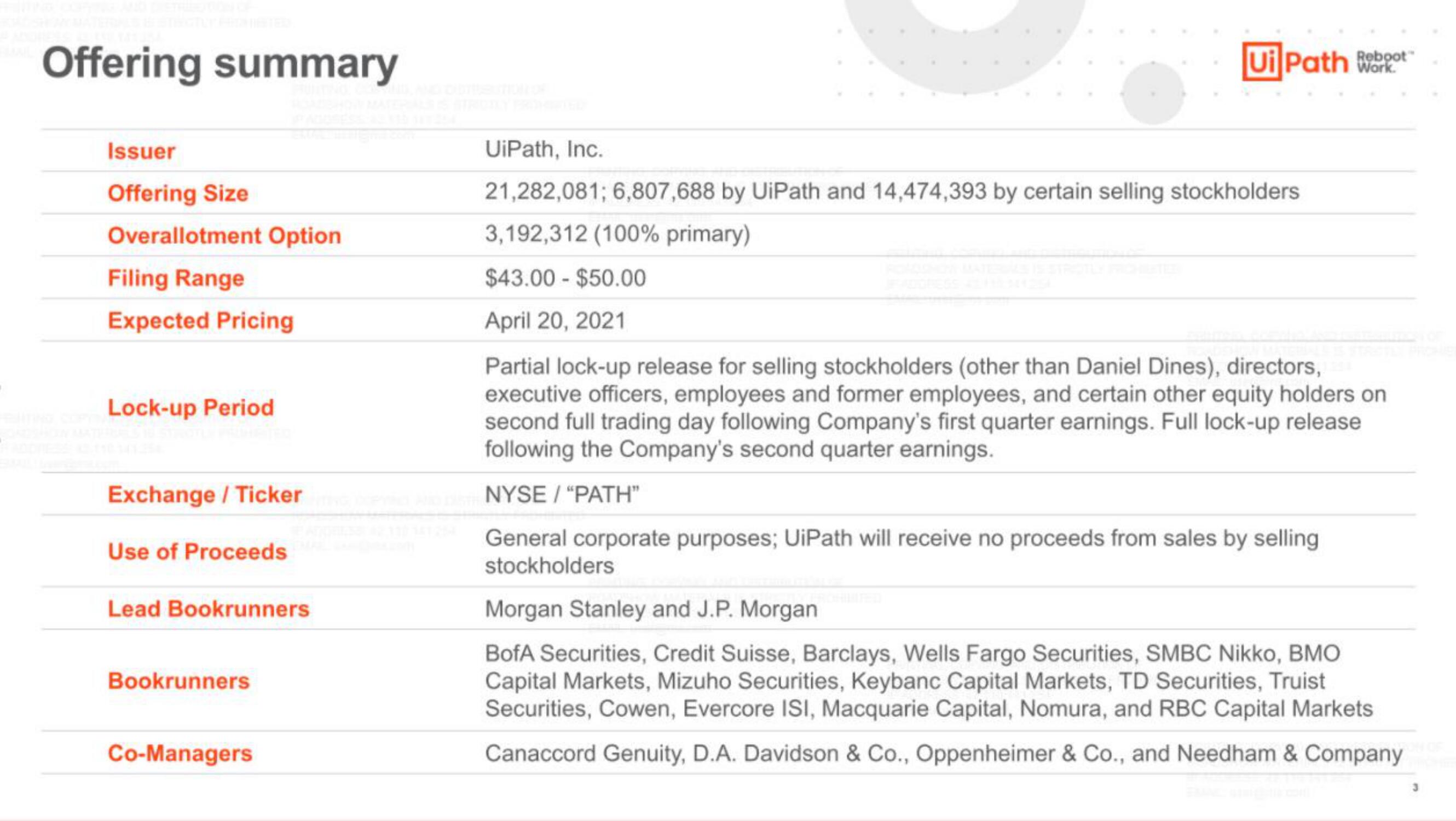

Offering summary

Issuer

Offering Size

Overallotment Option

Filing Range

Expected Pricing

Lock-up Period

Exchange / Ticker

Use of Proceeds

Lead Bookrunners

Bookrunners

Co-Managers

Reboot

Ui Path Work

UiPath, Inc.

21,282,081; 6,807,688 by UiPath and 14,474,393 by certain selling stockholders

3,192,312 (100% primary)

$43.00-$50.00

April 20, 2021

Partial lock-up release for selling stockholders (other than Daniel Dines), directors,

executive officers, employees and former employees, and certain other equity holders on

second full trading day following Company's first quarter earnings. Full lock-up release

following the Company's second quarter earnings.

NYSE /"PATH"

General corporate purposes; UiPath will receive no proceeds from sales by selling

stockholders

Morgan Stanley and J.P. Morgan

BofA Securities, Credit Suisse, Barclays, Wells Fargo Securities, SMBC Nikko, BMO

Capital Markets, Mizuho Securities, Keybanc Capital Markets, TD Securities, Truist

Securities, Cowen, Evercore ISI, Macquarie Capital, Nomura, and RBC Capital Markets

Canaccord Genuity, D.A. Davidson & Co., Oppenheimer & Co., and Needham & Company

VON OFView entire presentation