Grove SPAC Presentation Deck

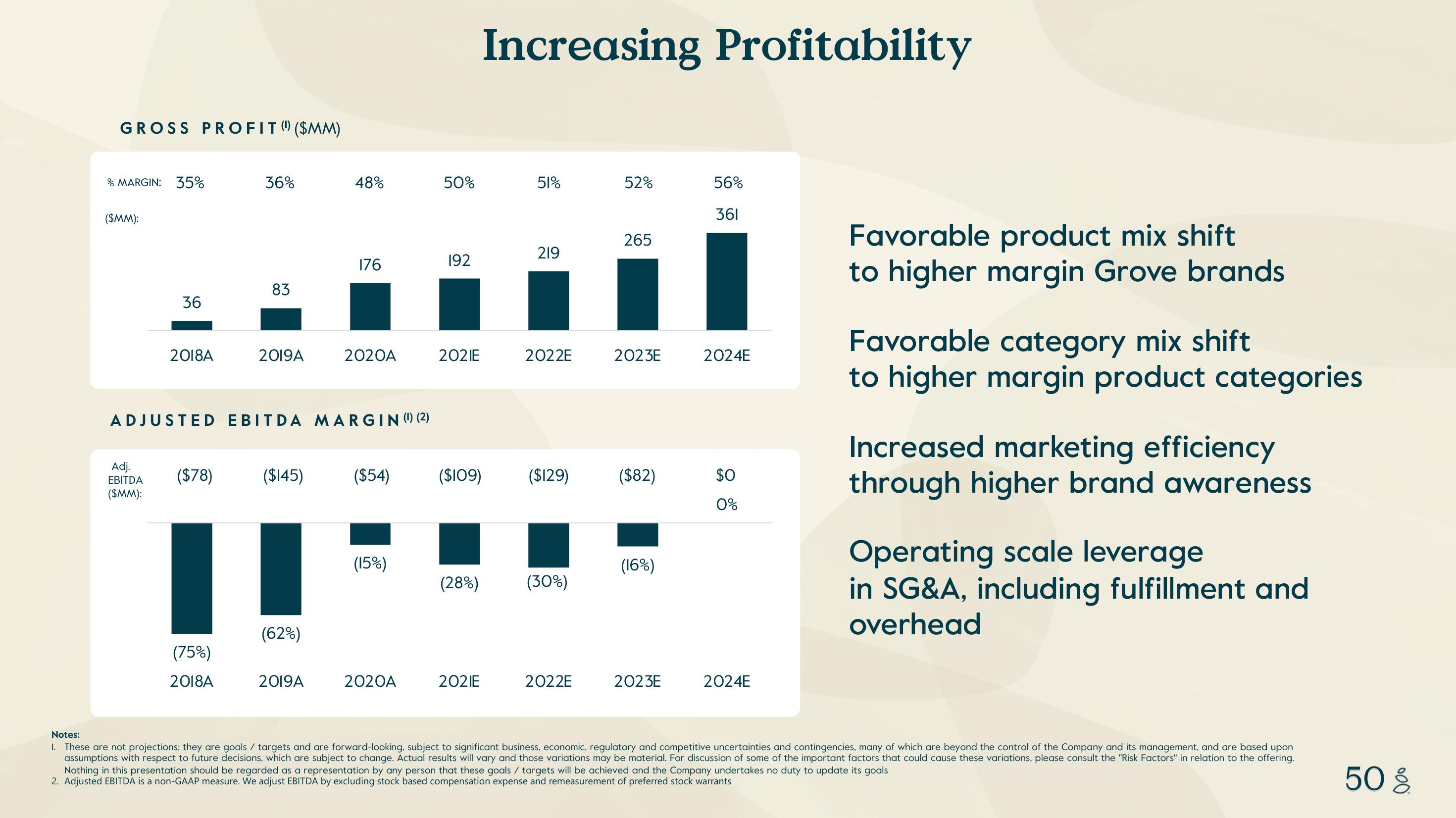

GROSS PROFIT() ($MM)

% MARGIN: 35%

($MM):

36

Adj.

EBITDA

($MM):

2018A

($78)

36%

(75%)

2018A

83

2019A

ADJUSTED EBITDA MARGIN (1) (2)

($145)

(62%)

48%

2019A

176

2020A

($54)

(15%)

2020A

50%

192

2021E

Increasing Profitability

51%

2021E

219

2022E

($109) ($129)

(28%) (30%)

2022E

52%

265

2023E

($82)

(16%)

2023E

56%

361

2024E

$0

0%

2024E

Favorable product mix shift

to higher margin Grove brands

Favorable category mix shift

to higher margin product categories

Increased marketing efficiency

through higher brand awareness

Operating scale leverage

in SG&A, including fulfillment and

overhead

Notes:

I. These are not projections; they are goals / targets and are forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon

assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the "Risk Factors" in relation to the offering.

Nothing in this presentation should be regarded as a representation by any person that these goals / targets will be achieved and the Company undertakes no duty to update its goals

2. Adjusted EBITDA is a non-GAAP measure. We adjust EBITDA by excluding stock based compensation expense and remeasurement of preferred stock warrants

50 %View entire presentation