Silicon Valley Bank Results Presentation Deck

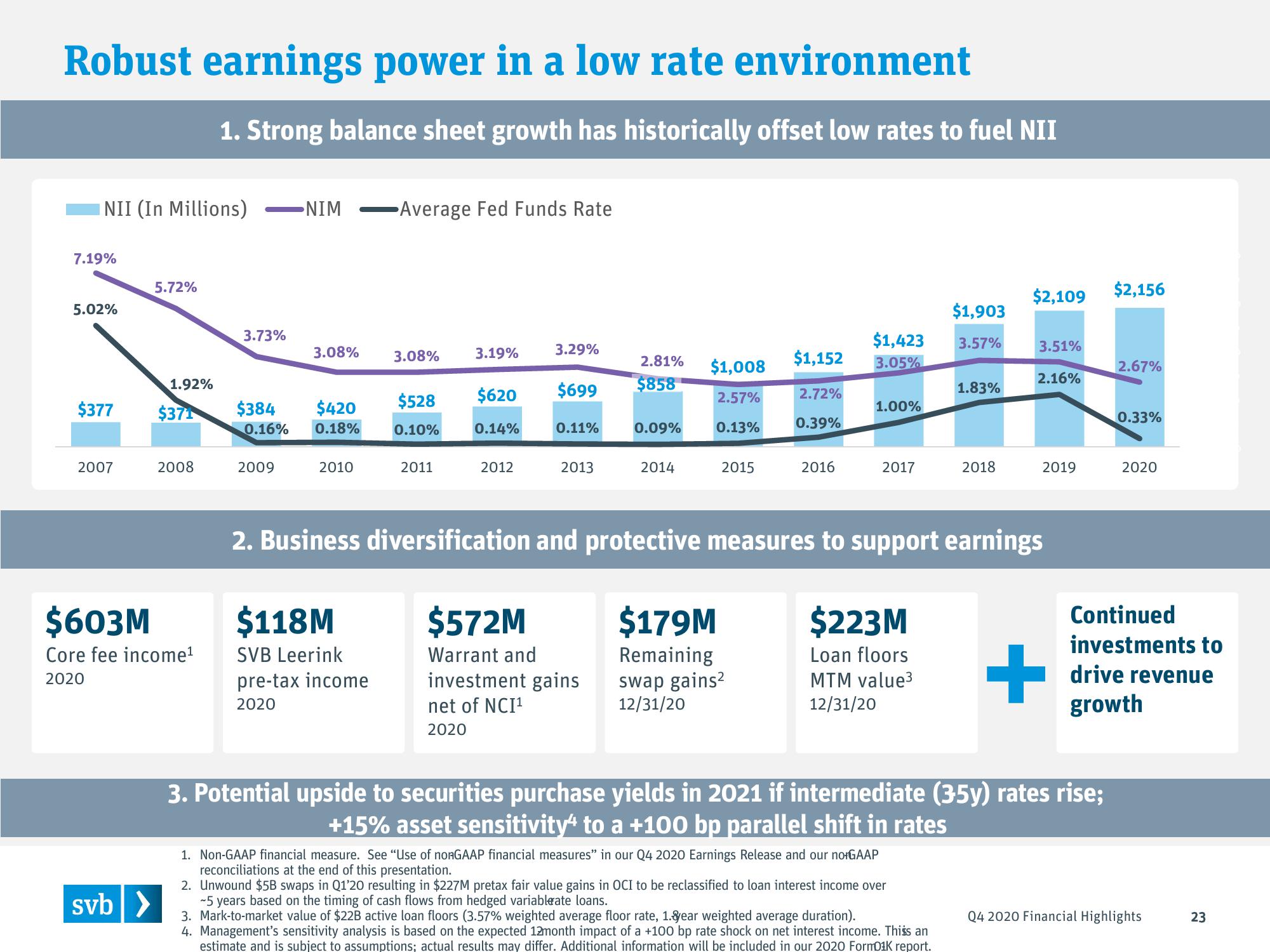

Robust earnings power in a low rate environment

1. Strong balance sheet growth has historically offset low rates to fuel NII

NII (In Millions)

7.19%

5.02%

$377

2007

5.72%

svb >

1.92%

$371

2008

$603M

Core fee income¹

2020

3.73%

NIM -Average Fed Funds Rate

2009

3.08%

$384 $420

0.16% 0.18%

2010

3.08%

$118M

SVB Leerink

pre-tax income

2020

$528

0.10%

2011

3.19%

$620

0.14%

2012

3.29%

2.81%

$699 $858

0.11%

2013

0.09%

$572M

Warrant and

investment gains

net of NCI¹

2020

2014

$1,152

$1,008

2.57%

0.13%

2015

2.72%

0.39%

$179M

Remaining

swap gains²

12/31/20

2016

$1,903

$1,423 3.57%

3.05%

1.00%

2017

$223M

Loan floors

MTM value³

12/31/20

1.83%

2018

2. Business diversification and protective measures to support earnings

1. Non-GAAP financial measure. See "Use of nonGAAP financial measures" in our Q4 2020 Earnings Release and our no GAAP

reconciliations at the end of this presentation.

2. Unwound $5B swaps in Q1'20 resulting in $227M pretax fair value gains in OCI to be reclassified to loan interest income over

-5 years based on the timing of cash flows from hedged variableate loans.

3. Mark-to-market value of $22B active loan floors (3.57% weighted average floor rate, 1.ear weighted average duration).

4. Management's sensitivity analysis is based on the expected 12month impact of a +100 bp rate shock on net interest income. Thiss an

estimate and is subject to assumptions; actual results may differ. Additional information will be included in our 2020 FormD¹K report.

$2,109

3.51%

2.16%

2019

+

3. Potential upside to securities purchase yields in 2021 if intermediate (35y) rates rise;

+15% asset sensitivity to a +100 bp parallel shift in rates

$2,156

2.67%

0.33%

2020

Continued

investments to

drive revenue

growth

Q4 2020 Financial Highlights

23View entire presentation