Vroom Results Presentation Deck

reconciliation of non-gaap financial measures

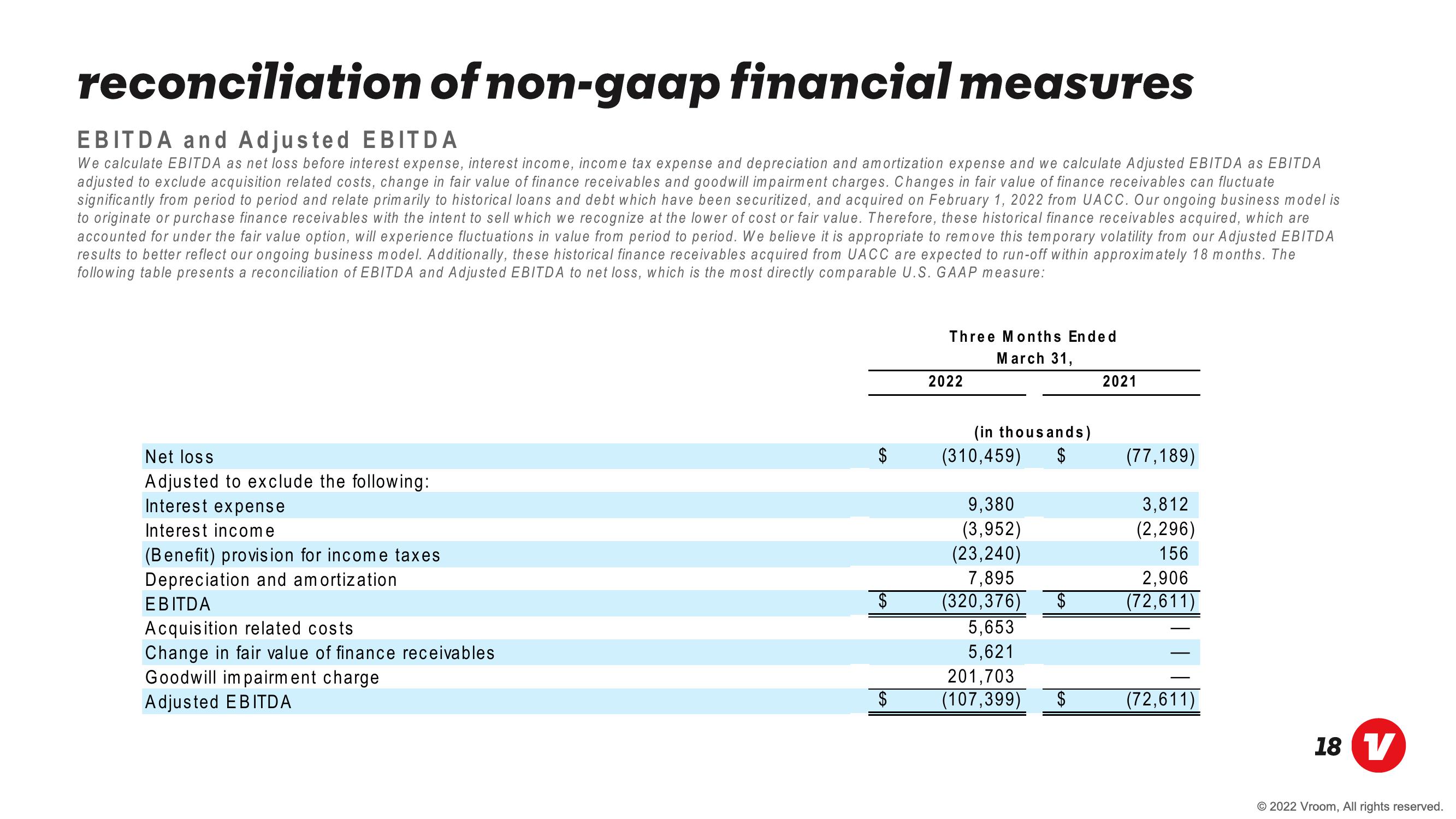

EBITDA and Adjusted EBITDA

We calculate EBITDA as net loss before interest expense, interest income, income tax expense and depreciation and amortization expense and we calculate Adjusted EBITDA as EBITDA

adjusted to exclude acquisition related costs, change in fair value of finance receivables and goodwill impairment charges. Changes in fair value of finance receivables can fluctuate

significantly from period to period and relate primarily to historical loans and debt which have been securitized, and acquired on February 1, 2022 from UACC. Our ongoing business model is

to originate or purchase finance receivables with the intent to sell which we recognize at the lower of cost or fair value. Therefore, these historical finance receivables acquired, which are

accounted for under the fair value option, will experience fluctuations in value from period to period. We believe it is appropriate to remove this temporary volatility from our Adjusted EBITDA

results to better reflect our ongoing business model. Additionally, these historical finance receivables acquired from UACC are expected to run-off within approximately 18 months. The

following table presents a reconciliation of EBITDA and Adjusted EBITDA to net loss, which is the most directly comparable U.S. GAAP measure:

Net loss

Adjusted to exclude the following:

Interest expense

Interest income

(Benefit) provision for income taxes

Depreciation and amortization

EBITDA

Acquisition related costs

Change in fair value of finance receivables

Goodwill impairment charge

Adjusted EBITDA

$

Three Months Ended

March 31,

2022

(in thousands)

(310,459)

$

9,380

(3,952)

(23,240)

7,895

(320,376)

5,653

5,621

201,703

(107,399)

2021

(77,189)

3,812

(2,296)

156

2,906

(72,611)

(72,611)

18 V

© 2022 Vroom, All rights reserved.View entire presentation