Liberty Global Results Presentation Deck

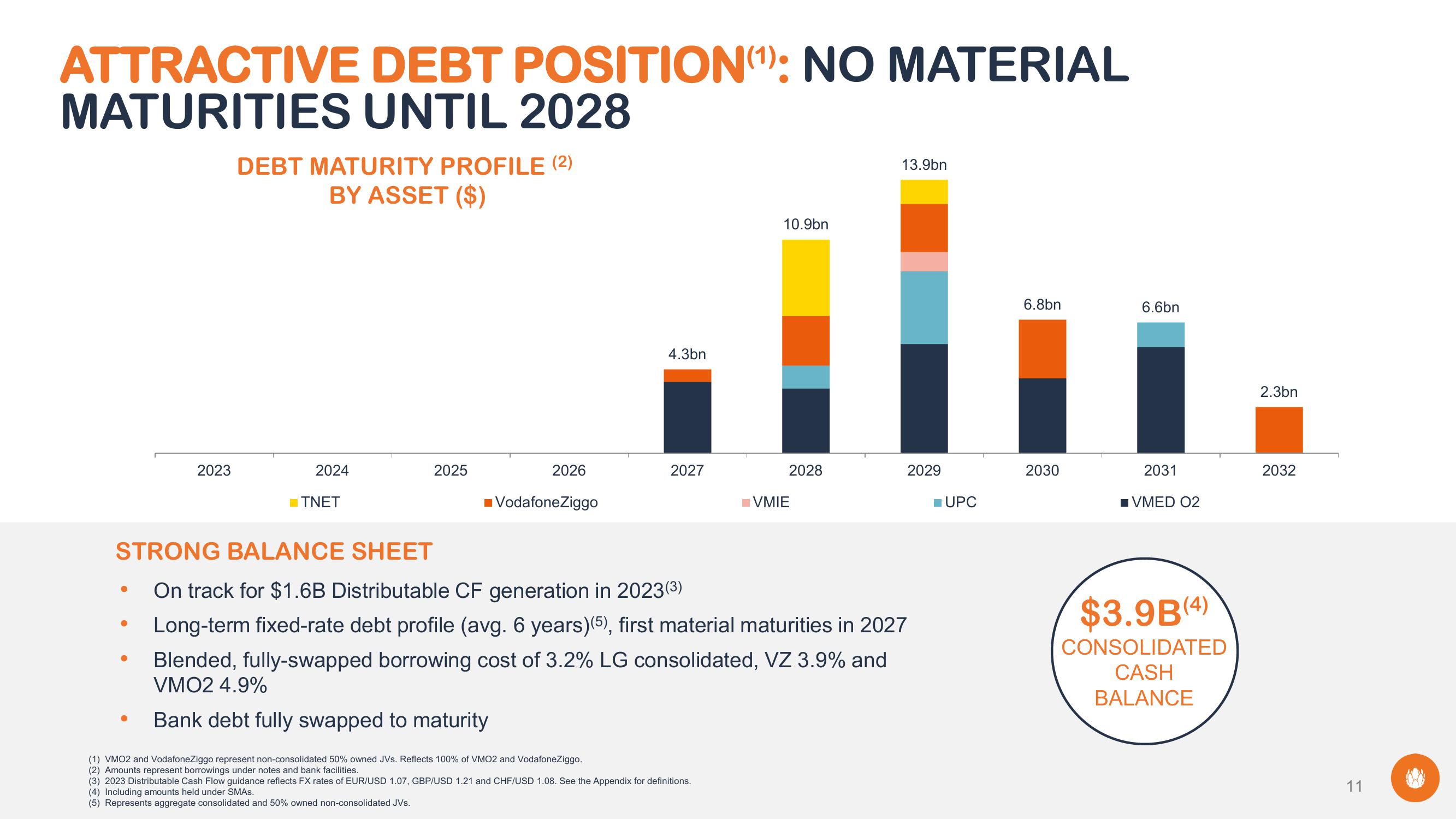

ATTRACTIVE DEBT POSITION(¹): NO MATERIAL

MATURITIES UNTIL 2028

●

●

2023

●

DEBT MATURITY PROFILE (2)

BY ASSET ($)

2024

TNET

2025

2026

■ VodafoneZiggo

4.3bn

(1) VMO2 and VodafoneZiggo represent non-consolidated 50% owned JVs. Reflects 100% of VMO2 and VodafoneZiggo.

(2) Amounts represent borrowings under notes and bank facilities.

2027

10.9bn

STRONG BALANCE SHEET

On track for $1.6B Distributable CF generation in 2023(³)

Long-term fixed-rate debt profile (avg. 6 years)(5), first material maturities in 2027

Blended, fully-swapped borrowing cost of 3.2% LG consolidated, VZ 3.9% and

VMO2 4.9%

Bank debt fully swapped to maturity

(3) 2023 Distributable Cash Flow guidance reflects FX rates of EUR/USD 1.07, GBP/USD 1.21 and CHF/USD 1.08. See the Appendix for definitions.

(4) Including amounts held under SMAS.

(5) Represents aggregate consolidated and 50% owned non-consolidated JVs.

VMIE

2028

13.9bn

2029

UPC

6.8bn

2030

6.6bn

2031

■VMED O2

$3.9B (4)

CONSOLIDATED

CASH

BALANCE

2.3bn

2032

11View entire presentation