Bank of America Investment Banking Pitch Book

Illustrative Valuation Analysis

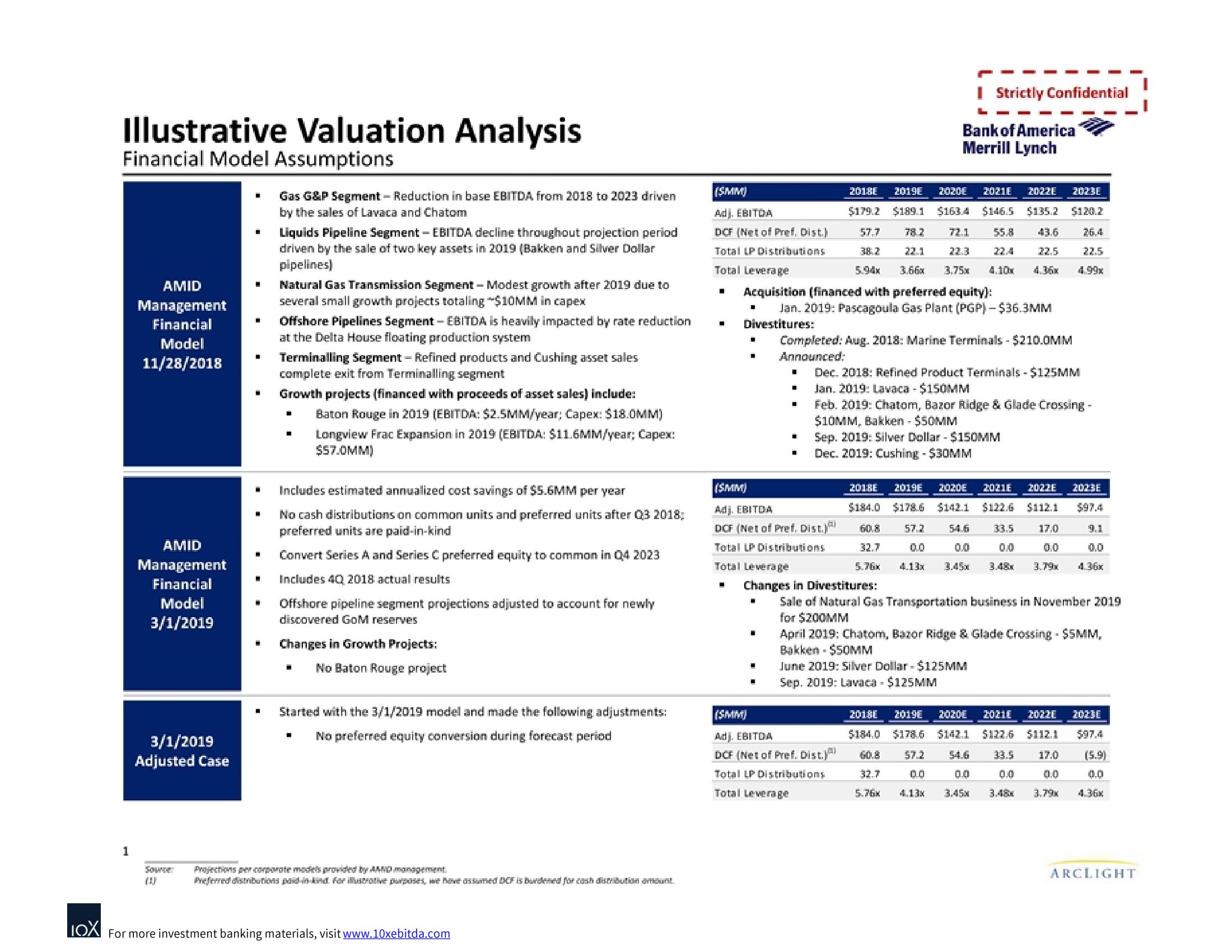

Financial Model Assumptions

1

AMID

Management

Financial

Model

11/28/2018

AMID

Management

Financial

Model

3/1/2019

3/1/2019

Adjusted Case

·

-

-

■

■

▪

■

-

■

Gas G&P Segment - Reduction in base EBITDA, from 2018 to 2023 driven

by the sales of Lavaca and Chatom

Liquids Pipeline Segment - EBITDA decline throughout projection period

driven by the sale of two key assets in 2019 (Bakken and Silver Dollar

pipelines)

Natural Gas Transmission Segment - Modest growth after 2019 due to

several small growth projects totaling $10MM in capex

Offshore Pipelines Segment- EBITDA is heavily impacted by rate reduction

at the Delta House floating production system

Terminalling Segment - Refined products and Cushing asset sales

complete exit from Terminalling segment

Growth projects (financed with proceeds of asset sales) include:

■

■

Baton Rouge in 2019 (EBITDA: $2.5MM/year; Capex: $18.0MM)

Longview Frac Expansion in 2019 (EBITDA: $11.6MM/year; Capex:

$57.0MM)

Includes estimated annualized cost savings of $5.6MM per year

No cash distributions on common units and preferred units after Q3 2018:

preferred units are paid-in-kind

Convert Series A and Series C preferred equity to common in Q4 2023

Includes 40, 2018 actual results

Offshore pipeline segment projections adjusted to account for newly

discovered GoM reserves

Changes in Growth Projects:

No Baton Rouge project

Started with the 3/1/2019 model and made the following adjustments:

No preferred equity conversion during forecast period

■

Projections per corporate models provided by AMID management

Preferred distributions paid in kind. For illustrative purposes, we have assumed DCF is burdened for cash distribution amount.

LOX For more investment banking materials, visit www.10xebitda.com

(SMM)

Adj. EBITDA

DCF (Net of Pref. Dist.)

Total LP Distributions

Total Leverage

H

-

■

L

·

Acquisition (financed with preferred equity):

Jan. 2019: Pascagoula Gas Plant (PGP) - $36.3MM

Divestitures:

■

■

■

H

■

■

■

(SMM)

Adj. EBITDA

DCF (Net of Pref. Dist.)

Tota! LP Distributions

Total Leverage

■

Completed: Aug. 2018: Marine Terminals - $210.0MM

Announced:

2018E 2019E

2020E

2021E 2022E

2023E

$179.2 $189.1 $163.4 $146.5 $135.2 $120.2

55.8

Changes in Divestitures:

72.1

22.3

5.94x 3.66x 3.75% 4.10x 4.36x

57.7

38.2

43.6

22.5

78.2

Strictly Confidential

Bank of America

Merrill Lynch

(SMM)

Adj. EBITDA

DCF (Net of Pref. Dist.)

Total LP Distributions

Total Leverage

Dec. 2018: Refined Product Terminals - $125MM

Jan. 2019: Lavaca - $150MM

Feb. 2019: Chatom, Bazor Ridge & Glade Crossing -

$10MM, Bakken - $50MM

Sep. 2019: Silver Dollar - $150MM

Dec. 2019: Cushing - $30MM

2018E 2019E 2020E 2021E ZOZZE 2023E

$184.0 $178.6

$142.1 $122.6 $112.1 $97.4

54.6

9.1

60.8

32.7

5.76x 4.13x 3.45x 3.48x 3.79x 4.36x

17.0

0.0

57.2

60.8

32.7

5.76x

26.4

22.5

4.99x

33.5

Sale of Natural Gas Transportation business in November 2019

for $200MM

April 2019: Chatom, Bazor Ridge & Glade Crossing - $5MM,

Bakken - $50MM

June 2019: Silver Dollar-$125MM

Sep. 2019: Lavaca - $125MM

20180 2019E 2020€ 2021E 2022E

$184.0

$178.6 $142.1

54.6

0.0

4.13x 3.45%

57.2

0.0

2023E

(5.9)

$132.6 $112.1 $97.4

33.5 17.0

0.0

3.48 3.79x

0.0

4.36x

ARCLIGHTView entire presentation