Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

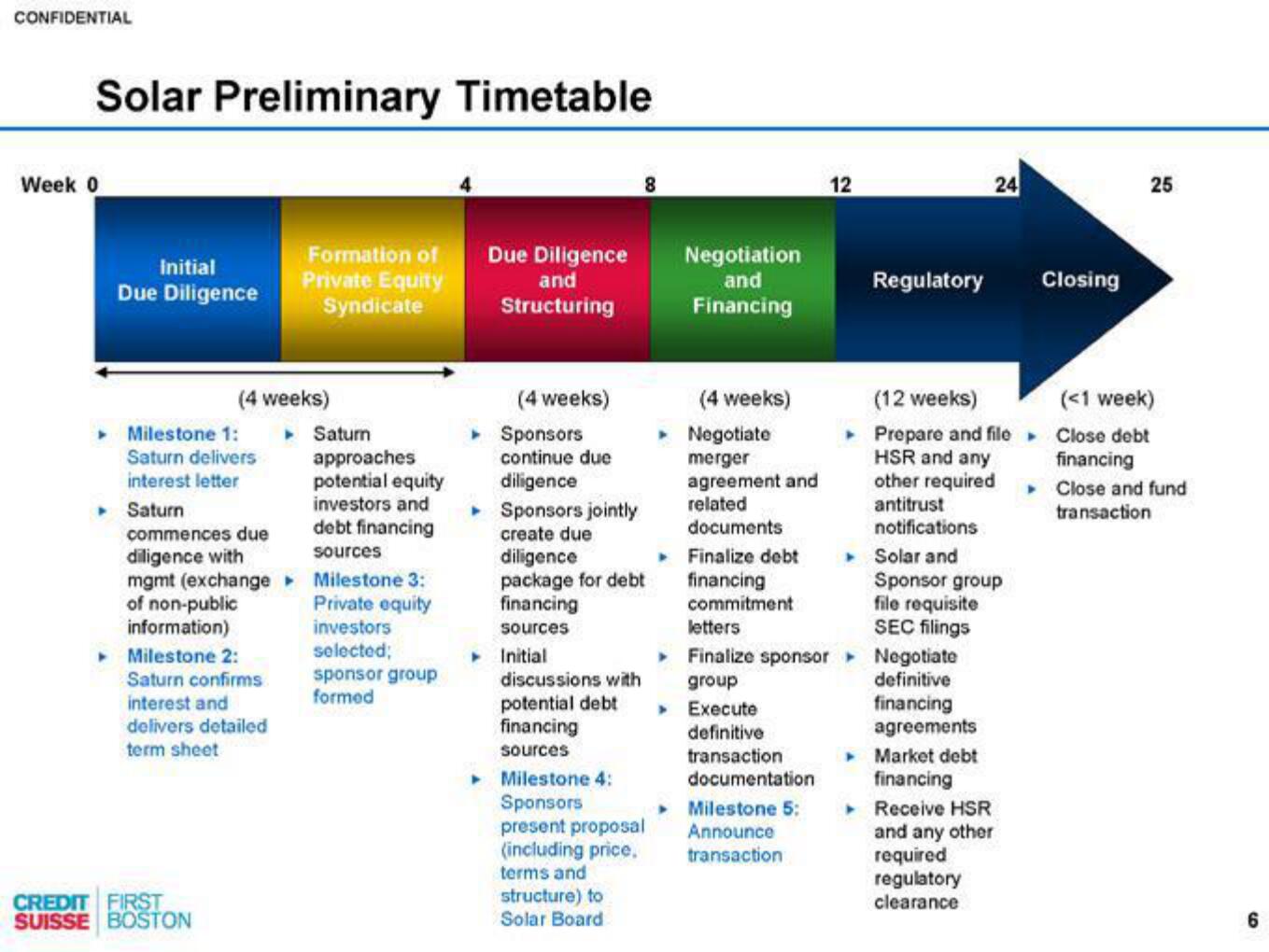

Solar Preliminary Timetable

Week 0

➤

Initial

Due Diligence

Milestone 1:

Saturn delivers

interest letter

▸ Saturn

(4 weeks)

commences due

diligence with

mgmt (exchange

of non-public

information)

▸ Milestone 2:

Saturn confirms

interest and

delivers detailed

term sheet

CREDIT FIRST

SUISSE BOSTON

Formation of

Private Equity

Syndicate

▸ Saturn

approaches

potential equity

investors and

debt financing

sources

Milestone 3:

Private equity

investors

selected;

sponsor group

formed

Due Diligence

and

Structuring

(4 weeks)

Sponsors

continue due

diligence

Sponsors jointly

create due

diligence

package for debt

financing

sources

► Initial

discussions with

potential debt

financing

sources

Milestone 4:

Sponsors

present proposal

(including price.

terms and

structure) to

Solar Board

▸

▸

Negotiation

and

Financing

(4 weeks)

Negotiate

merger

agreement and

related

documents

> Execute

definitive

transaction

documentation

12

Milestone 5:

Announce

transaction:

Regulatory

Finalize debt

financing

commitment

letters

Finalize sponsor▸ Negotiate

group

definitive

financing

agreements

Market debt

financing

► Receive HSR

and any other

required

regulatory

clearance.

24

(12 weeks)

▸ Prepare and file

HSR and any

other required

antitrust

notifications

▸ Solar and

Sponsor group

file requisite

SEC filings

Closing

25

(<1 week)

Close debt

financing

▸ Close and fund

transaction

6View entire presentation