Apollo Global Management Investor Day Presentation Deck

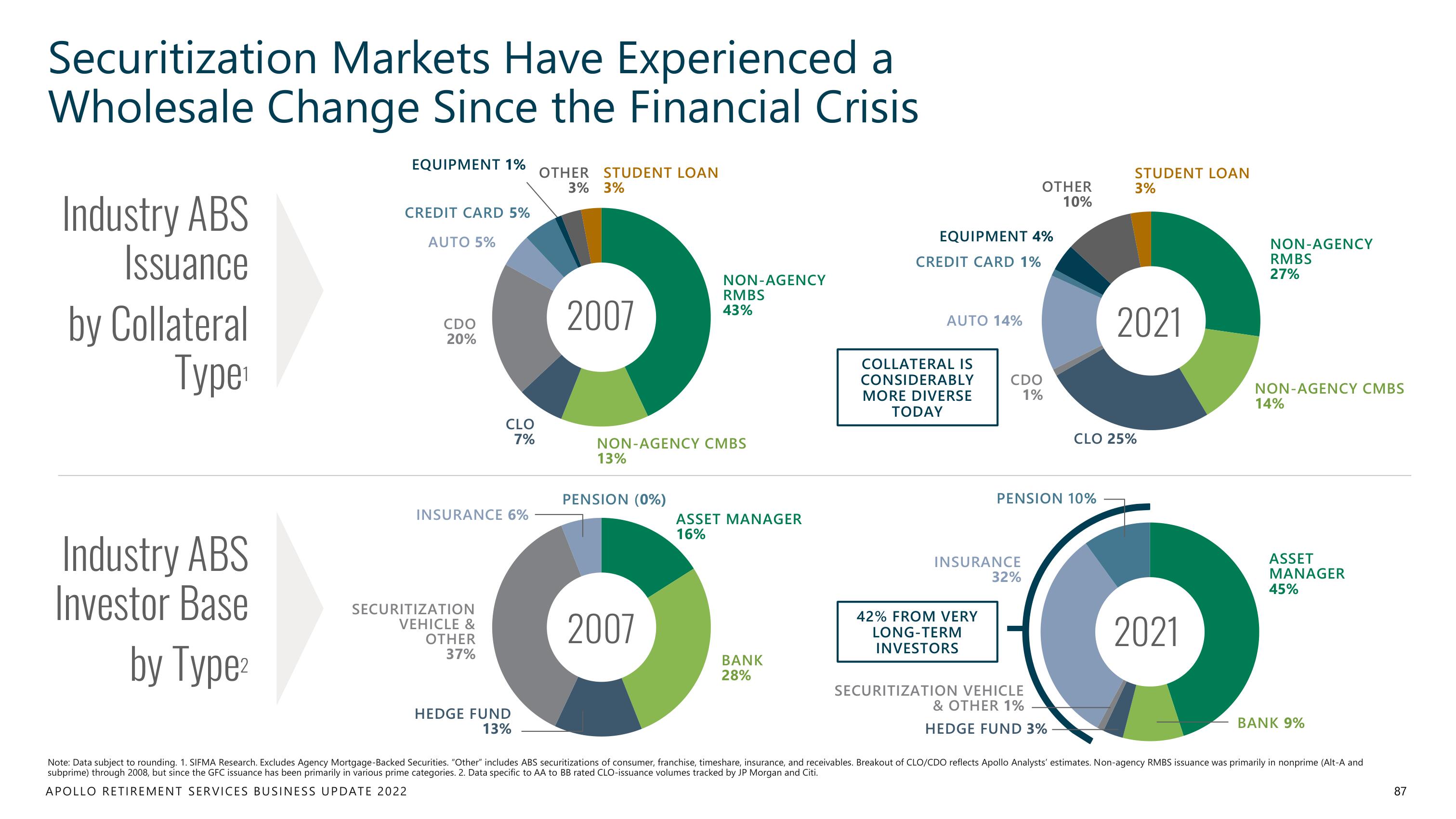

Securitization Markets Have Experienced a

Wholesale Change Since the Financial Crisis

Industry ABS

Issuance

by Collateral

Type₁

Industry ABS

Investor Base

by Type²

EQUIPMENT 1%

CREDIT CARD 5%

AUTO 5%

CDO

20%

CLO

7%

INSURANCE 6%

SECURITIZATION

VEHICLE &

OTHER

37%

HEDGE FUND

13%

OTHER STUDENT LOAN

3% 3%

2007

13%

NON-AGENCY CMBS

PENSION (0%)

NON-AGENCY

2007

RMBS

43%

ASSET MANAGER

16%

BANK

28%

EQUIPMENT 4%

CREDIT CARD 1%

AUTO 14%

COLLATERAL IS

CONSIDERABLY

MORE DIVERSE

TODAY

42% FROM VERY

LONG-TERM

INVESTORS

OTHER

10%

CDO

1%

INSURANCE

PENSION 10%

32%

SECURITIZATION VEHICLE

& OTHER 1%

HEDGE FUND 3%

STUDENT LOAN

3%

2021

CLO 25%

2021

NON-AGENCY

RMBS

27%

NON-AGENCY CMBS

14%

ASSET

MANAGER

45%

BANK 9%

Note: Data subject to rounding. 1. SIFMA Research. Excludes Agency Mortgage-Backed Securities. "Other" includes ABS securitizations of consumer, franchise, timeshare, insurance, and receivables. Breakout of CLO/CDO reflects Apollo Analysts' estimates. Non-agency RMBS issuance was primarily in nonprime (Alt-A and

subprime) through 2008, but since the GFC issuance has been primarily in various prime categories. 2. Data specific to AA to BB rated CLO-issuance volumes tracked by JP Morgan and Citi.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

87View entire presentation