HBT Financial Results Presentation Deck

Non-GAAP Reconciliations (cont'd)

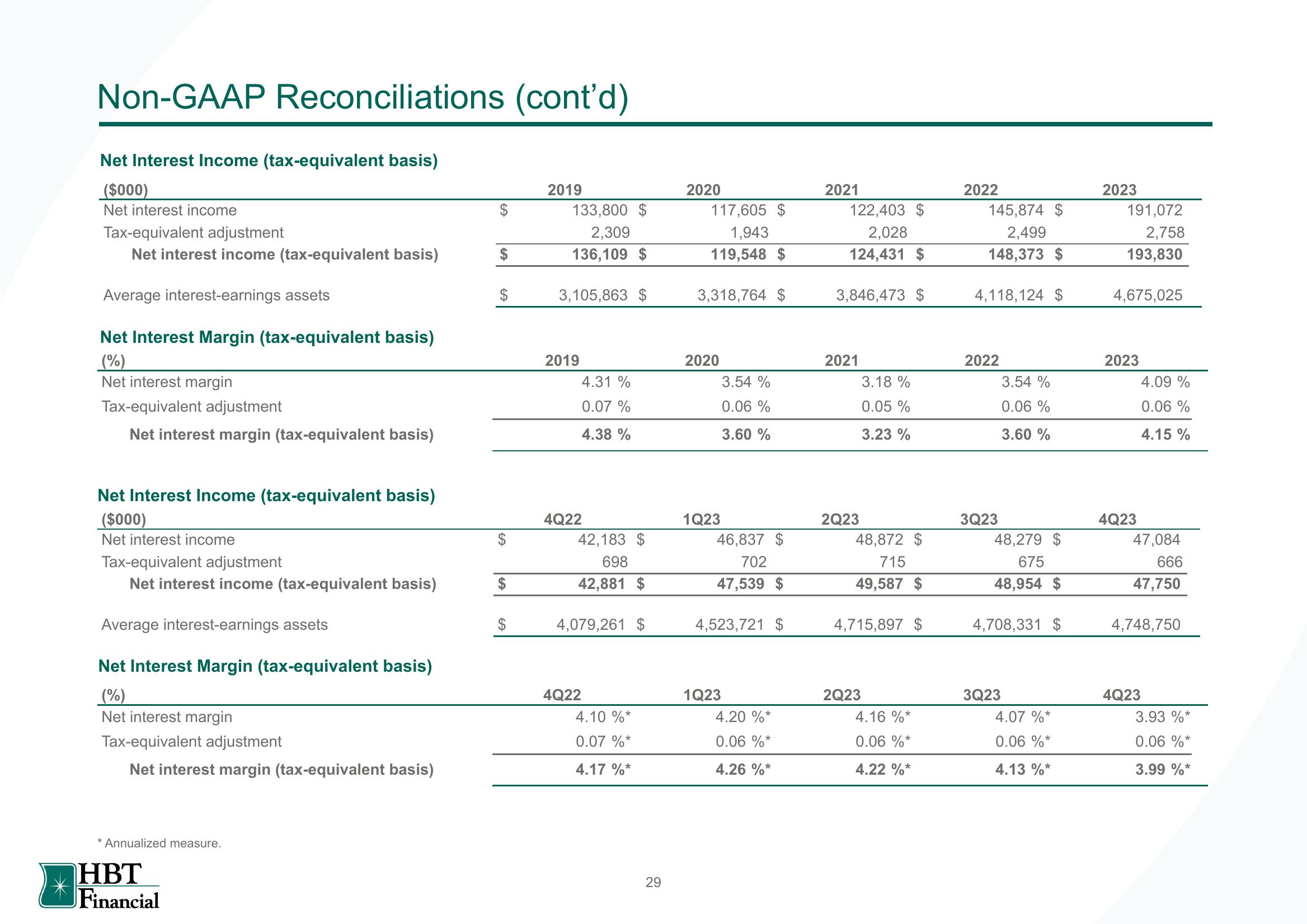

Net Interest Income (tax-equivalent basis)

($000)

Net interest income

Tax-equivalent adjustment

Net interest income (tax-equivalent basis)

Average interest-earnings assets

Net Interest Margin (tax-equivalent basis)

(%)

Net interest margin

Tax-equivalent adjustment

Net interest margin (tax-equivalent basis)

Net Interest Income (tax-equivalent basis)

($000)

Net interest income

Tax-equivalent adjustment

Net interest income (tax-equivalent basis)

Average interest-earnings assets

Net Interest Margin (tax-equivalent basis)

(%)

Net interest margin

Tax-equivalent adjustment

Net interest margin (tax-equivalent basis)

* Annualized measure.

HBT

Financial

$

$

2019

133,800 $

2,309

136,109 $

3,105,863 $

2019

4.31 %

0.07 %

4.38 %

4Q22

42,183 $

698

42,881 $

4,079,261 $

4Q22

4.10 %*

0.07 %*

4.17 %*

29

2020

117,605 $

1,943

119,548 $

3,318,764 $

2020

3.54 %

0.06 %

3.60 %

1Q23

46,837 $

702

47,539 $

4,523,721 $

1Q23

4.20 %*

0.06 %*

4.26 %*

2021

122,403 $

2,028

124,431 $

3,846,473 $

2021

2Q23

3.18 %

0.05 %

3.23%

48,872 $

715

49,587 $

4,715,897 $

2Q23

4.16 %*

0.06 %*

4.22 %*

2022

145,874 $

2,499

148,373 $

4,118,124 $

2022

3Q23

3.54%

0.06 %

3.60 %

48,279 $

675

48,954 $

4,708,331 $

3Q23

4.07 %*

0.06 %*

4.13 %*

2023

191,072

2,758

193,830

4,675,025

2023

4Q23

4.09 %

0.06 %

4.15 %

47,084

666

47,750

4,748,750

4Q23

3.93 %*

0.06 %*

3.99 %*View entire presentation