Vale Results Presentation Deck

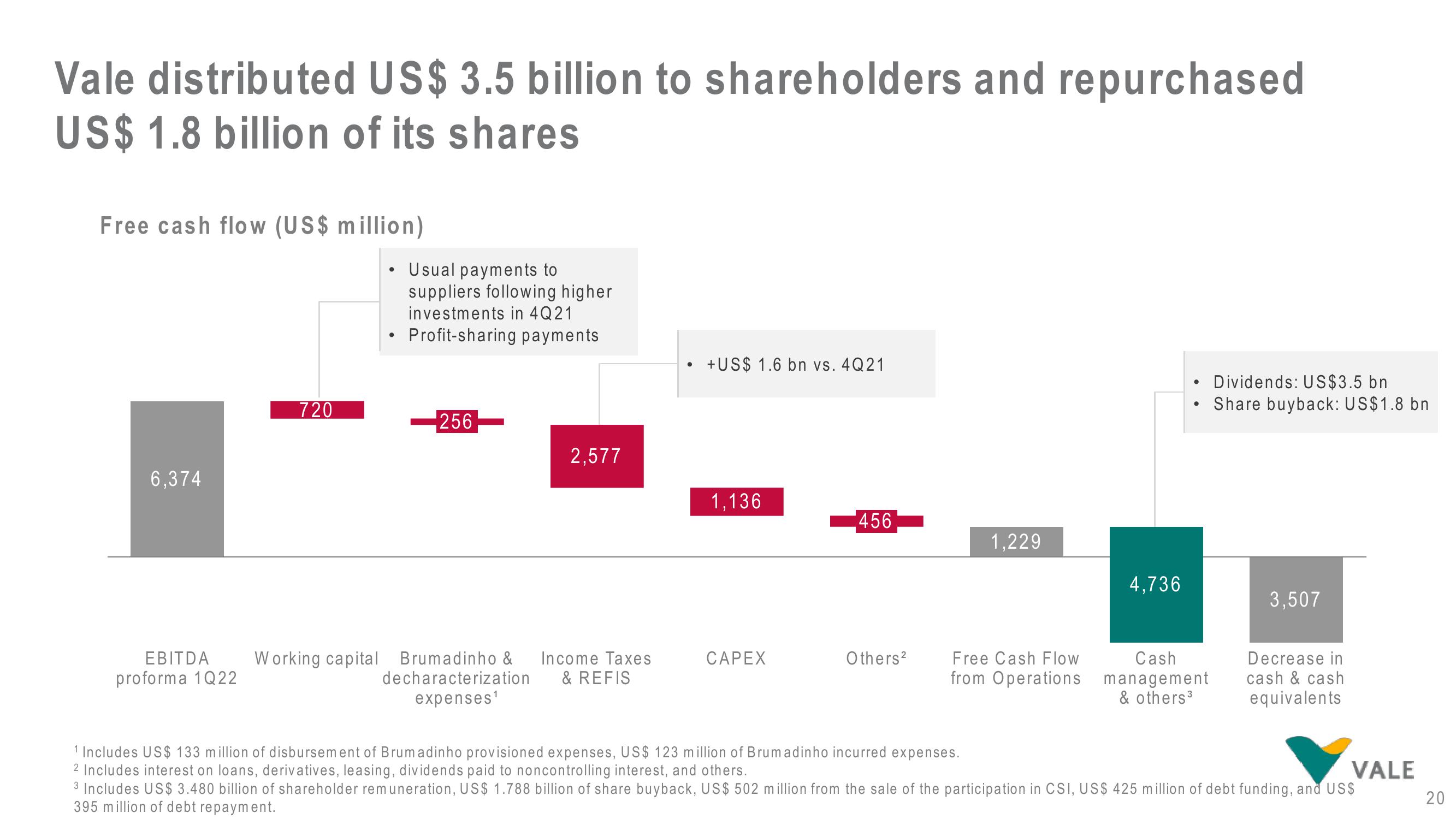

Vale distributed US$ 3.5 billion to shareholders and repurchased

US$ 1.8 billion of its shares

Free cash flow (US$ million)

6,374

EBITDA

proforma 1Q22

720

Usual payments to

suppliers following higher.

investments in 4Q21

Profit-sharing payments

256

2,577

Working capital Brumadinho & Income Taxes

de characterization & REFIS

expenses¹

●

+US$ 1.6 bn vs. 4Q21

1,136

CAPEX

456

Others²

1,229

Free Cash Flow

from Operations

4,736

●

●

Cash

management

& others³

Dividends: US$3.5 bn

Share buyback: US$1.8 bn

3,507

Decrease in

cash & cash

equivalents

¹ Includes US$ 133 million of disbursement of Brumadinho provisioned expenses, US$ 123 million of Brumadinho incurred expenses.

2 Includes interest on loans, derivatives, leasing, dividends paid to noncontrolling interest, and others.

VALE

3 Includes US$ 3.480 billion of shareholder remuneration, US$ 1.788 billion of share buyback, US$ 502 million from the sale of the participation in CSI, US$ 425 million of debt funding, and US$

395 million of debt repayment.

20View entire presentation