Embracer Group Results Presentation Deck

EMBRACER GROUP - INTERIM REPORT Q4 FY 22/23

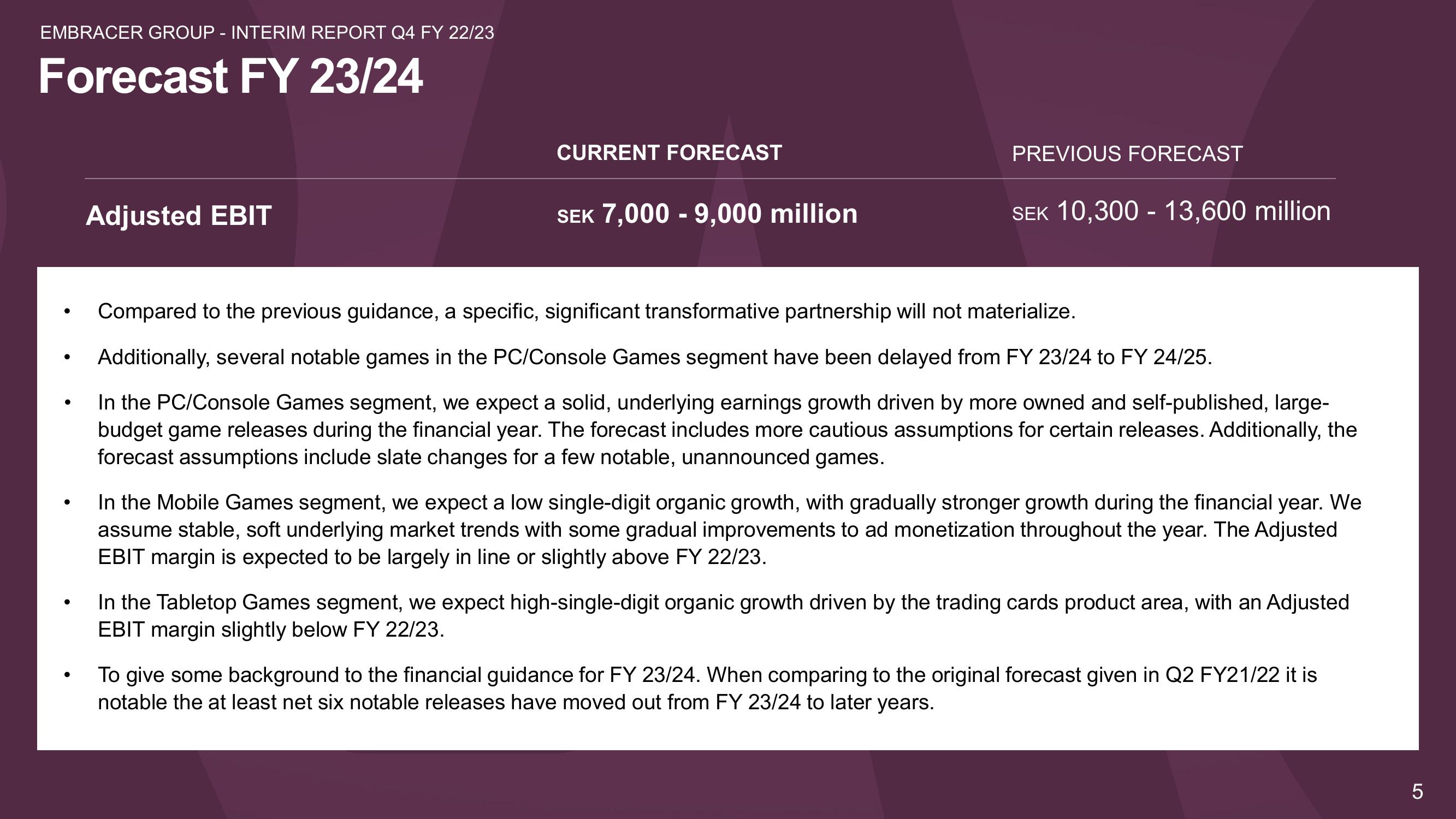

Forecast FY 23/24

●

●

●

●

●

●

Adjusted EBIT

CURRENT FORECAST

SEK 7,000 - 9,000 million

PREVIOUS FORECAST

SEK 10,300 - 13,600 million

Compared to the previous guidance, a specific, significant transformative partnership will not materialize.

Additionally, several notable games in the PC/Console Games segment have been delayed from FY 23/24 to FY 24/25.

In the PC/Console Games segment, we expect a solid, underlying earnings growth driven by more owned and self-published, large-

budget game releases during the financial year. The forecast includes more cautious assumptions for certain releases. Additionally, the

forecast assumptions include slate changes for a few notable, unannounced games.

In the Mobile Games segment, we expect a low single-digit organic growth, with gradually stronger growth during the financial year. We

assume stable, soft underlying market trends with some gradual improvements to ad monetization throughout the year. The Adjusted

EBIT margin is expected to be largely in line or slightly above FY 22/23.

In the Tabletop Games segment, we expect high-single-digit organic growth driven by the trading cards product area, with an Adjusted

EBIT margin slightly below FY 22/23.

To give some background to the financial guidance for FY 23/24. When comparing to the original forecast given in Q2 FY21/22 it is

notable the at least net six notable releases have moved out from FY 23/24 to later years.

LO

5View entire presentation